Our News

We are delighted to announce that we are welcoming two prestigious and experienced businessmen in senior advisory roles at eRevalue, further complementing our senior and technical advisory boards.

Sebastian Hempstead (Strategic Advisor to eRevalue), Executive Vice President, Brandwatch

Sebastian Hempstead has driven Enterprise SaaS revenues and growth strategies in Europe, North America, Latin America & Asia Pacific.

Most recently he was at Brandwatch, a social data analytics company, where he took the company from new US market entrant in 2011 to market leader in 2016, as confirmed by Forrester. He will work with our team on go-to-market strategy and execution.

Etienne Butruille (Technical Advisor to eRevalue), Deputy Global Head of Sustainability at Banco Santander

As Deputy Head of Global Responsibility for one of the largest banks in the world, Etienne brings a wealth of knowledge and over 20 years experience in the fields of sustainability, risk, ESG and corporate reporting.

Etienne is an expert in the field of environmental sustainability, holding a MSc in Environmental Science from the New Jersey Institute of Technology, and a MSc in Business Strategy and Environmental Management from the University of Bradford.

We are thrilled to welcome his experience and inspiration to our Technical Advisory Board.

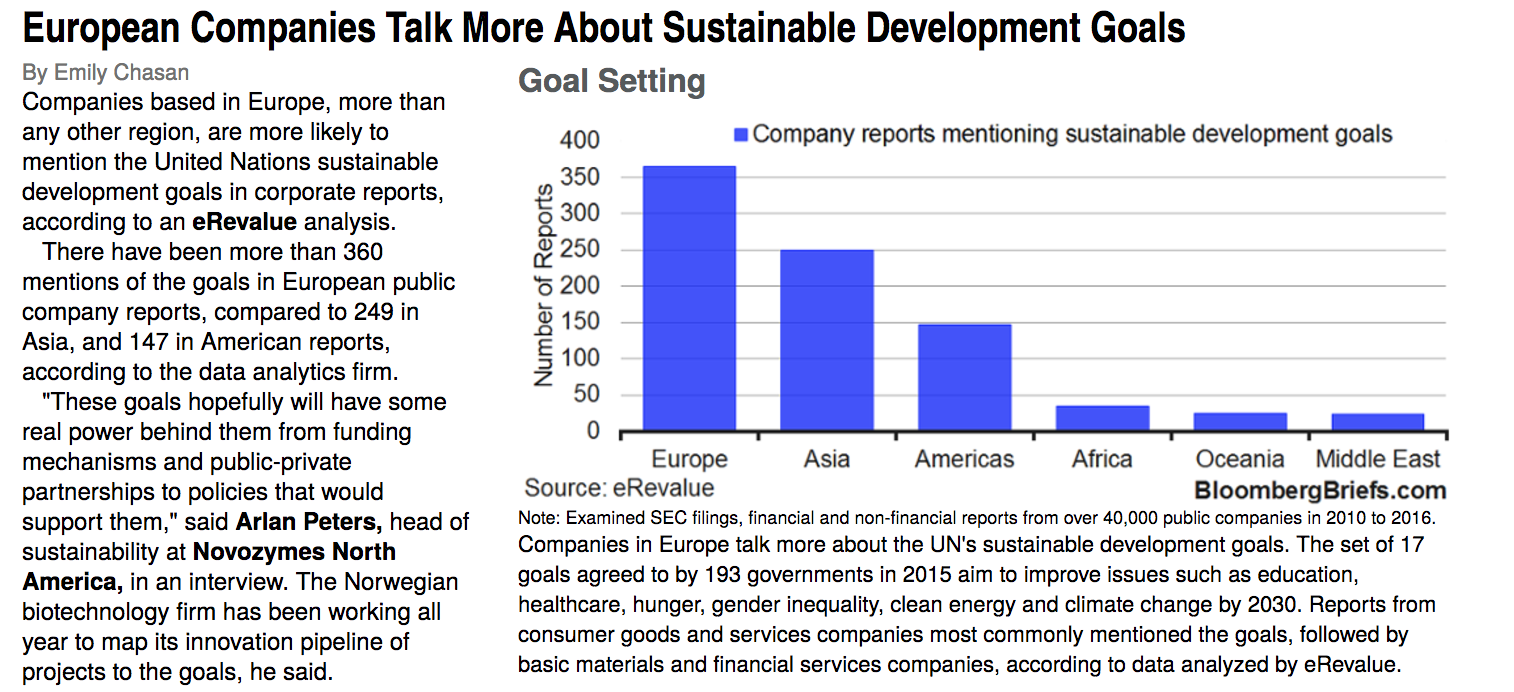

As reported in Bloomberg Briefs, using eRevalue data, the Sustainable Development Goals (SDGs) are most popular in European corporate reports when compared with other regions.

eRevalue will soon launch it’s SDG Radar – available within our AI engine and business intelligence tool, Datamaran®.

For more information on eRevalue’s SDG Radar, click here.

We are delighted to see Hedda Pahlson-Moller, our European Client and Investor Relations correspondent, featured on the front page of the Luxemburger Wort, and a special mention of eRevalue as a way to help businesses manage ESG issues. Translated for our English readers pleasure, the article reads as follows:

Portrait of a Responsible Entrepreneur

Hedda, Business Angel

Article by Thierry Labro

Being 5 feet 9, with blonde hair falling on her shoulders and a discreet smile, Hedda Pahlson-Moller is one of a kind. Even if she wanted to, the Swede, born in Quebec in 1975, could not be like other women. She does not go unnoticed anywhere.

Her story begins at age two, in Connecticut, where her father, an engineer, develops his business in a hurricane of life, between his boats, his marina and his companies, and a committed and applied social worker mother. The grasshopper and the ant are soon separated. The young woman is ten years old. “My father gave me the basics or pragmatism… and my mother the obligation to give back to society what society gave us.”

A War Hero Ancestor and a Countess For a Grandmother

Born a free spirit, the Rhode Island Basketball player embarks into international relations. She discovers at the American Embassy in Berlin that “the world is not changed so easily.” Farewell to politics, frustration sends her to humanitarian activities.

She heads to New Delhi to work for an NGO, the Centre for Science and Environment. She virtually drapes herself with a sari, the traditional and colourful dress worn by Indian women, and recalls her Spartan living conditions on the spot. As if to assure that stripped of everything, it is perhaps there that she has learned the most from human relations.

Asia brings her to the Development Bank of Japan and then the Swedish Embassy. The European returned to the land of her illustrious ancestors. She is the great-granddaughter of Major Pahlson, a legend of the Swedish Army, who allowed Finland to save honour at the end of the Second World War by hiding away state secrets before the dreaded arrival of the Soviets.

She is also the granddaughter of Gunilla Bernadotte, who became Countess of Wisborg thanks to Grand Duchess Josephine Charlotte, when she married in second marriage the fifth and last son of the King of Sweden, after the latter had renounced his title to marry a Swedish journalist.

Hedda’s father returned to Sweden and bought the Manor and Park of Rottneros, which inspired “Ekeby” by Selma Lagerlöf, one of the most famous novels of Swedish literature – Selma was the first woman to receive a Literature Nobel prize in 1909. “It’s an extraordinary place, surrounded by forest, where I spend each summer with the kids.”

Like politics, Humanitarian work does not satisfy her desire to change the World . “In the 1990s, NGOs did not have the means to do this. I figured I was going to get there through entrepreneurship.”

The year 2000 favoured her: her first job takes her to Hewlett Packard. Between Belgium and France. “I was in Grenoble. It was so difficult for me who had known New York, New Delhi, Edinburgh and all these cities … One day, on my way home, I stopped in Luxembourg. I instantly adopted this country and I believe it adopted me. Even though recently, someone I love very much told me that I will always be a ‘usual suspect’. This does not sound negative to me at all.”

Hedda “the romantic” begins a third course, a third cycle in entrepreneurship in Copenhagen and throws herself into business, social investment and social innovation.

She is aware that her bulimia of change seems inaccessible to most of those who would like to play on every board. Her resume is a testament to the twenty or so start-ups on which the business angel watches over, the two companies she runs, and the five other structures, companies or think tanks in which she drives her energy.

“I make mistakes, I sometimes make bad investment decisions,” she acknowledges naturally with her Swedish culture of peace, while her American fibre drives her to continue to engage. “Slowly comes a wave that recognizes that social investment can have a positive influence on business. Before, entrepreneurs paid taxes for the state to take care of the common welfare and wanted to make a profit. Now they understand that profit can be made by taking social dimensions into account. In many different ways, with happy, fulfilled employees, with values that are conveyed in terms of image or with the disappearance of trouble with justice.”

“Let’s Hack Capitalism!”

She grabs a teaspoon. Would like to twist it as you twist your neck to a rumour. “If we were to calculate all external costs, the matter that we’re going to have to reinject somewhere, to get it from the other side of the world, the circular economy really makes sense. BT, Ben & Jerries, Unilever and many other companies have understood this. Let’s hack the capitalism! “

“eRevalue”, which is in her equity portfolio, has developed a tool that helps decision-making in management, in terms of environment, governance and social benefits. “Since they have been using it, some companies have become ‘first movers’.” The first ones to strike gold, and they discovered it almost by chance. A Luxembourgish tradition, even if this company does not (yet) have Luxembourgish clients.

The entrepreneur has become business angel. The business angel became a professor for the Sacred Heart University and for the University of Luxembourg. Neither grasshopper nor ant, but a butterfly that lives every day as a new day. Who spends each day hand in the hair of her two blond heads seeing how Luxembourgish society has changed during the last ten years.

“At the beginning, at university, there were five students in my classes. Young men who dreamed of becoming entrepreneurs. Today the rooms are full, 30 to 40 year old women! There are more Luxembourgers too. The entrepreneur is no longer the one who did not really work, “she says.

Her first lesson is tolerance to failure. “There is no success without prior failure. At the age of five, the majority of entrepreneurs fail! But the worst part is that 70% of them did not try again! That is what we need to change. ”

Her latest project, the latest one she committed herself to, equilibre.lu, promotes gender balance in the professional world. “In my mind, there is no difference. I am here in society. There is everything in us, a part of femininity and a share of masculinity. The rest…”

To read the full article go to: http://www.wort.lu/de/business/portrait-d-un-entrepreneur-responsable-hedda-business-angel-58b436bca5e74263e13ab390

Everyone’s Talking About the SDGs, But This AI Company is Making it Happen

With the Paris Agreement still maintaining a dominant voice in social media and news, and the SDGs placing a strong emphasis on business to lead the way, eRevalue is offering a user-friendly and efficient solution to a complicated problem. The award winning AI technology company is launching a Sustainable Development Goals (SDGs) radar in April this year, to compliment its business intelligence tool Datamaran®. The ‘SDG radar’ was pre-launched with several exclusive eRevalue clients in late 2016. In April 2017, this unique capability will be available for companies everywhere.

On March 7th, 2017, high level speakers from the UN Environment, the Global Compact Network Canada, Scotiabank and eRevalue will be running a webinar exploring the role of business in achieving the SDGs. The expert panel will discuss their perspective on what businesses can do to implement the SDGs – and the role of technology in assisting this process.

Marjella, former Director of the Global Reporting Initiative (GRI), developed the online business intelligence tool, Datamaran®, in collaboration with a global market of end users including corporate users, advisory firms and industry experts. Almost three years ago, Marjella had the unique and innovative idea to make continuous reporting and strategic decision making on emerging issues not only possible, but easily actionable for senior decision makers across departments – not just the CSR team. Utilising AI technology to monitor industry trends, her idea is now a reality, and is helping companies to continuously navigate risks and opportunities. The cloud based business intelligence software is already being used by MNEs in sixteen countries.

“We are building the SDG radar system into Datamaran® as an automated option. The beauty of this tool is that whatever framework you are using – be it GRI, SDG, IIRC, UN Global Compact, etc, our ontology can handle it. We are excited about the potential of our technology to catalyze positive change in the business community”

Marjella Alma, CEO, eRevalue®

Natural Language Processing Technology

Companies are leveraging Natural Language Processing (NLP) topic modelling technology using Datamaran® to identify best practice, benchmarking large volumes of corporate disclosure data on key strategic issues, mapped against a universe of their choosing; competitors, sectors, countries or industries. Having the ability to quickly scan existing practices tied to SDGs through a database of 7,000+ companies is invaluable in kickstarting this process.

There are several key reasons why corporations are increasingly complying with the SDG framework:

Compliance risk: although few regulatory initiatives are directly mentioning the SDGs – there are many existing hard law and soft norms that cover topics that are relevant to the SDGs. By addressing the SDGs and making it more integrated to the sustainability/corporate strategy, compliance risks can be mitigated.

Competitive risk: companies that position themselves in line with the SDGs could receive more attention from Millennials who are placing more importance on business as a force for good.

Reputational risk: Recent political development in Europe and the US has resulted in a greater focus, and arguably an added incentive, for business to take a leadership role. Particularly among the younger generation, there is a lack of confidence in government as the only source of leadership and more companies are required to take action.

Long-term thinking over short-term profits

There is accumulating evidence to show that businesses who take a long-term view outperform those with short-term interests. The SDGs force companies to look ahead, and the board is required to execute this agenda.

Investors are increasingly aware that good companies make good stocks: a recent report released by Bank of America Merill Lynch states that investors could have avoided 90% of bankruptcies if they had invested only in companies with above average ESG performance.

The tool is not just an illustration of the above points, it is a practical solution to the complex business environment. It is a way for companies to navigate the significant challenges presented by the SDGs to create positive change. Members of the C-suite care about the SDGs – and this tool gives CSR professionals the business case to elevate the discussion.

As Richard Branson says: “Every company has the potential to change the world, and will not survive if it doesn’t” (see link: https://www.virgin.com/richard-branson/responsible-business)

Do you want to learn more?

Register for the eRevalue SDG Webinar: Implementing the SDGs: Seizing the Opportunity

Mar 7, 2017 3:00 PM in London

This webinar will explore the role of business in relation to the SDGs.

What are the key obstacles businesses need to overcome to seize the SDG opportunity? Our expert panel will give their perspective on this topical issue and take questions from the audience.

Speakers include:

Elisa Tonda, UN Environment

Helle Bank Jorgensen, UNGC

Samantha Mesrobian, Scotiabank

Erin Levey, eRevalue

In the News

Cape Town, Zurich, London, 7 December 2016 – People, energy and climate were the top material issues for leading sustainability corporates in 2016.

This appeared from a manual and automated analysis of sustainability, integrated and annual reports of the 24 Industry Group Leaders of the Dow Jones Sustainability Index (DJSI) of 2016.

The analysis expanded the manual analysis performed by Matrialitytracker over the past two years, with an additional automated analysis done by eRevalue’s narrative data analytics platform, Datamaran. The analysis was performed as eRevalue joined the Center for Corporate Governance and BSD Consulting as institutional partners of the world online hub for materiality trends and standards.

“The impressive collection of standard requirements and trends that can be found at Materialitytracker, combined with our business intelligence platform Datamaran, which tracks key regulatory, competitive and emerging topics emphasized by publicly listed corporations in their reporting, is an ideal match. We are excited about joining the online hub, and helping more businesses to improve their corporate reporting” said Marjella Alma, Chief Executive Officer of eRevalue.

In the new analysis of 2016 a comparison was made of what the 24 Industry Group Leaders formally state to be their most material topics, as decided through stakeholder engagement, and what they most talk about in their reports covering the year 2015-2016. What is formally stated was determined based on manual analysis, and compared with automated analysis of what is most emphasized, based on eRevalue’s comprehensive business analytics tool, Datamaran.

From the formal positions it was evident that the top issues include how companies manage their people and energy, accompanied by high prioritization of human rights in the form of diversity and inclusion, ethics and corruption, the health and safety of employees, and ensuring related standards in global supply chains.

“The importance of securing sustainability standards in supply chains comes as no surprise to us. It is an area in which we have worked with corporates since the 1990s, and it is evident that consumers demand greater assurance of conditions under which product supplies have been developed abroad,” said Peter Teuscher, Managing Director of BSD Consulting.

Human resources (including talent management) again moved to the top of the list for the 24 DJSI Industry Group Leaders of 2016. Second position among the top 20 topics across sectors was taken by Supply Chains (including responsible management and traceability), followed this year by climate and energy in third position. Furthermore, there were some important differences between what companies formally state to be their top material topics and what topics they 2 most talk about in their annual sustainability reports (SRs) and integrated reports (IRs).

The analysis showed that leading corporates devote more attention to Corporate Governance in annual reports (ARs), with higher emphasis placed on the topics employee benefits, shareholder activism, investor relations, board composition and executive compensation (found among the top 20 topics).

“The latest findings highlight that there is much room for improvement still in reporting integration, making the link between performance in corporate governance and performance related to the environmental and social agenda. We are delighted that eRevalue is joining us in keeping track of progress, including the identification of key risks and opportunities in a more connected world of information overload,” said Daniel Malan, Director of the Centre for Corporate Governance in Africa at Stellenbosch University Business School.

While the top 20 topics formally stated as most material in IRs or SRs include external development-related topics such as community impact, environmental stewardship, improved access, food and nutrition as well as public health and education, these topics do not feature among the top 20 topics more emphasized in both annual non-financial and financial reports.

They are rather addressed in an internal, business operational context (for example employee health and training) or addressed broadly through a reference to human rights. This implies that external developmental issues are not addressed in much detail in reporting by the 24 sustainability leaders.

This poses a challenge for the new Sustainable Development Goals (SDGs) agreed under auspices of the United Nations, even though topics associated with them are formally recognized as key material topics by the leading sustainability corporates.

Also of interest are the reporting types or self-declared titles the 24 Industry Group Leaders give their reports. Apart from examining financial ARs by all, the core of the analysis was focused on (based on availability) three companies with IRs, four companies with AR only (but including sustainability information), 14 companies with one AR and one SR, one company with only an SR (alongside quarterly financial reports), and two companies with only an AR (one releasing an SR biennially and one with only web-based sustainability reporting to complement the AR).

The 2016 results and new partnership was published at the time of the annual conference of the International Corporate Governance Network (ICGN) and International Integrated Reporting Council (IIRC), held in London on 6-7 December 2016.

For more information and a listing of the top 20 material topics identified from the manual and automated analysis of the SRs, IRs and ARs of the 24 DJSI Industry Group Leaders, see below.

http://www.materialitytracker.net/results/djsi-industry-leaders-key-material-topics/

We are delighted to announce that we’re on the cover of Finance Monthly, discussing how a dynamic and business response coupled with our “game-changing” technology adds value to the business of risk management.

Blog update: We won the Game Changers Award 2017 (updated 16 Jan 2017)

Read the full article here: http://www.finance-monthly.com/issue/issue-10-2016/#34/z

Finance Monthly Issue October 2016 featuring eRevalue & Crowe Horwath

Finance Monthly Issue October 2016 featuring eRevalue & Crowe Horwath

The Luxembourg Business Angel Network (LBAN) participated in eRevalue’s recent £2 million funding round, an investment they believe will be an “excellent investment for our members”.

This follows the endorsement of Rising Tide, a new generation of women investors, earlier in 2016.

Read the full article published by The European Trade Association for Business Angels (EBAN):

http://www.eban.org/luxembourg-business-angel-network-guest-editorial

Global Head of Sustainability Indices, Product Management

S&P Dow Jones Indices

Blog posted by S&P Dow Jones Indices: August 11, 2016 – 9:38 am – http://www.indexologyblog.com/2016/08/11/esg-implications-and-the-brexit-an-uncertain-future-or-a-new-paradigm-shift/

Website: www.spdji.com

On June 23, 2016, the U.K. held a public vote [1] on whether to leave the European Union (EU), which led to a so-called “Brexit,” bringing a seismic shock to British, European, and global politics. Perhaps the biggest uncertainty is the future shape of European politics. Currently, we can only speculate what the impact might be on a range of policies linked to environmental, social, and corporate governance (ESG) themes.

So what will the implications of the U.K. leaving the EU be for the advancement of the Paris Agreement on Climate Change? Will the U.K. remain a leading voice for global development and humanitarian action? Read this blog to find out…

The economic impact of BREXIT

The British pound sterling fell 8% against the U.S. dollar on June 24, 2016—the biggest one-day fall since free-floating exchange rates were introduced in the early 1970s, and it is still down by more than 10% from its pre-referendum value against the U.S. dollar.[2]

Great Britain also lost its top ‘AAA’ credit rating with S&P Global Ratings which could have an impact on the U.K.’s borrowing costs in the long term. On Aug. 4, 2016, the Bank of England announced its largest stimulus package since the financial crisis of 2008 in an attempt to head off a possible Brexit-induced downturn.[3] The Bank of England warned prior to the referendum that financial uncertainty was to be expected and has repeated the warning since.

Even though the vote took place almost two months ago, we do not yet know when the U.K. will trigger Article 50 of the Lisbon Treaty [4] to kick-start the formal process of leaving the EU, nor do we know how long that process will last, or what form the U.K.’s future relationships with the EU will eventually take.

Policies announced thus far by the new U.K. government are mixed in terms of their support for ESG:

- Implications for environmental issues: The immediate closure of the Department for Energy and Climate Change the new commitment to fracking, and the lack of interest in public green finance engagements (in contrast to earlier this year) raises wider questions as to the U.K.’s commitment to environmental issues such as climate change, recycling, and air pollution. It has been suggested that the U.K.’s withdrawal from the EU could lead to a weakening of domestic standards as it focuses on the short-term interests of industry. This could in turn blunt U.K. firms’ incentives to develop programs in these areas.

- Implications for social issues: On the other hand, Theresa May, the new prime minister, has already made multiple public announcements in relation to more social justice, with a focus on equality, education, remuneration and workers’ rights. One of her greatest achievements as Home Secretary was the enactment of the Modern Slavery Act (2015) which consolidates slavery and trafficking offenses and introduces tougher penalties and sentencing rules.

- Implications for governance: Last month, Mrs. May also pledged to make pay ratios public and shareholder votes on executive pay binding. However, at the same time, the U.K. government is one of the strongest opponents of the EU’s Directive 2014/95/EU, which makes disclosure of extra-financial information and diversity mandatory, and during the EU referendum, Prime Minister May hinted that Britain should withdraw from the European Convention on Human Rights, regardless of the referendum result.

A U-turn on important ESG policies could be a concern for investors as the U.K. negotiates its withdrawal from the EU. However, there are clear indicators that the UK is not changing its direction: The UK’s Pensions Regulator finally enacted a new code of practice which mandates trustees of British pension funds to consider material ESG factors when making investment decisions. Additionally, ‘ESG & Brexit’ assessments by ESG research houses such as eRevalue and Sustainalytics [5] show that the impact of most ESG-related policy changes in a post-Brexit U.K. might not be severe over the short run, which, in turn, should support the continuity of U.K. firms’ strong ESG performance and a stakeholder-led “New Paradigm for Corporate Governance” as introduced by the U.K. Companies Act (2006).

At S&P Dow Jones Indices, our views on materiality and extra-financial risks and opportunities, at corporate and constituents level, remain unchanged – and a range of our sustainability indices have continued to perform strongly versus their benchmarks. For example the DJSI World Diversified Select Index (launched on May 30, 2013), the S&P 500® ESG Index (launched on Feb. 1, 2016) and the S&P 500 Environmental & Socially Responsible Index (launched on May 11, 2015).[6]

In addition, we have aligned our ESG policy efforts with the G20’s commitment and joined the newly formed Working Group on Green Finance by UNCTAD and the Sustainable Stock Exchanges Initiative, which was launched at the World Investment Forum in Nairobi in July 2016.

[1] The U.K.’s public referendum—a vote in which everyone (or nearly everyone) of voting age could take part—was held on Thursday, June 23, 2016, to decide whether the U.K. should leave or remain in the European Union. Leave won by 52% to 48%. The referendum turnout was 71.8%, with more than 30 million people voting.

[2] With the British pound sterling worth USD 1.31 (as of Aug. 4, 2016), it was down to the lowest levels since 1985. It has also fallen in value against the Euro. See http://uk.reuters.com/article/us-britain-markets-sterling-idUKKCN0ZN1R0 for more information.

[3] Mark Carney, the Governor of the Bank of England, warned that despite the central bank’s “exceptional package of measures”—which included its first interest rate cut in more than seven years to a record low of 0.25% from 0.5%, a new GBP 70 billion bond-buying program and a new GBP 100 billion funding scheme for banks—one-quarter of a million people were set to lose their jobs because of the economic shock. See http://www.ft.com/cms/s/0/0d729692-5a1a-11e6-9f70-badea1b336d4.html#axzz4GfMVAfm5 for more information.

[4] For the U.K. to leave the EU, it has to invoke an agreement called Article 50 of the Lisbon Treaty, which gives the two sides two years to agree the terms of the split. Theresa May, the U.K.’s new Prime Minister, has said she will not kick off this process before the end of 2016. This means that we will not begin to get a clear idea of what kind of deal the U.K. will seek from the EU on trade, immigration, and other policies until next year.

[5] According to eRevalue’s database, which includes more than 2,100 regulations on non-financial transparency, only two sets of current U.K. regulations regarding ESG disclosure are likely to be affected by the Brexit; see also Sustainalytics’ “ESG & Brexit” Report: http://www.sustainalytics.com/esg-spotlight-brexit-assessing-esg-implications.

[6] Data as of July 29, 2016. For more information, see www.spdji.com.

S&P Dow Jones Indices is an independent third party provider of investable indices. We do not sponsor, endorse, sell or promote any investment fund or other vehicle that is offered by third parties. The views and opinions of any third party contributor are his/her own and may not necessarily represent the views or opinions of S&P Dow Jones Indices or any of its affiliates.

Disclosure: Copyright © 2016 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures, please visit www.spdji.com/terms-of-use.