eRevalue BLOG

Accelerating pressures from the public, regulators, and investors demand more robust and immediate transparency from companies on environmental, social, and corporate governance (ESG) issues.

While reporting on ESG issues is fast becoming a must-have for companies worldwide, the practice still begs the question: are companies ready for disclosure and what are the risks associated with being transparent – or not?

Let’s take a look at conflict minerals disclosure, a debated topic increasingly on the global corporate agenda after the United Nations (UN) 2009 Security Council claimed that profits from minerals extracted from the Democratic Republic of the Congo were being used to finance local conflicts.

Although a newly approved decision by the U.S. court of Appeals no longer requires companies to disclose whether their products contains minerals sourced from war-torn Democratic Republic of Congo (DRC), as originally stipulated by the 2010 Dodd-Frank legislation, companies are still required to conduct due diligence on their supply chains and file reports to the U.S. Securities and Exchange Commissions with their findings.

Similarly, a recent EU proposal will force thousands of European companies to disclose information on the steps taken to identify and address risks in their supply chains in relation to conflict minerals.

Data captured by eRevalue’s Datamaran™ – a collaborative analytics platform that provides expert intelligence on regulatory, reputational, and competitive risks related to ESG issues – shows that only 1334 companies worldwide submitted conflict minerals disclosures in 2014.

This limited growth in disclosure is especially evident when we look at sustainability reports, as shown in the figure below. While companies in the US are requested to disclose the information in their annual reports, the most advanced ones also do so in their sustainability reports, Intel being a leading example.

Growth in conflict minerals disclosure in sustainability reports by industry

Data capture courtesy of eRevalue’s Datamaran™

Companies in the technology industry are unsurprisingly taking the lead, given that these minerals are found in almost every technology or device on which modern society depends – mobile phones, automobiles, computer hardware, and more. But are they ready to move beyond disclosure as a compliance exercise?

The Fairphone is an example of how companies may be. The Dutch company produces repairable smartphones made with conflict-free minerals sourced in the DRC, and is incorporating ESG issues into their core strategy.

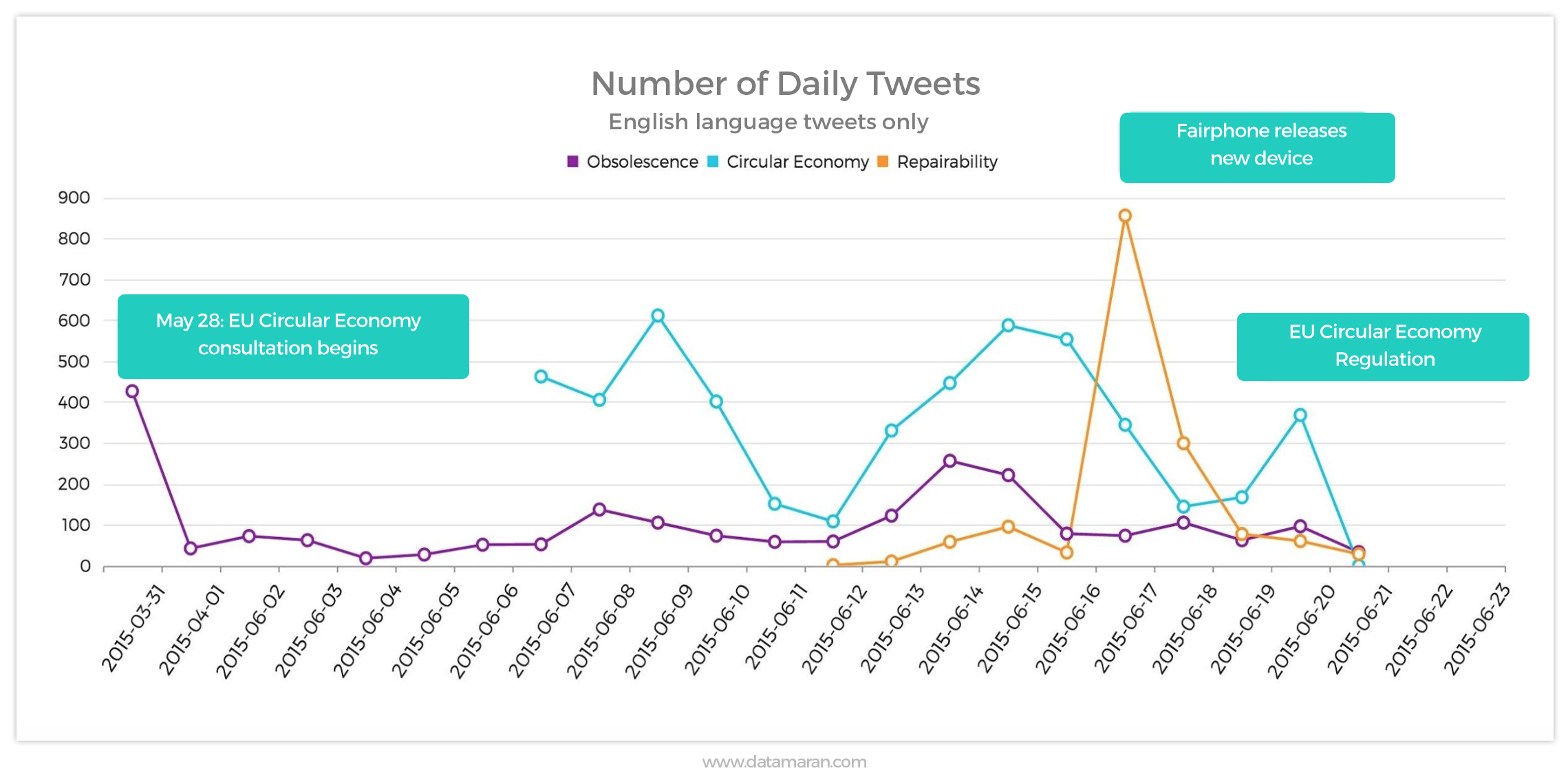

Following the release of the Fairphone 2, Datamaran™ detected a peak in activity on Twitter on June 17, 2015 around related issues, such as the #circulareconomy and #repairability; the majority of these Tweets approved the company’s modular technology and social responsibility promise.

Data capture courtesy of eRevalue’s Datamaran™

This activity signals to the fact that there can be competitive opportunities for those willing to go beyond transparency, and embed these issues into their core business strategy – especially in the face of competition, regulation, and investor pressures. The Fairphone is expected to sell 50,000 ethical smartphones this year.

At eRevalue, we will continue to watch how these regulatory, competitive, and investor pressures impact corporate disclosure – and see which companies will take the lead in moving reporting from a compliance exercise to a competitive advantage.

Interested in learning more about Datamaran™? Get in touch at info@erevalue.com.

Today’s business landscape is often unpredictable.

As a corporate decision-maker, keeping track of competition, regulation, and public opinion on the issues that matter most to your business is time consuming and overwhelming, but necessary for continued business growth.

That’s why Datamaran™ constantly monitors interactions in the competitive, regulatory, and public opinion landscapes – to enable focused and confident decision-making in a time-efficient and resource-effective way. How? It extracts narrative information (text) from thousands of corporate reports, websites, regulations, and digital media to deliver actionable data points on financial, environmental, social, and corporate governance (ESG) issues.

These data points reveal patterns that signal to emerging risks and opportunities related to competition, regulatory compliance, and reputation. They provide market sentiment by indicating which issues are currently prevalent and emerging as prevalent within any industry (Datamaran™’s database currently covers over 6,000 companies worldwide), referenced in current and emerging regulation (international, national, and local), and central to public discussions and stakeholder opinions.

By doing so, it reduces costs, saves time, and improves effectiveness in strategy setting and decision-making.

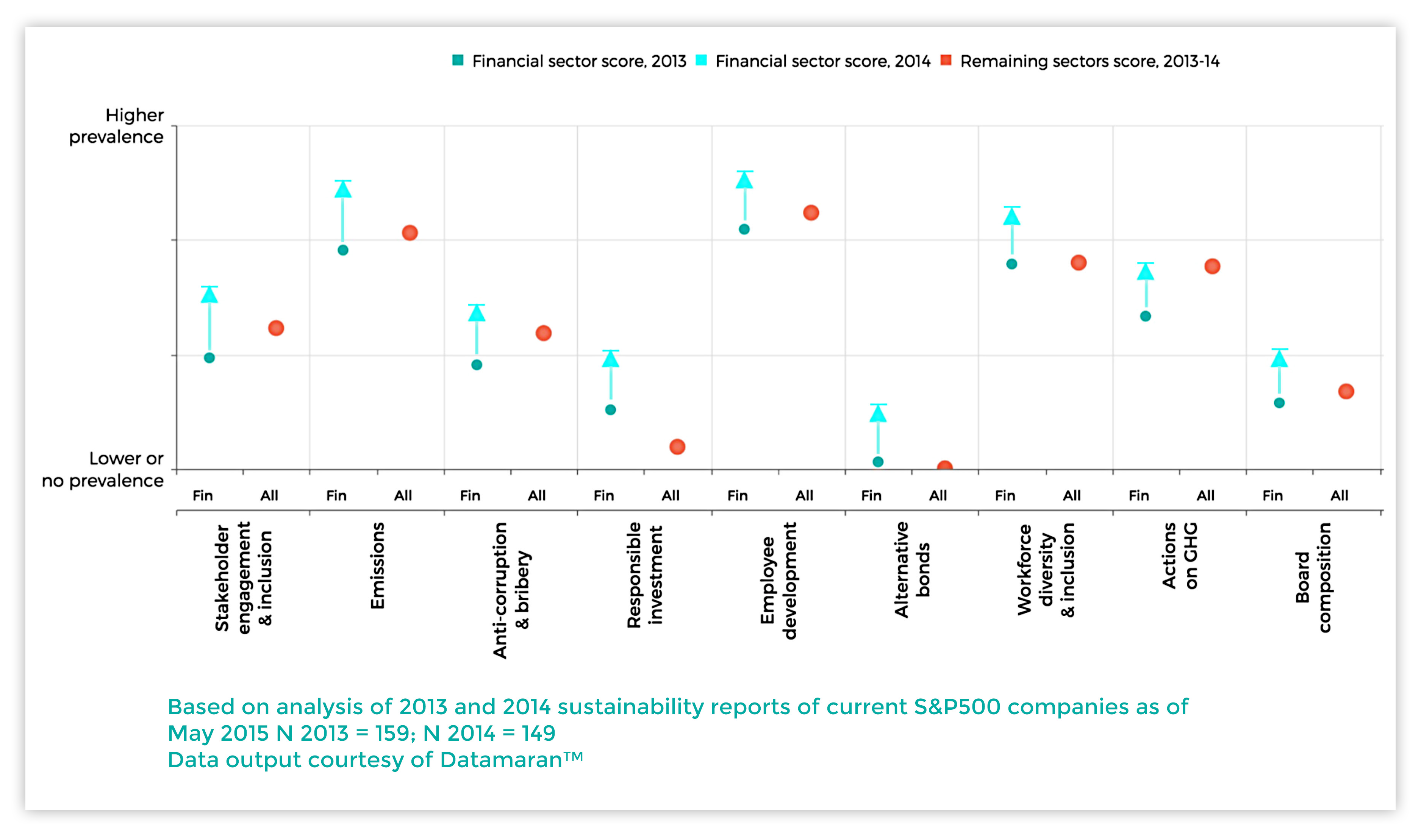

For instance, based on a sample analysis of 2013 and 2014 sustainability reports published by S&P 500 countries (as of May 2015), Datamaran™ shows that the top emerging issues in the financial services industry focus on a combination of financial, environmental, social, and governance topics.

The below chart illustrates how certain issues – such as alternative bonds – are increasingly prevalent in the financial services industry whereas they remain stagnant in the other industries represented by the S&P500.

Emerging issues in the financial services industry – focus on the S&P 500

The high prevalence of employee-focused issues, such as workforce diversity and inclusion and employee development, coincides with the increasing regulatory pressure on corporate culture in the financial services industry, a key component of which is trust.

Trust, or lack thereof, has been a heavily debated issue in the financial services industry, especially since the 2008 financial crisis. We now see a resulting emphasis on compliance capacities within companies, as businesses endeavor to keep up with increasing pressures – by competitors, regulators, and the public – to be transparent and responsible in a fast-paced global market.

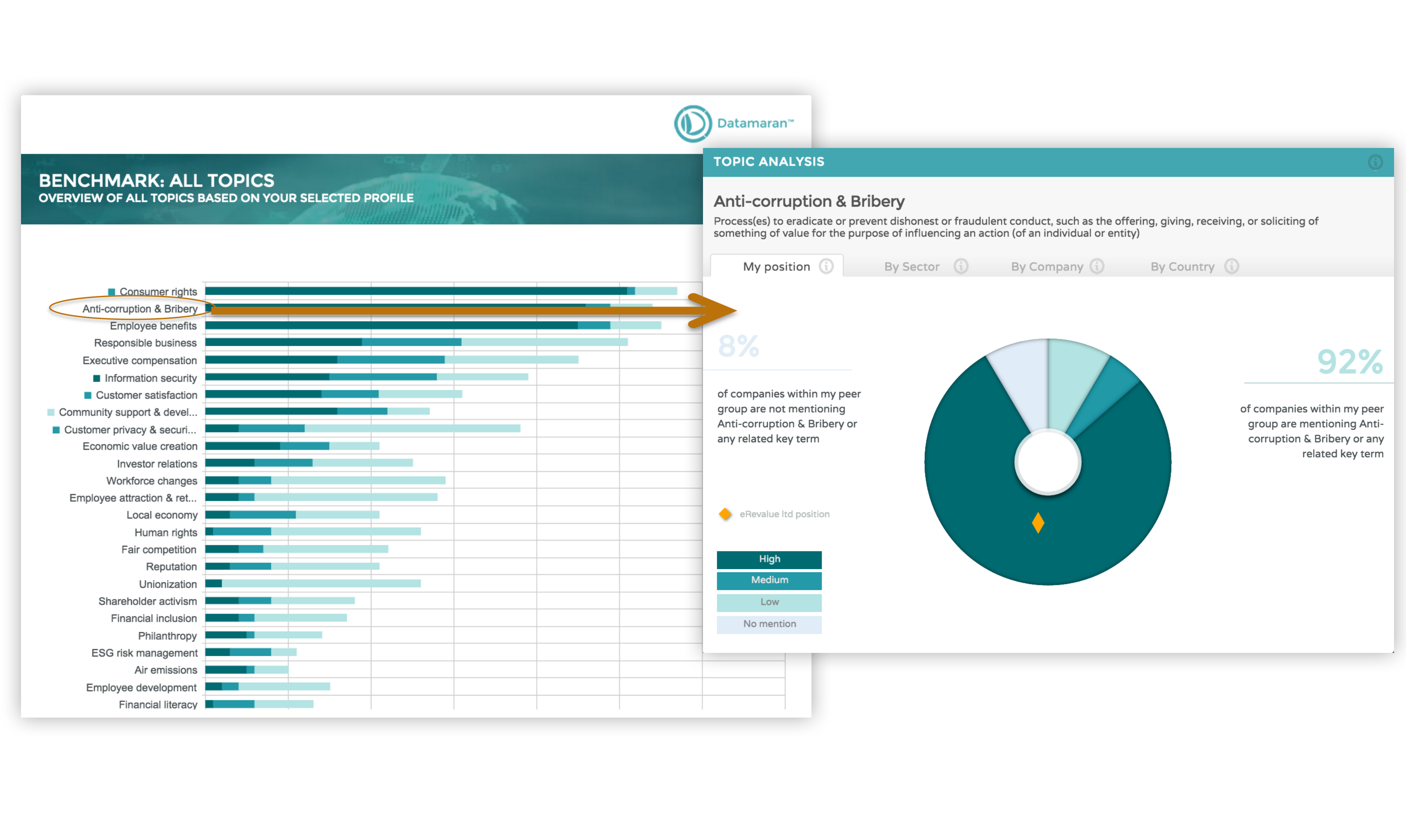

Zooming in on the topic of anti-corruption and bribery (central to the notion of trust), Datamaran™ shows how the majority of financial services companies in the United States place a high level of emphasis on this topic in their 2014 corporate annual reports – sustainability, financial, and SEC filings.

The below charts illustrate industry trends based on information extracted from these sources, zooming in on the issues with both a high and low prevalence in these reports (scrolling down the “Benchmark: all topics” chart provides a view of those topics with low prevalence).

The “Topic Analysis” chart – the digestible donut, as we like to call it – illustrates the relative prevalence of a specific topic within the industry. Focusing on anti-corruption and bribery, it provides an immediate view of industry sentiment as well as a company’s specific market position (i.e. to answer the question: is a company leading, lagging, or on par with its peers?).

Industry best practice in financial services in the US in 2014

Anti-corruption and bribery is a heavily debated issue beyond the financial services industry, as evidenced by the recent FIFA scandal.

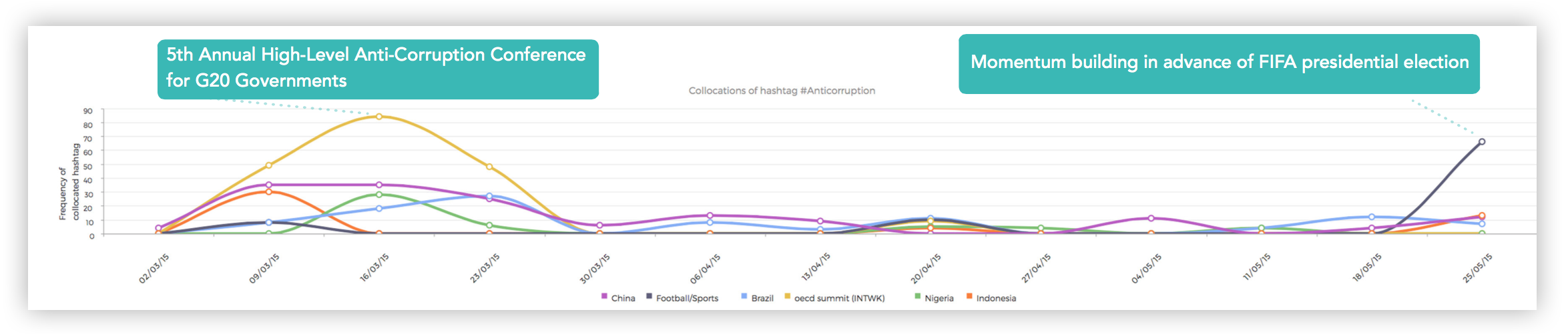

Consistently listening to public conversations on strategic business issues, Datamaran™ immediately detected a peak of Twitter activity around anti-corruption and bribery just days before the FIFA presidential election. As you can see in the below chart, Twitter conversations on #anticorruption peaked in relation to discussions about European football and, as shown in the following charts, FIFA’s biggest stakeholders – its corporate sponsors.

Title: Recent Twitter activity around “#anticorruption” & #fifa

The chart above also illustrates the association between #anticorruption and other developments, including the 5th Annual High-Level Anti-Corruption conference for G20 governments; however, after 25 May, the majority of tweets including #anticorruption focused exclusively on the FIFA scandal and its corporate sponsors.

» At eRevalue, we wondered: what is the impact on FIFA’s corporate sponsors, and how are they reacting?

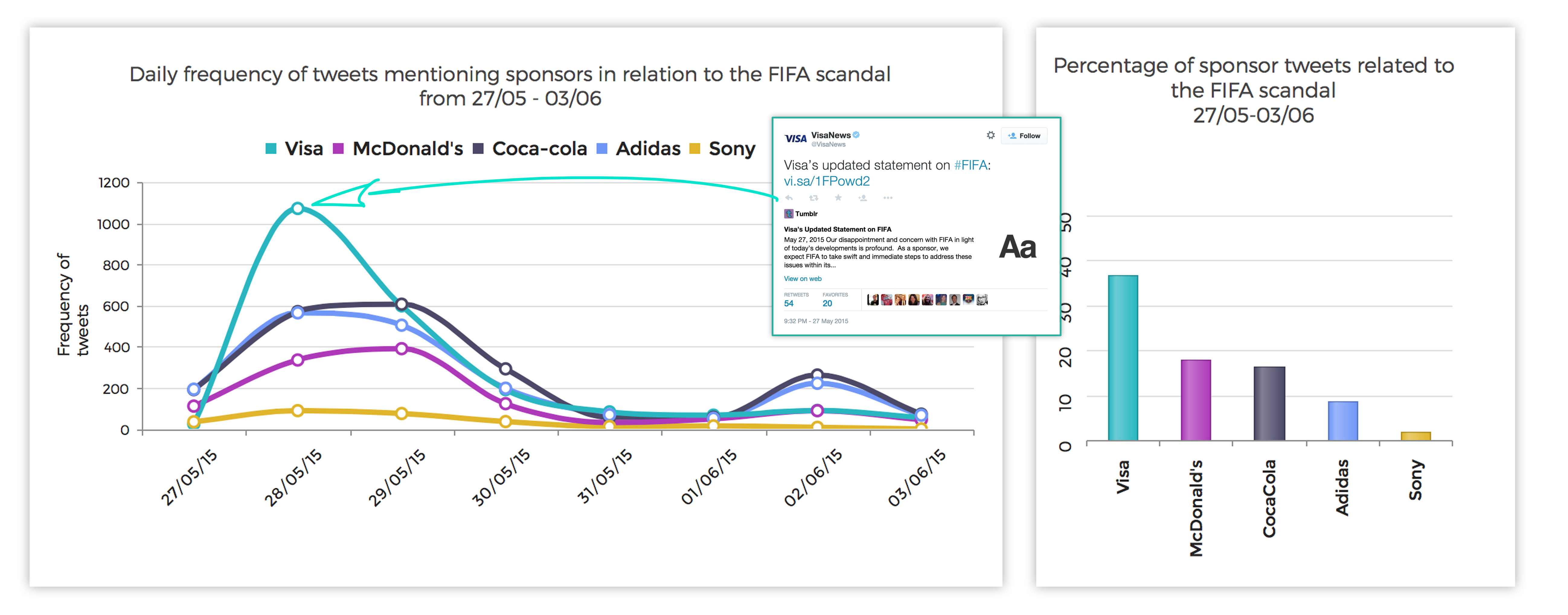

Following the conversation around #anticorruption and #football over the next days, we found that FIFA’s corporate sponsors were often targets of negative public sentiment and, at points, became actively involved in the discussion.

The above charts shows how Visa and Coca-Cola were two of the most active stakeholders, publishing statements regarding the scandal, whereas Sony, which dropped out of its corporate sponsorship deal with FIFA in November 2014, remained relatively quiet. These statements received mixed responses from the public, reinforcing the challenges companies face with being transparent in today’s hyper-connected world.

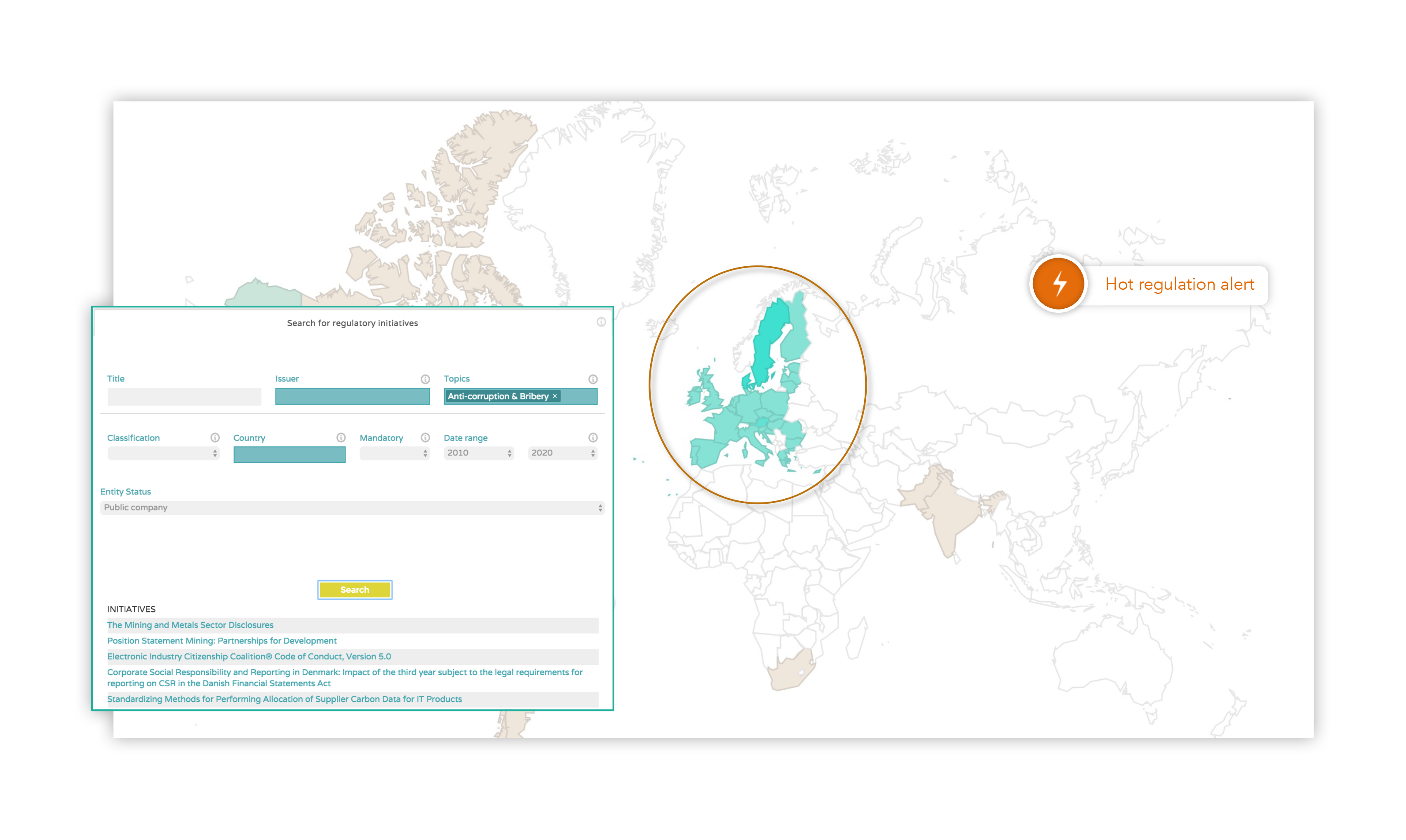

» Reputational risk aside, we asked: what are the potential regulatory implications for these companies – now and in the future?

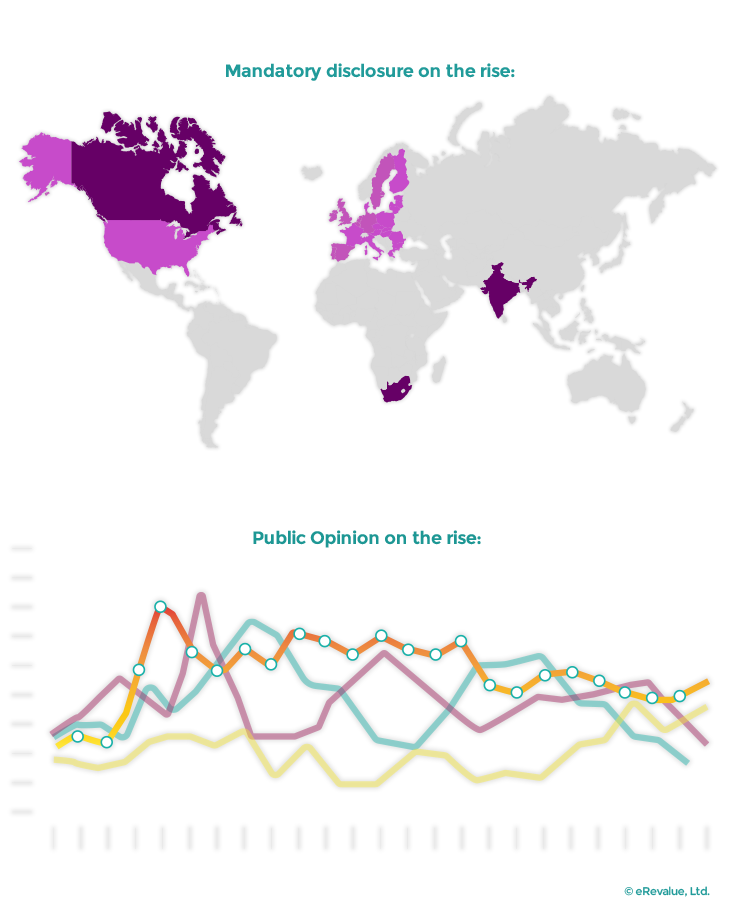

With Datamaran™, we immediately identified the relevant regulations by searching for initiatives that require disclosure on and/or reference anti-corruption and bribery and related issues – now and in the future. The below illustrations provide a view of these regulations, indicating in which jurisdictions the initiatives are currently or will soon be active.

Datamaran™’s regulatory database covers active and emerging regulations that impact corporate disclosure on various financial, economic, environmental, social, and corporate governance (ESG) issues – all of which are accessible via tailored analytics, advanced searches, and customized alerts.

» In only a few clicks, Datamaran™ delivered this immediate market intelligence, offering an all-around view of potential reputational, regulatory, and competitive risks and opportunities related to anti-corruption and bribery.

Interested in learning how Datamaran™ can keep you ahead of the game? Get in touch to schedule a demo.

Today is a big moment for us, and for our first users. Datamaran V1 has officially set its sails on our first anniversary, launched to an exclusive group of companies that we are thrilled to welcome aboard.

When people ask about Datamaran – what it is it, how does it work, why do people use it – I respond in two ways.

The first, a description for those curious about the software itself: Datamaran™ is the first software of its kind; it is a collaborative analytics platform that can visualize combined ESG (environmental, social, and corporate governance) and financial insights to deliver a tailored view of the issues that matter most to a business from various strategic perspectives, such as compliance, legal, public affairs and business development.

The second, a statement for those curious about what it does for the user and why it’s unique: it helps the “non-Teslas” of the world succeed in today’s unpredictable business landscape.

Datamaran extracts narrative from millions of publicly available sources – legislation, corporate reports, websites and social media – to alert decision makers to relevant developments in real-time; and help them get ahead of emerging regulation, build contingency plans for investments in new markets, track developments related to business partners and peers, and engage directly with the opinions shaping their reputation.

As we like to say, we do the legwork, you – the user – do the masterminding.

We’re thrilled that an exclusive group of companies will be Datamaran’s first users, having worked closely with us on the development of the software during its pilot phase. Thanks to the collaboration, Datamaran meets the needs of its various global users, helping them navigate the complex regulatory, industry, and public opinion landscapes.

Mahindra Sanyo Steel Pvt. Ltd. was one of the piloteers that contributed to the product development process. Managing Director Mr. Uday Gupta said: “We are excited to be on of the first users of Datamaran™, as it captures appropriate data and critical insights for us amid today’s ‘infobesity.’ With Datamaran, we can connect our strategy, brand promise, and reputational capital to build a robust risk and opportunity framework against the fast-changing business landscape.”

How does it do this? “Datamaran delivers interactive visualizations that will help to inform management better,” Claudia Graziani, Corporate Public Affairs, BSH Hausgeräte GmbH, a Datamaran piloteer explains.

Below is a glimpse at the types of visualizations that you can analyze and share in board meetings, on quarterly calls, and with your colleagues from anywhere, any device, at anytime. The visualizations show how Datamaran tracks current and emerging regulatory requirements on a specific issue as well as discussions on related issues taking place on social media in real-time.

Ready to get on board Datamaran? Get in touch to schedule a demo and learn more about your future.

Here’s what some of our users have to say about their journey:

“Datamaran’s simple approach to the user experience makes a complex environment of key business issues more accessible, enabling us to consistently evaluate our company’s position on an issue- and regional-level basis. It delivers interactive visualizations that will help to inform management better.”

– Claudia Graziani, Corporate Public Affairs, BSH Hausgeräte GmbH, a Datamaran piloteer.

“eRevalue’s data-driven approach and state-of-the-art technology creates the necessary link between financial and non-financial value creation. This approach informs decision-making in an unprecedented way.”

– Lara Muller, CEO at Onimpact, a Datamaran piloteer and exclusive ambassador to eRevalue.

“If vision is the engine of change, data is the fuel. Datamaran delivers this data in a clear and consistent way, helping to make some of the most complex issues of our time more digestible and, in turn, more actionable for business leaders worldwide.”

– Katherine Smith, Executive Director at Boston College Center for Corporate Citizenship (BCCCC), a Datamaran piloteer.

“eRevalue’s Datamaran enables easy and effective analysis and alignment of external sustainability drivers and corporate value creation. It fills the gap in the marketplace for strategic sustainability business intelligence data.”

– Tomi Pajunen, Senior Advisor at Mitopro, a Datamaran piloteer.

Crunching data, breaking silos: women in tech at TechCrunch Disrupt

“We’re going backward in a field that is supposed to be all about moving forward,” Hillary Clinton commented at the Watermark Silicon Valley Conference this past February. “We can literally count on one hand the number of women who have actually been able to come here and turn their dreams into billion-dollar businesses,” she said.

I’m not a feminist – maybe you can call me an “idealist realist” – and I believe in meritocracy in business. The best person for the job should do the job regardless of gender; but I am fascinated by how women in business and politics changes things. In this blog, I am going to give credit to some amazing women I’ve come across along my eRevalue journey, albeit short.

I wonder if you will recognize this, but many times my husband (CFO at eRevalue) and I leave a meeting with completely different take aways. “Were we in the same meeting?” – yes, we definitely were – but with entirely different perspectives – and emotions.

That mere observation coupled with the fact that only just now women are starting to climb the ladder is at the very least remarkable, and suggests how more women at the top may impact corporate decision-making. This will, I believe, lead to more well-rounded decisions – why not call it “curvy decision-making” (I know, bad joke, I take it back) – as issues will be analyzed and considered from more diverse vantage points.

Net neutrality is a hot topic that seems only to be getting hotter, especially in today’s media. Rooted into the principle that internet service providers and governments should treat all data equally, net neutrality is central to the notion of a free, open, and widely accessible internet, in which data and content are available on a level playing field for all individuals.

Politicians, companies, and bloggers are now debating how the recent approval of net neutrality rules by the United States (US) Federal Communications Commission (FCC), and related moves by other governments worldwide, will play out in the business world.

In the US specifically, Democrats and internet content companies are celebrating the openness net neutrality promises, and others, namely big telecommunication companies, are warning of possible federal lawsuit challenges against it.

At eRevalue, we’re following this debate using Datamaran™ to scan across media channels, the global regulatory landscape, and corporate reports to extract key insights on this debate – and then translate these insights into predictive analytic models.

The data shows that companies seem unprepared. The topic has been, in the past, only marginally reported on, even by companies in the US where open access to communication is historically a debated topic.

The idea lying behind net neutrality emerged in the US short after the dotcom and telecom bubbles; it involves leading ISPs companies and content providers, all based in the US and counting for approximately 25 per cent of the country’s annual growth rate.

In fact, today’s cornerstone regulations on communication worldwide find their root in the US legal system, stemming back to 1934 when then President F. D. Roosevelt signed the Communication Act to prohibit competition among Telecom corporations.

This year’s ruling, coined Obamanet, focuses on the 21st century “information age” and risks associated with the “internet of things.”

A reaction to various high-profile lawsuits and public concerns, the recent FCC ruling aims to put an end to years of debates between regulators, the government, internet service providers (ISPs), content providers and customers – and yet, it seems that the debate is now stronger than ever before.

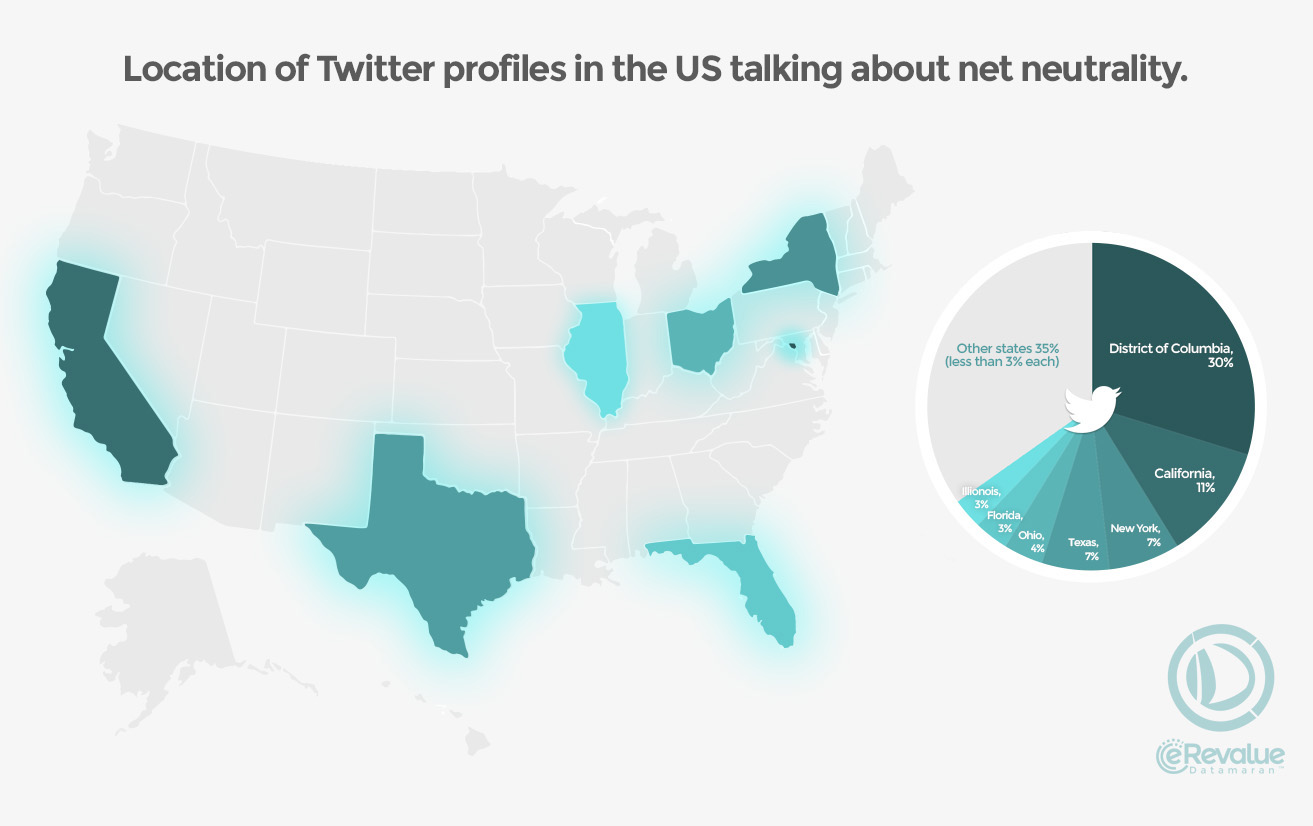

Such dissent is currently evident on social and fast media platforms, where net neutrality is a hot topic, particular in the US. Twitter accounts located in the US constituted the vast majority of Twitter activity around net neutrality over the past two months.

Looking deeper, our social media analysis shows that the US “leads the discussion.” By zooming in on Twitter activity post-FCC ruling, for instance, we found that the majority of activity was driven by US-based Twitter accounts located across the country – from the District of Columbia to California, as shown in the below charts.

Powered by Datamaran™. Data captured between 8 – 22 March, 2015.

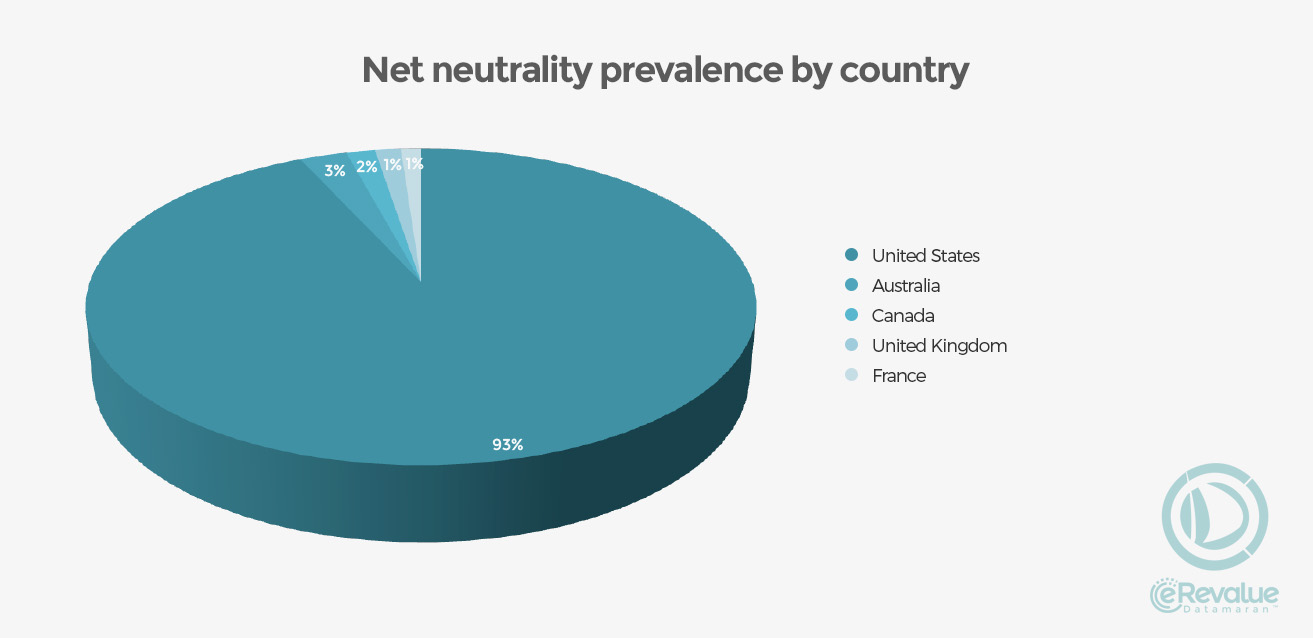

This is in line with the fact that the majority (approximately 93 percent) of companies disclosing information on net neutrality in their corporate reports are headquartered in the US, as illustrated in the chart below.

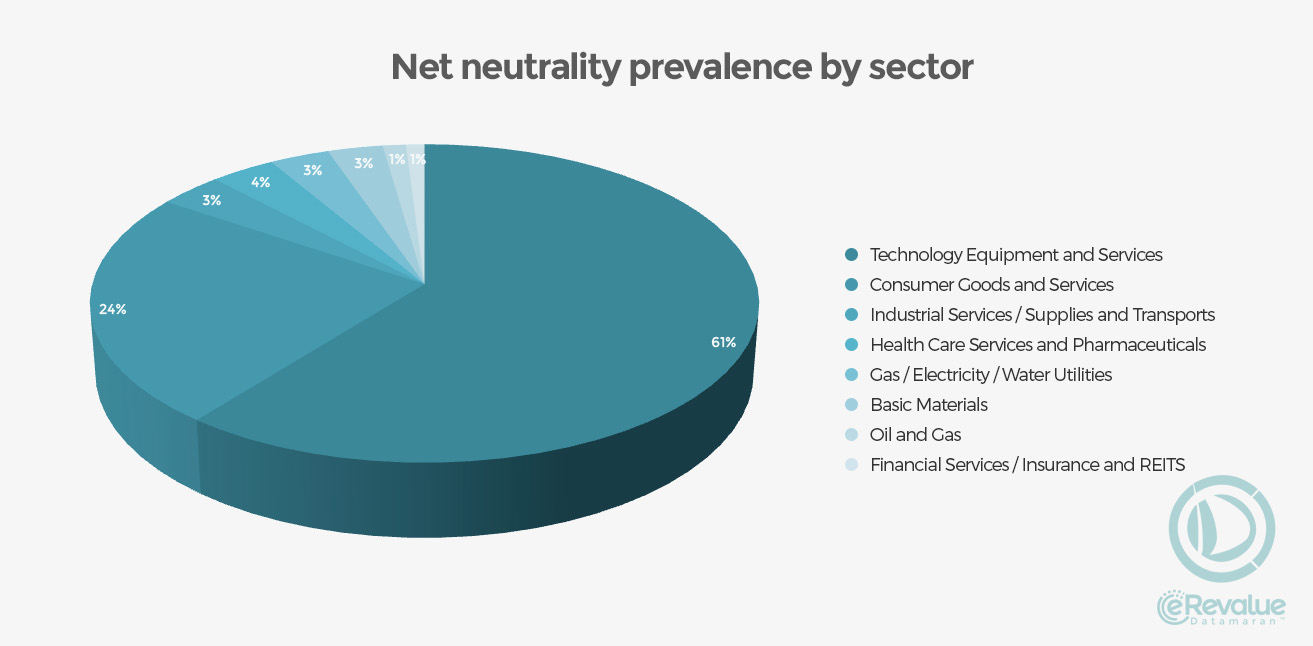

The majority of these companies are, as expected, from the Technology Equipment and Services industry followed by the Consumer Goods and Services industry given their customer-centric focus.

A deeper analysis of social media activity shows a variety of arguments in favor of and against net neutrality, with the topic being linked to related issues, such as market access, consumer satisfaction, and human rights.

When compared with the low prevalence of this topic in corporate reports, this social media activity reinforces the reactive disclosure behavior that underlines corporate reporting overall – in the US and beyond.

This analysis suggests, therefore, that companies have yet to identify the potential risks and opportunities associated with open access to the internet, which, based on these recent regulatory developments, could intensify quickly.

The business risks associated with these regulatory developments range from short-term direct financial impacts, such as heavy fines, to longer-term reputational challenges resulting from public dissent.

We can, therefore, expect to see an increased focus on net neutrality in business reporting and communications, as companies continue to react to developing regulations and public emphasis.

Net neutrality is just one example of the descriptive and prescriptive power that can be drawn from Datamaran’s output, which distills insights into the lifecycle of an issue within the corporate, regulatory, and stakeholder landscapes – and enables users to prepare for what may happen down the line.

Using this elevated view aboard Datamaran™, we will continue to explore these emerging risks and opportunities, and share our insights along the way.

Interested in learning more? Feel free to get in touch at any time as we set Datamaran’s sails for launch very soon.

*With contributions from Ivo Mugglin (Industry Associate) and Emmanuelle Haack (Regulatory Associate).