eRevalue BLOG

Our partners at MaterialityTracker have just published a very interesting article highlighting Mervyn King’s (former Judge of the Supreme Court of South Africa and Chairman of the King Committee on Corporate Governance in South Africa) views on non-financial disclosure requirements and their importance when defining materiality.

Law, jurisprudence and courts are challenged to keep up with winds of change

March 2017 User View by Mervyn King, former Judge of the Supreme Court of South Africa and Chairman of the King Committee on Corporate Governance in South Africa

THERE are differences in how materiality is defined by the accounting profession, the legal profession, courts, stock exchanges and regulators. Materiality has been molded over 100 years via legal judgments and court decisions, as well as by accounting standards bodies. Lack of agreement across the Atlantic on what constitutes common international standards for financial reporting has led, among others, to a proliferation in definitions of materiality. It is against this background that as IIRC Chairman I asked the heads of the internationally leading reporting standards bodies to join a discussion under the Corporate Reporting Dialogue. Today they collectively look into overlap and convergence. They’ve come up with an agreed general definition of materiality, and now have a basis from which to tackle more technical matters such as appropriate thresholds to apply in determining materiality.

Convening the Corporate Reporting Dialogue, the International Integrated Reporting Council (IIRC) arranged for among others the International Accounting Standards Board (IASB), Global Reporting Initiative (GRI) as well as the Financial Accounting Standards Board (FASB) and Sustainability Accounting Standards Board in the USA to develop a general definition of materiality which could be applied in both the accounting world and the sustainability world. The definition developed is as follows:

“Material information is any information which is reasonably capable of making a difference to the conclusions stakeholders may draw when reviewing related information.”

In judging on materiality, legal experts and courts consider any public disclosures, not only reports or annual statements as such. They ask what is material to a case issue involved, material to the matter of dispute between two parties, or material to the business of a company. That is different to material matters where an accountant or auditor looks at report preparation or assurance of its material content. Levels of materiality will also differ from company to company. It depends on contextual factors such as industry, market and historical track record of the company.

New information technology and data analytics will help tremendously in improving analysis of data and circumstances relevant to a company. The work gets automated versus being done by young analysts. There is definitely an issue of information overload, and what is reported daily in the media – including social media – is not necessarily the best guide to what is most material to individual companies. But if there is a legal dispute between a company and someone, any public statement will be assessed in the context of determining the relative credibility of two parties involved in a dispute.

In the litigious society that is the USA, much weight is put on use of the term materiality from an evidential point of view. As a result lawyers advise people not to use terms such as materiality outside of their statutory filings. The assumption is that materiality implies clear financial consequences, and the term should not be used loosely, certainly not inconsistently between different types of reports. But more weight should not be given to statutory documents. The question of materiality should be treated on the basis of parity when it comes to reporting on matters which could result in the reader or user drawing a different conclusion from the one reported. It doesn’t follow since the term appears in a statutory document that you should give more weight to it. When you are complying with a statutory requirement there is always the factor of mindless compliance. You don’t apply your mind to the question of what is material or not, and you end up with so-called boilerplate disclosures. Mindless compliance implies there is no application of the collective mind of a Board on the issues involved.

Financial accounting standards recognize that deciding on materiality involves considering not only financial and quantitative information, but also non-financial and qualitative information. Behind a quantitative financial figure, there is lots of judgment, valuation and application of standards to come up with a number that is presented as a fair statement of the financial position of a company. Thus there is a qualitative aspect to the quantitative number. In making those judgment calls managers consider what is significant and what is important in valuing for example a major asset. Eventually the auditor will say I have examined this and believe it is a reasonable conclusion. He gives a reasonable assurance audit of that number. But qualitative judgment calls went into the decision-making process. The financial statement on face of it is quantitative, but there is extensive qualitative reflection underneath it.

From a qualitative judgment point of view, you also have to feed sustainability trends into your assessment of risks. Consider that we now have extinction accounting, applied by for example a food retailer when assessing the consequences of the depletion of bee populations. These include the impact of decreasing pollination for wheat production, implications for supply risks and ultimately for a fair presentation of the financial position of the food retailer. In our resource deprived world, extinction accounting is becoming an important discipline. This includes valuation of Natural Capital and its translation into financial figures. Of course, you cannot monetize everything and you cannot divorce it from the judgmental call being made because a risk has to be accounted for. New research is considering whether we should stop calling things “financial and non-financial”, since the non-financial can easily destroy a company. Maybe we should just refer to “assets and liabilities”.

Over the last decade “non-financial” disclosure requirements have been growing in number. Yet what is required by law or by regulation to be reported is not by definition material. Just the opposite. Regulations and reporting standards are not a constant. They are dynamic, always changing. As you have corporate scandals and failures, new regulations are introduced and add complexity. For many this has become incomprehensible. It may be that some report preparer has applied a requirement, for example a new standard on revenue recognition, but it is a mindless compliance. Legal requirements can result in boilerplate text repeated annually with what is not necessarily material information…

eRevalue is proud to be a fully diverse organisation promoting equal rights, with offices in London, New York, San Francisco and Valencia. Our team comprises over 17 nationalities. today we would like to celebrate some of the brilliant women behind our success.

Women in Leadership

Marjella Alma – eRevalue – CEO – Photo by Bart Dykstra

As the CEO and co-founder of eRevalue, Marjella provides a strong vision for the business, gives strategic direction to the team and leads business development. A technical expert with in-depth knowledge of ESG reporting standards and responsible investing. She is a fantastic leader, and an inspirational motivator for the whole team.

She created eRevalue as she believes that big data in ESG provides a major business opportunity.

Prior to this, Marjella was the head of the New York office of GRI (the Global Reporting Initiative) – the most widely used standard for measuring and managing Environmental, Social and Corporate Governance (ESG) risks. She joined the GRI headquarters in Amsterdam in 2007 where she successfully set up the services department, and at the age of 30, became the youngest female Director for the GRI.

With strong female leadership from our CEO, Marjella has taken the organisation from four to thirty staff members in under three years. Over 60% of our senior leadership team are women, meaning our team outshines the recommended 30% of women in senior positions.

To her credit in having an open and fair recruitment process, just over 50% of our team are women. We are proud to work alongside a fantastic team of male workers too.

Hedda Pahlson-Moller, Client & Investor Relations, Europe

Hedda was recently featured on the front page of the Luxemburger Wort as a shining example of a responsible entrepreneur and Business Angel.

Hedda brings 15 years of experience building and investing in businesses; 10 years of teaching at University level (she is currently the Professor of Entrepreneurship at Sacred Heart University (Luxembourg Campus); and 7 years of Board positions in Funds (early stage and microfinance) and European platforms (EVPA, EBAN, etc). Hedda has a background in professional services and ICT, and primarily in strategy and commercialization roles. She is also an active early-stage investor.

As you might expect, Hedda also has an impressive educational background. She has a BA in International Relations (Foreign Policy, Diplomacy and Global Security), an MSc in Political Economics and an MBA. This woman has clear (business) plans to save the world.

Susanne Katus, VP Business Development

With experience working at the Global Reporting Initiative alongside our CEO Marjella Alma, Susanne possesses a strong overview of the key issues that we cover at eRevalue. She joined the company as its first hire and, along with our CTO Jerome Basdevant, represented eRevalue as a finalist at TechCrunch Disrupt NYC 2015.

Her global experience advancing ESG strategy in business, combined with her research background in emerging markets, underpins her belief and passion for ESG issues. She has worked with various industries and stakeholders (regulators, international organizations, academics, businesses, industry associations, accountants and the media), is a published author and guest lectures at MBA programs.

Erin Levey, Head of Research. Photo by Bart Dykstra

Erin leads the research team at eRevalue on the direction and scope of analysis provided to clients.

Erin is a member of UNPRI SDG Advisory Committee. Previously, she was an SRI Analyst for responsible investors for 4 years – analysing companies on their ESG performance and building RI research strategies for institutional investors. Prior to that Erin worked for 5 years in the Oil & Gas, Mining and Construction sectors in Australia and the UK – her graduate role was in the construction and initial operating phase of Australia’s first Oil Hydrogenation plant. She has worked across Mining Services, Construction, Pharmaceuticals and Facilities Services as a Sustainability and HSEQ professional.

Maeva Devienne, Customer Success Manager. Photo by Bart Dykstra

Maeva leads on customer success at eRevalue, having previously worked in consultancy for sustainability and research across a range of industries at Deloitte (consumer business, natural resources, finance, agriculture, public sector, energy, waste management, tourism and education). This experience has given her a dynamic flexibility in understanding how ESG issues affect different industries.

Shona Maguire, Senior Marketing Manager. Photo by Bart Dykstra

Shona leads the marketing and communications strategy and development at eRevalue.

A former digital marketing director using inbound marketing techniques, with over three years of experience working in B2B, B2C and sustainability related communications activities for multinational organisations, and 10 years of experience in communications and business development roles in environmental, human rights and international development positions.

Women in Tech

Angela Onslow – eRevalue – Photo by Bart Dykstra

Our in-house, expert Data Scientist, Angela Onslow, analyzes and visualizes our data sets contributing to the ongoing development of our Natural Language Processing SaaS platform, Datamaran® using a variety of programming languages and libraries, including Python, Javascript and D3.

As a Fellow at the ASI Data Science, Angela has an impressive array of educational achievements. She has a BSc in Physics from Royal Holloway, University of London, an MSc in Complexity Sciences for which she received a distinction. Additionally, she holds a PhD in Computational Neuroscience from the University of Bristol.

Anuja Yadav – Photo by Bart Dykstra

Anuja Yadav is a Data Analyst with 3 years of experience as a business analyst in market research for Tata Consultancy Services in collaboration with Nielsen. She has experience in pricing and promotions for the FMCG industry.

Knowing what topics are material to your business is an essential component in managing the success of your business, which is why materiality assessments are so crucial. With rapid changes in the technology available within a globalized world, it is now possible to combine the creative and analytical skills of human beings, with the productivity potential of machines to efficiently process large data sets, creating automated analytics across multiple data sources in a matter of minutes.

We are seeing an unprecedented rise in risks associated to climate change, cyber and geopolitical risks, and increased demand for transparency. Markets are evolving. Social expectation is changing. We now have access to game-changing technology which is disrupting the traditional materiality process. Companies are starting to harness the power of data to make real time decisions on these issues – and we, at eRevalue, are helping them to do this. In fact, those CSR and sustainability professionals that are working on their once-a-year “materiality assessments” right now – can now do so using evidence-based information and use technology to monitor any significant changes overtime.

“In 8 years at the Global Reporting Initiative (GRI), working in the area of sustainability and Environmental, Social and Corporate Governance (ESG), I realised technology was the key to delivering genuinely insightful information on how business issues are evolving over time. It has always been my aspiration to use technology to change the game, by manipulating the explosion of available data into structured knowledge for improved value creation for business”. Marjella Alma, CEO, eRevalue

Any companies that are not harnessing the potential of emerging technologies are unlikely to be able to regain lost ground.

Enhancing Human Expertise with Technology

Being able to harness technology to analyse more accurate and larger sets of information, is what is making the difference to companies. Technologies deliver faster, cheaper, more exhaustive information, and create opportunities to streamline decision-making and stakeholder engagement processes.

“The platform provides us with a decision-making basis to derive concrete initiatives to improve our performance with regard to the material topics”. Dr. Monika Streck, Head of Strategic Sustainability Management, Munich Airport

Forward-thinking companies are beginning to react to this disruptive technology, using it to refine their existing approaches to prioritizing material issues across teams – risk, sustainability, legal, finance and investor relations. eRevalue works with companies in 12 countries that are doing this within various industries – banking, electric utilities, real estate, consumer goods, oil & gas, air & defense, mining & metals, and pharmaceuticals.

They recognise that anticipating and addressing emerging issues will help increase the lifespan of their business. Risk management has traditionally been a slow and manual process, making issues identification difficult. Companies need to evaluate the relevance of a multitude of sources, all of which are continuously evolving. Using data analytics, combined with AI technology, means that the process of monitoring changes in the corporate landscape is now considerably more time efficient, relevant and up to date.

“It’s not about determining numbers behind the strategy, but determining the strategy behind the numbers”, Leonardo Gutson, eRevalue (former KPMG consultant)

The key question for decision makers is this: Are you moving with the times, or are you stuck in the past?

Fast Forward

We are seeing a rise in demand for continuous materiality assessments across a range of business maturity models. As such, we have recently enhanced our service offerings to support this process – starting from automated industry/peer benchmarking all the way up to integrating these non-traditional issues into traditional ERM processes. We call this “integrated ERM”. And we aren’t the only ones talking about a more integrated approach to sustainability and risk management – Deloitte and WBCSD are also discussing these issues.

eRevalue’s business intelligence platform Datamaran® automates the tedious process of extracting and analyzing information from a large number of sources – corporate reports, regulatory initiatives, social media and digital news. It enables professionals to easily digest and convert data into valuable knowledge. This approach offers an innovative solution for assessing what might be material, enhancing risk management and informing corporate strategy:

“How can we use data to drive conversations within our company, getting the right people at the table…and the business opportunity is not just for the people in the sustainability silo, but looking at data to help us drive conversations across our company”. Jennifer Leitsch, Director of Corporate Responsibility, CBRE

Building the Foundation – Baseline & Emerging Business Issues

We have identified 100+ emerging business issues that can impact the ability of companies to operate efficiently, across geographies and sectors. This list is built upon non-financial reporting frameworks, the Global Risk Report of the WEF and therefore includes issues related to environment, social and governance (ESG) – but also geopolitical and technology risks.

The scope evolves as new issues are identified with key headline topics related to climate change, digitization, executive compensation, board composition, IP infringement, responsible procurement, human rights, bribery and corruption and many more. The value to be derived from addressing these issues can include greater efficiency, cost-savings, effective reputation management, positive company ethos and transparent governance.

Depending on the company, value chain, sector and key areas of operations, the issues will be different. eRevalue also differentiates between what non-traditional issues are becoming the de facto “new baseline” as well as what is top of mind today – “the hot topics”.

Being dynamic and responsive to change by using real-time quality analytics across emerging issues is crucial, which goes hand in hand with the capability to identify and address issues as they arise.

“The current pace of evolution of businesses’ operating environment requires to look beyond traditional risk management practices. The use of big data and artificial intelligence can help modernize and optimize the process.” Maeva Devienne, eRevalue (former Deloitte Consultant)

eRevalue was created to bridge the gap between non traditional and core business. Our business intelligence tool, Datamaran® extracts large amounts of global data from a variety of sources of emerging issues, highlighting real-time identification of connections between various data sets.

This is a powerful offering for continuous materiality assessments, identifying trends, gaps, and opportunities for automated monitoring of strategic issues. The approach includes analysis of any type of corporate report, regulatory initiatives, social media and media – and a validation of the issues prioritized by key stakeholders. Automated alerts keep clients informed on identified issues through the annual subscription – and alert clients when new issues come to the table.

Get in touch to find out more about how we can help you with continuous materiality.

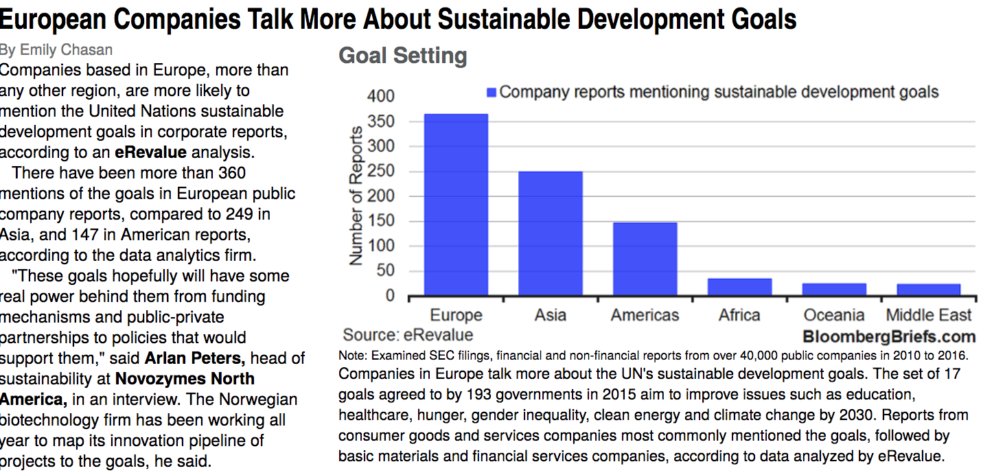

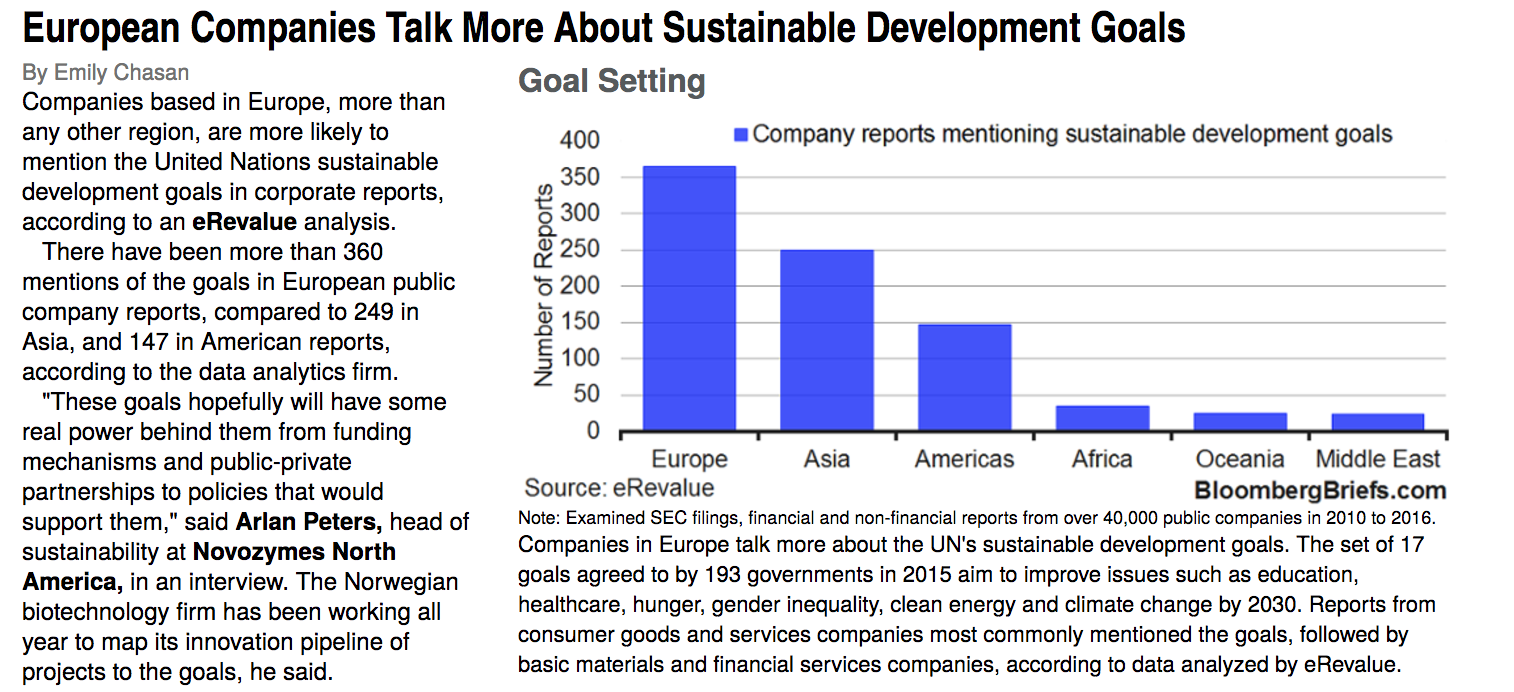

As reported in Bloomberg Briefs, using eRevalue data, the Sustainable Development Goals (SDGs) are most popular in European corporate reports when compared with other regions.

eRevalue will soon launch it’s SDG Radar – available within our AI engine and business intelligence tool, Datamaran®.

For more information on eRevalue’s SDG Radar, click here.

We are delighted to see Hedda Pahlson-Moller, our European Client and Investor Relations correspondent, featured on the front page of the Luxemburger Wort, and a special mention of eRevalue as a way to help businesses manage ESG issues. Translated for our English readers pleasure, the article reads as follows:

Portrait of a Responsible Entrepreneur

Hedda, Business Angel

Article by Thierry Labro

Being 5 feet 9, with blonde hair falling on her shoulders and a discreet smile, Hedda Pahlson-Moller is one of a kind. Even if she wanted to, the Swede, born in Quebec in 1975, could not be like other women. She does not go unnoticed anywhere.

Her story begins at age two, in Connecticut, where her father, an engineer, develops his business in a hurricane of life, between his boats, his marina and his companies, and a committed and applied social worker mother. The grasshopper and the ant are soon separated. The young woman is ten years old. “My father gave me the basics or pragmatism… and my mother the obligation to give back to society what society gave us.”

A War Hero Ancestor and a Countess For a Grandmother

Born a free spirit, the Rhode Island Basketball player embarks into international relations. She discovers at the American Embassy in Berlin that “the world is not changed so easily.” Farewell to politics, frustration sends her to humanitarian activities.

She heads to New Delhi to work for an NGO, the Centre for Science and Environment. She virtually drapes herself with a sari, the traditional and colourful dress worn by Indian women, and recalls her Spartan living conditions on the spot. As if to assure that stripped of everything, it is perhaps there that she has learned the most from human relations.

Asia brings her to the Development Bank of Japan and then the Swedish Embassy. The European returned to the land of her illustrious ancestors. She is the great-granddaughter of Major Pahlson, a legend of the Swedish Army, who allowed Finland to save honour at the end of the Second World War by hiding away state secrets before the dreaded arrival of the Soviets.

She is also the granddaughter of Gunilla Bernadotte, who became Countess of Wisborg thanks to Grand Duchess Josephine Charlotte, when she married in second marriage the fifth and last son of the King of Sweden, after the latter had renounced his title to marry a Swedish journalist.

Hedda’s father returned to Sweden and bought the Manor and Park of Rottneros, which inspired “Ekeby” by Selma Lagerlöf, one of the most famous novels of Swedish literature – Selma was the first woman to receive a Literature Nobel prize in 1909. “It’s an extraordinary place, surrounded by forest, where I spend each summer with the kids.”

Like politics, Humanitarian work does not satisfy her desire to change the World . “In the 1990s, NGOs did not have the means to do this. I figured I was going to get there through entrepreneurship.”

The year 2000 favoured her: her first job takes her to Hewlett Packard. Between Belgium and France. “I was in Grenoble. It was so difficult for me who had known New York, New Delhi, Edinburgh and all these cities … One day, on my way home, I stopped in Luxembourg. I instantly adopted this country and I believe it adopted me. Even though recently, someone I love very much told me that I will always be a ‘usual suspect’. This does not sound negative to me at all.”

Hedda “the romantic” begins a third course, a third cycle in entrepreneurship in Copenhagen and throws herself into business, social investment and social innovation.

She is aware that her bulimia of change seems inaccessible to most of those who would like to play on every board. Her resume is a testament to the twenty or so start-ups on which the business angel watches over, the two companies she runs, and the five other structures, companies or think tanks in which she drives her energy.

“I make mistakes, I sometimes make bad investment decisions,” she acknowledges naturally with her Swedish culture of peace, while her American fibre drives her to continue to engage. “Slowly comes a wave that recognizes that social investment can have a positive influence on business. Before, entrepreneurs paid taxes for the state to take care of the common welfare and wanted to make a profit. Now they understand that profit can be made by taking social dimensions into account. In many different ways, with happy, fulfilled employees, with values that are conveyed in terms of image or with the disappearance of trouble with justice.”

“Let’s Hack Capitalism!”

She grabs a teaspoon. Would like to twist it as you twist your neck to a rumour. “If we were to calculate all external costs, the matter that we’re going to have to reinject somewhere, to get it from the other side of the world, the circular economy really makes sense. BT, Ben & Jerries, Unilever and many other companies have understood this. Let’s hack the capitalism! “

“eRevalue”, which is in her equity portfolio, has developed a tool that helps decision-making in management, in terms of environment, governance and social benefits. “Since they have been using it, some companies have become ‘first movers’.” The first ones to strike gold, and they discovered it almost by chance. A Luxembourgish tradition, even if this company does not (yet) have Luxembourgish clients.

The entrepreneur has become business angel. The business angel became a professor for the Sacred Heart University and for the University of Luxembourg. Neither grasshopper nor ant, but a butterfly that lives every day as a new day. Who spends each day hand in the hair of her two blond heads seeing how Luxembourgish society has changed during the last ten years.

“At the beginning, at university, there were five students in my classes. Young men who dreamed of becoming entrepreneurs. Today the rooms are full, 30 to 40 year old women! There are more Luxembourgers too. The entrepreneur is no longer the one who did not really work, “she says.

Her first lesson is tolerance to failure. “There is no success without prior failure. At the age of five, the majority of entrepreneurs fail! But the worst part is that 70% of them did not try again! That is what we need to change. ”

Her latest project, the latest one she committed herself to, equilibre.lu, promotes gender balance in the professional world. “In my mind, there is no difference. I am here in society. There is everything in us, a part of femininity and a share of masculinity. The rest…”

To read the full article go to: http://www.wort.lu/de/business/portrait-d-un-entrepreneur-responsable-hedda-business-angel-58b436bca5e74263e13ab390