eRevalue BLOG

There is a line of thought that states technology has caught up with human potential. Largely unhindered by technical constraint, we live in an age where technology is unlocking untapped areas of human creativity. Welcome to the Fourth Industrial Revolution.

What is the Fourth Industrial Revolution?

The first revolution is considered to be the revolution of the manufacturing industry. The second revolution is the larger industrial revolution, which was facilitated by the steam engine and transport infrastructure. The third is the digitization of production.

Generally speaking, the fourth industrial revolution is considered to be the fusing of physical, digital and biological worlds, which we are now facing.

1. Don’t Fear Automation: We’ve Been Here Before

In the process of mining this potential, we face a difficult period as large quantities of jobs become automated.

This is not the first time such a trend has occurred. During the First Industrial Revolution, there was a group of workers in the Northern counties of England – known as the Luddites – who aggressively opposed the machine-led disruption of many manufacturing systems.

The 19th century Luddites were chiefly concerned about losing their livelihoods. Their struggle was understandable but largely an emotional response that occasionally spilled into violence.

Two centuries and two industrial revolutions have passed since then. History has an uncanny knack of repeating itself and now acutely similar concerns are being raised about the automation of jobs. This promises to leave the unskilled workforce further behind. This process could be especially harmful for women by halting progression on the currently closing economic gender gap.

However, there is an important historical lesson to note here. The wisdom of hindsight reveals that the fears of the Luddites in the First Industrial Revolution did not reflect the job trend. Indeed, jobs expanded beyond the wildest imagination of the 1800’s.

2. The Fourth Industrial Revolution will Create New Jobs

The data can be dispiriting. Last year, the World Economic Forum estimated that by 2020 there would be ‘a net loss of over 5 million jobs in 15 major developed and emerging economies’.

The Guardian reported that ‘By 2021, robots will have eliminated 6% of all jobs in the US’, and ‘up to 15m jobs in Britain’.

Major manufacturing hubs like those in India and Bangladesh are also set to be hit particularly hard. The World Bank estimated that nearly 70% of existing jobs in India may be replaced by automation. In 2012, futurist Dr. Thomas Frey predicted that two billion jobs might disappear by 2030.

These figures led one commentator to remark: ‘Aside from climate change, this reinvention of work is the most wicked problem facing humanity’.

You get the picture, it’s critical that a major reinvention of work takes place, and soon.

How Best to Respond?

The rate of technological development in the fourth industrial revolution leaves us, in some respects, without choice. Adoption of automation is the only available path we can take. It is the strategies we implement in reforming the future of work that hold the key to the future.

The challenges are closely tied to the leading three areas of risk highlighted in this year’s World Economic Forum (WEF) report. The fears of automation impact economic growth and reform, the rebuilding of communities, and managing technical disruption.

A recent report from Oxfam highlights the currently unjust aspect of this revolution. The shocking truth of inequality (8 men share the same wealth as the world’s poorest 50% of people) points to the challenges we have in distributing wealth fairly in the future.

However, a successful evolution in the nature of work will eventually help to strengthen communities. If prosperity is spread across the economic spectrum, the universal benefits of technology will only serve a positive role in the world.

One of the characteristics of economic reform will be the creation of jobs in occupations that we are yet to envisage. A good example of this recently emerged from the US. It is projected that the occupation set to receive the largest amount of growth in the next decade is a wind-farm technician.

If you had said that at the start of this century, most boardrooms would have questioned your sanity. This is indicative of the type of the future job market we can’t predict, and a reason not to fear automation in other areas.

3. Investment in New Skills

In the majority of instances, we can predict where automation will replace human work. Any replicable, consistent manual or cognitive task will, at some stage, become automated. This should lead to a more concerted education of skills. Governments must put skills, rather than fact retention, at the top of the educational agenda.

It appears major business are already aware of the need to invest in new skills. A new study shows that ‘‘a clear majority of businesses believe that investing in skills, rather than hiring more short-term or virtual workers, is the key to successfully managing disruptions to the labour market for the long term’. This is a good sign, and will ensure a corporate revolution not only systemically but also culturally.

It’s more important than ever to add resilience to your organisation through the training of new skills. This shift in corporate thinking is an important development, and one that signifies a simpler revolution transition.

As a business, you have two options;

- Be afraid – put your head in the sand and watch your competitors productivity levels soar ahead of you

- Get with the programme. Literally. Reinforce key job functions with innovative business intelligence software, and utilise the power of big data to get ahead of the curve. Begin it today.

- Click here for a free trial of Caspian, our entry level business intelligence platform.

There has been a seismic shift in stakeholder expectation of private sector responsibility – especially focusing on supply chains, information security, and the use of corporate records. Regulations are reacting to increasing stakeholder expectation, and are changing the world of business as we know it. In this article, we discuss 3 key regulatory risks to be aware of in 2017 for business compliance.

-

The Responsible Raw Materials Initiative (RRMI)

The mining sector is one rife with long-lasting and significant social and environmental risks. Research suggests these risks are increased when working with gold, tantalum, tin and tungsten.

The Electronic Industry Citizenship Coalition (EICC) and Responsible Electronics and Conflict-Free Sourcing Initiative (CFSI) have co-sponsored the creation of the Responsible Raw Materials Initiative (RRMI), with the aim of ensuring transparency for all minerals used in the supply chain, not just 3TG (tin, tungsten, tantalum and gold).

This emphasis on other minerals also included addressing the risks surrounding cobalt mining, which is linked to the worst forms of child labor.

The IRMA certification will be implemented in 2017 and will use international standards such as the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as its guideposts.

-

The Investigatory Powers Act

This UK Act governs the use and oversight of investigatory powers by law enforcement and security and intelligence agencies.

It requires web and phone companies to store records of websites for 12 months for access by police, security services and other public bodies.

It also makes explicit powers for security services for the bulk collection of large volumes of personal communications data, as well as powers of the security services and police to access and monitor computers and phones.

It places a new legal obligation on companies to assist in these operations to bypass encryption.

-

USA Freedom Act of 2015

This Act reforms the authorities of the Federal Government, such as the FBI, the Inspectors General, the Attorneys General and the FISA Courts, to require the production of business records, conduct electronic surveillance, use pen registers, trace devices, and gather information for counterterrorism and criminal purposes.

Provisions include safety matters on maritime navigation and nuclear materials companies.

Together, these three regulatory initiatives mark a shift in the way businesses will act in the 21st century.

For more information on our regulatory database, click here for a free demo.

Our database covers the corporate reporting of 7000 of the world’s largest companies since 2010. We will be discussing the top 10 fastest emerging risks at an exclusive roundtable in London on 25th January. But for now, we wanted to discuss why corporations need to be ready for the #1 fastest rising corporate risk of 2017.

With the World Economic Forum’s Global Risk Report having just been released, there are a lot of discussions around global risks, and business risks.

But do you know the fastest emerging risk in terms of corporate disclosure?

#1 Regulatory Risk: Anti-Corruption & Bribery

The eRevalue regulatory initiatives database now covers 3000 regulatory initiatives.

600 initiatives have been added in the last 5 months.

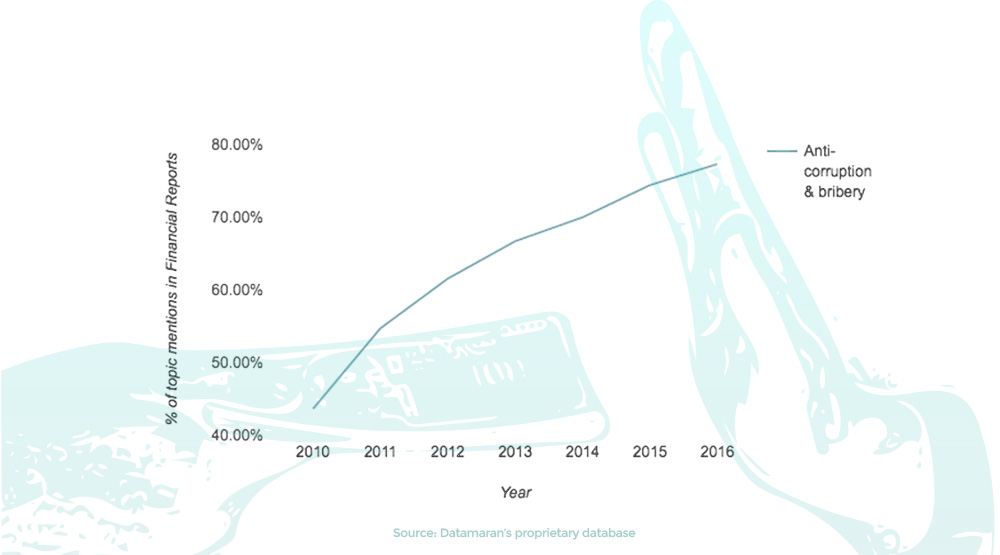

In 2010, there were 213 regulatory initiatives tagged with the topic of Anti-Corruption and Bribery in the Datamaran database, but this year, that number has increased to 419 initiatives, almost doubling the regulatory risk of this topic.

There has been a considerable increase in regulations across the environmental, social and governance (ESG) spectrum, which is a rising concern for many businesses. In the US, there has been a 78% increase in ESG Regulation since 2010.

Globally, there has been a 64% increase in ESG Regulation Since 2010. Furthermore, 74% of the initiatives we track have a legally binding force, so this is an area that business executives need to be ready for in 2017.

In 2010, only 43.5% of companies were talking about anti-corruption and bribery in their financial reports. This isn’t to say it wasn’t a problem then, but it does suggest it was less of a business risk. In 2016, that number had risen to 77%, making it the fastest rising area of corporate risk.

Are You On Top of This Risk?

More often than not, we have seen that the companies caught out by media and public shaming scandals, are usually those who have not risen to the expectations of stakeholders as quickly as their peers. For this reason, it’s worth checking how you are reporting on the areas of fastest rising risk.s your corporation disclosing on anti-corruption and bribery?

There is less tolerance from public stakeholders on the issue of corruption and bribery, with an added threat of litigation. Corporations need to do something about these changes quickly, before the risk catches up with them.

If you want to start integrating business intelligence software into your business, click here for a free demo.

Or why not explore our entry level platform yourself…click here for a free 24 hour trial.

*Our fully transparent methodologies are made publicly available by eRevalue and can be found in the Technical Brochure attached.

The ontology covers economic, environmental, social, corporate governance and technology topics impacting businesses worldwide. This ontology is built upon generally accepted reporting frameworks and standards, and is augmented by new issues that arise.

One of the many products created in the current paradigm of international institutions and treaties with countless signatures is that strong leadership demands global responsibility. If this is well-defined and consistent, accountability can take place at the local level. So what does global responsibility: local accountability look like?

Source: http://www3.weforum.org/docs/GRR17_Report_web.pdf

Global Responsibility

The rise of populism in 2016 demonstrates that there is something awry in the current leadership sphere. The theme of this year’s meeting in Davos – ‘Responsible and Responsive leadership’ – is more pressing and relevant, given the tumultuous events of 2016.

It was a year that left power-makers in disarray, political systems in turmoil, economic markets in a state of uncertainty and the prescient fear of renewed military hostility.

If one of the emerging themes that arose in the last year was frustration in institutional decision-making, what changes are required to ensure better leadership in the future?

The Challenge of Versatility

Firstly, the data revolution needs to take place across all sectors. Governments, investors, and the voluntary sector all need to join businesses in smart data investment to affirm – and sometimes challenge – their judgement.

Having the ability to assess trends on a global and local level is a challenge that all large institutions are facing.

It requires live data sets that have the flexibility to be refined and the scope adapted depending on the decisions you are making. In a world of open source applications, data sets must be open enough to probe, explore, and understand.

Relevant data can keep all forms of organizations – governments and corporates – up to date with these challenges. How in tune with public sentiment were the political campaigns leading up to Brexit or Trump? The opinion polls were wrong on both occasions – and one hopes that social media monitoring is an increased part of data monitoring by the next election.

Eyes on Davos

Corporate leaders would be wise to observe the events at Davos, and the lessons learned over the past year. The challenges Government’s face in establishing global responsibility is also a challenge that businesses will increasingly face as more corporate partnerships are formed to drive sustainable development.

We are already seeing that agreements like COP21 are threatened if collaborative responsibility only lasts for the length of an election cycle. Corporations can safeguard such regress through championing integrated thinking throughout the organization.

China’s Arrival at Davos

The theme of Davos is further challenged by the star guest. For the first time, the Chinese leader, Xi Jinping, is in attendance. The peculiarity of China’s arrival at Davos this year was well observed by Forbes’ Douglas Bulloch: ‘it is a strange turn of events when the biggest name attending a summit premised on the free exchange of ideas, progressive politics and the triumph of the internet in facilitating these, will be the head of a state where censorship is routine, progressive politics forbidden and the internet largely blocked.’

The timing of China’s presence has raised several eyebrows. However, it is also a positive indication of their willingness to participate in world issues. Their own leadership example may pose more questions than it provides answers, but their contribution is vital in the strengthening of global cooperation – one of the five main risks identified in this year’s risk report.

The upcoming Presidential inauguration raises more than the slight possibility that on a political level, there may not be global responsibility. The response of Mike Tyrrell of SRI-Connect is one of pragmatism. Replacing ‘mild mannered advocacy’, Tyrrell recommends becoming ‘aggressive sustainable investors’.

Source: https://www.linkedin.com/pulse/green-tooth-claw-end-regulation-mike-tyrrell?trk=hp-feed-article-title-like

It is with this new sense of urgency that we must frame the outlook on global responsibility facilitating local accountability. That is the aim, the aspiration, but we must be prepared to accept that in an imperfect situation, leadership might also be required at the local.

Public opinion is changing rapidly. There is an expectation that corporate responsibility is displayed over a global outlook. This is where our platforms are able to advance business responsibility and local accountability for the largest companies. They provide quick and robust solutions to identifying and monitoring industry trends, improving performance on ESG reporting, and speeding up corporate accountability on all fronts.

Interested in learning more? Click here for a free demo.

Whether you like it or not, we are in the midst of a big data revolution. We are faced with a multitude of available data. If we use it right, we have a chance of speeding ahead by uncovering hidden insights. This could enable us to do far more than we have previously been capable of.

We have reached a tipping point in human productivity, one in which machine learning and intelligent technology is enabling us to reduce laborious tasks, and put the time saved into masterminding innovative solutions.

Disruptive Innovations and Emerging Technology

63% of executives are concerned about the increasing pace of disruptive innovations and the rise of new business technology in their industry*.

Fears suggest that this may affect competitive risk management amongst the business community.

Will access to business intelligence software create an information gap?

Is digital inequality the disruptive force of the 21st century?

And what is the cost of not knowing?

*Source: Executive Perspectives on Top Risks for 2017

Quantify the Qualitative

Where analysts traditionally spent the majority of their time reading and analysing reports, we now face a dynamic shift in focus. Machine reading technologies are enabling machines to read reports for us, searching for the key terms we are interested in.

We now have the capacity to access big data in a qualitative way. This creates the potential to create rapid efficiencies and greater understanding of the risks and issues we are facing in business.

“According to Thomson Reuters, there are more than 13,000 analysts active in the market today, issuing 2.7 million monthly estimate revisions for corporate earnings.

Quite clearly, meaningful analysis of these reports is beyond the capabilities of an unassisted individual, or group of individuals“. Source: FTSE Global Markets

The average financial analyst gets through 200 reports on average per month. That works out at around 1 report every 45 minutes. Caspian can give you that information in 1 minute. This is the big data revolution: you can now get through a month’s worth of reports in an afternoon.

Where analysts traditionally spent the majority of their time reading and analyzing reports, we now face a dynamic shift in focus.

Machine reading technologies are enabling automated reading, highlighting key terms we are interested in. We now have the capacity to access big data in a qualitative way. This creates the potential to create rapid efficiencies and greater understanding of the risks and issues we are facing in business.

Where human error and judgement fall short, sophisticated technology and analytics software that utilise techniques from the field of Natural Language Processing can assist us by highlighting the patterns in the data that were previously invisible to the human eye.

At the intersection of human and computer interaction, this technology gives us incredible potential. However if it is ignored, it could also present a considerable business risk.

Big Data in Healthcare

McKinsey & Co say big data is revolutionizing the healthcare industry. They recognize three major short term opportunities:

- Preventing negative health events from occurring

- Linking the health system around the patient, to reduce overlapping expenses

- Really understanding the health value chain

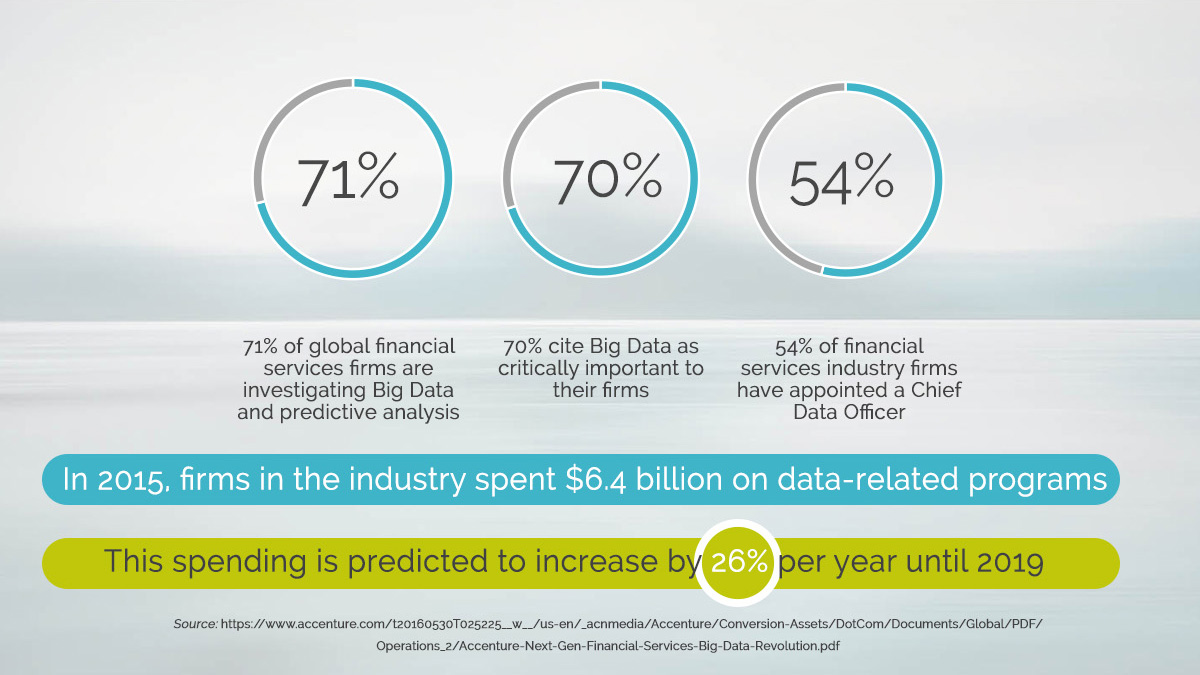

Next Generation Financial Services

Data driven decision making is now a central role of senior managers, and it is being used effectively to negotiate regulatory risk, enhance productivity and identify new business opportunities. Accenture talk about how CFOs can leverage big data to predict the future dynamics of business.

How Big Data is Changing the Business Landscape

The eRevalue Caspian database shows that “data driven decision making”, and “evidence based decision making” are increasingly mentioned in corporate financial reporting. Use of these terms in corporate disclosure has increased by 180% since 2014.

Source: Caspian Database www.erevalue.com/caspian

Furthermore, the term “big data” has been mentioned by 529 of 1296 corporate reports across the financial services industry in 2016; by comparison, no companies in 2010 mentioned the term in their reporting.

“A recent example I really like, highlighting the usefulness of data for businesses, comes from a study that used data consisting of Facebook “likes” to predict personality traits. Using this data the researchers were able to predict someone’s personality with more accuracy than their colleagues, friends or family. The only person marginally better at predicting their personality was their spouse!

Being able to predict customer personality with such a high degree of accuracy would be extremely beneficial to businesses”. Angela Onslow, Data Scientist, eRevalue. Read the article here.

Angela will be speaking at our exclusive Roundtable event in London later this month (25th January).

If you would like to explore how business intelligence software can help you, click here for a free 24 hour trial of Caspian, our entry level cloud based business intelligence tool.

If you want to access the most sophisticated business intelligence tool on the market, request a demo of Datamaran.

“Thanks to the ever-increasing sophistication of analytics and other innovative data related technologies, data is no longer a massive, indecipherable lump of facts, but a vibrant source of useful insights leading to better business decisions.” Source: Accenture