eRevalue BLOG

2016 has been a rollercoaster. One which will see far reaching effects in business survival rates across the global landscape. It has been the year that saw the loss of cultural heroes like Bowie and Prince; and the rise of populism, the far-right, Brexit and Trump. So we created a 2017 Business Survival Kit for you.

To say the stakes are high for businesses in the current economic and global climate is an understatement.

But amid the political unrest, we have seen seismic changes across global industries towards a more holistic and central governance role for sustainability within the global business model.

We now track 3000 regulatory initiatives in our database, meaning we have the most complete global database of soft and hard laws mandating corporate disclosure on non-financial and emerging risks.

We have also seen a rise in the number of companies producing integrated reports by around 50%.

This is why our key focus areas over the next year will be on two key areas; business risk and sustainable business.

Business Risk

The rise of technology, and big data analytics – if you’re not using them, are you falling behind?

Stakeholders are demanding more transparency. Are you disclosing on key areas of global risk?

- Environmental and natural resource security

- Economic growth and social inclusion

- Climate change and energy use

- International Trade and Investment

- Modern day slavery

- Circular economy

Our comprehensive and sophisticated database, Datamaran, now holds a complete set of 50,000 corporate reports, from 7,000 companies, over 95 countries from 2010-2016.

Take advantage of our team of experts, who are busy mining key business risk data to highlight the issues you will need to know about to stay ahead of emerging risks.

Sustainable Business

- The rise of the Sustainable Stock Exchange (SSE)

- Increased business responsibility towards the Global Sustainable Development Goals (SDGs)

- The increase in Integrated Reporting

- Increased need for Strategic Issues Monitoring which covers environmental, social and corporate governance issues

But enough about us. What about you?

Business Responsibility

You probably work within a company with a global and complex network, operating in a variety of regions where languages and cultural norms differ. These differences benefit your business, but ensuring universal consistency is a challenge.

You might feel that although responsibility should run through the blood of the entire company, accountability can only be fulfilled at the local level. What’s the best way to audit suppliers and ensure they’re in compliance?

You’ve likely discussed how to become more data driven, but the best direction to take is unclear. Intuitively, data driven decisions seem better for your business – but do they offer a tangible ROI?

New information flows offer more flexibility and agility than you’ve previously been able to manage. This requires a mindset and operational change – but which department is best to instigate this?

This article is your 2017 business survival kit, and will help you best prepare for the changes that are coming.

What’s on The Horizon?

The nature of technology companies is expected to continue to rapidly evolve in 2017. We see multinational companies creating new value chains with small suppliers harnessing big ideas; adding speed, flexibility and fresh approaches to existing operations.

eRevalue now has clients in 12 countries and across 9 corporate sectors, consultants, investors, policy makers, and academia.

In many respects, new approaches to data analysis and technological development converge at the interface between a multitude of sectors.

We will continue to deepen these links in 2017, looking to engage influential NGOs and Governments as the conversations progress.

To facilitate such a network, we now have offices in 5 countries despite being a start-up in our third year of operation. A broad geographic reach remains important as we refine our framework of emerging risks – in English and beyond.

We’re adding language capabilities to our online news coverage – ensuring that the global business outlook is matched by a news flow module that can analyze news in additional languages.

But it doesn’t end there.

Emerging Trends: Your 2017 Business Survival Kit

We’re launching some exciting new tools and languages to enable more robust monitoring of issues, frameworks, regulations and strategies to keep your business competitive in an information rich environment.

We have honed in on the 3 most essential issues you need to prepare for in 2017.

1. Aligning your Business Disclosure with the SDGs

You are probably both excited and daunted by the scope of the sustainable development goals.

We are seeing a rise in the number of companies disclosing their activities towards the SDGs, and are working with our clients to promote best practice and to identify new areas of reputational and competitive risk.

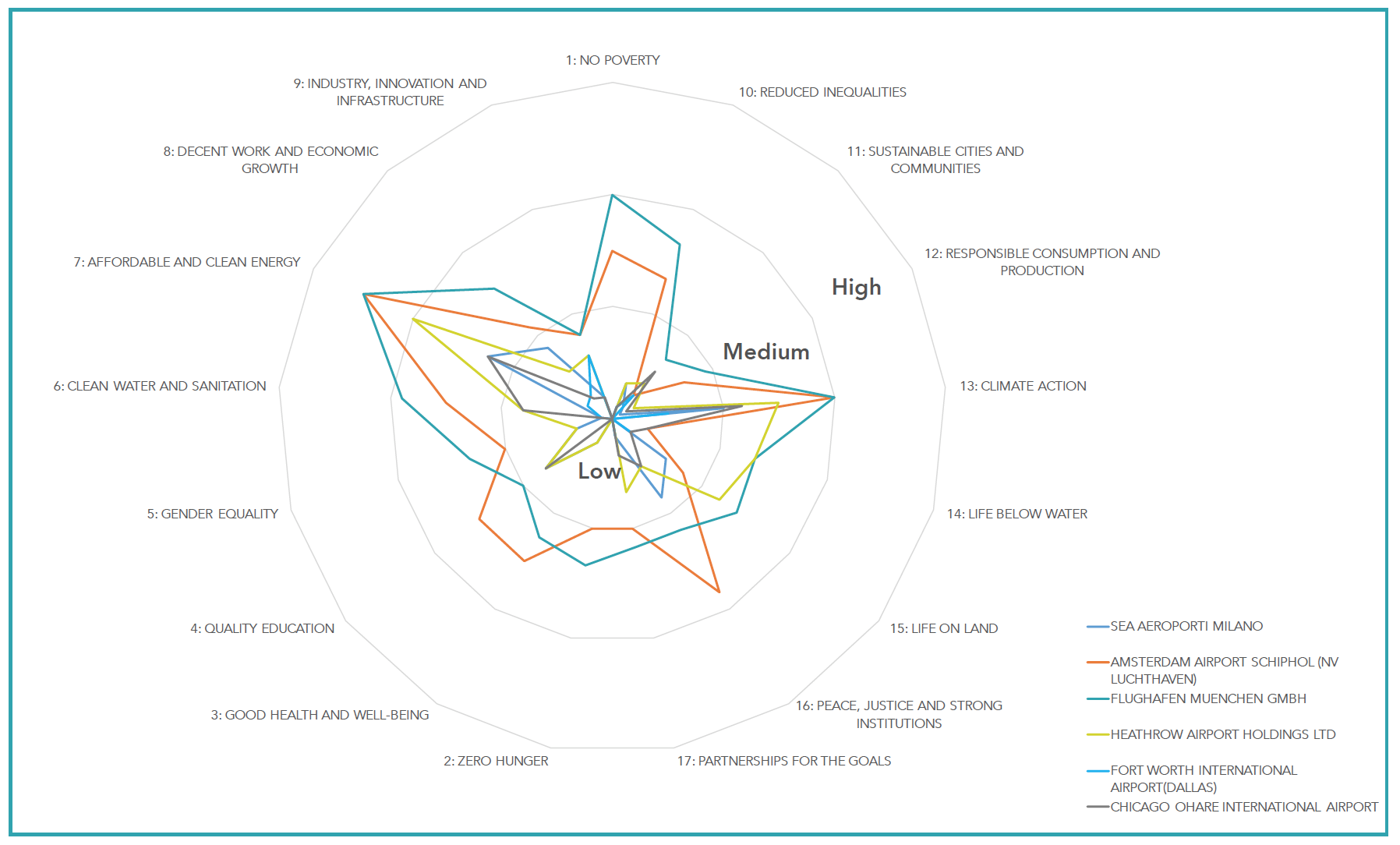

We have developed an SDG mapping tool to benchmark corporate disclosure on the SDG issues against those in the wider peer group. This has proved very popular.

Airport Corporate Disclosure Coverage on SDG-Related Topics (2016)

If you want to find out more about how companies in your country, region or industry are reporting on the Global Goals, get in touch for a free demo.

2. Strategic Issues Monitoring

Big data analytics is both complex and insightful, but it is also not the simplest thing to get right.

We have been working with a number of clients to create a service where we provide strategic issues monitoring as a service, leveraging our intelligent software and our expert advisors to help you get the most out of the strategic issues monitoring process.

We’re hosting a Roundtable Discussion in London on 25th January to an exclusive audience at our London office.

Strategic Issues Monitoring Roundtable (London) – 3pm-5pm

Speakers include Marjella Alma, Angela Onslow, Paul Druckman, Elaine Cohen and Geoff Kendall.

This event is by invitation only – if you would like more information – please contact us at the relevant office below.

Pune (India) – Click here to email

Valencia (Spain) – Click here to email

Luxembourg – Click here to email

London (UK) – Click here to email

San Francisco (USA) – Click here to email

New York (USA) – Click here to email

Minneapolis (USA) – Click here to email

3. Integrated Reporting

Integrated reporting is the process of bringing the company’s financial and sustainability reports into one concise story that highlights the material issues of the business. One argument for integrated reporting is that it shows, with transparency, the issues which the business truly places at the heart of it’s value creation.

It’s about making sure your business model is fit for purpose in the 21st century.

The number of integrated reports in our database in 2012 was 208, by 2016 the number has nearly doubled, and in 2016, it has reached 399.

Not only are we seeing an increase in the number of companies moving to integrated reporting, an increase in dialogue about how companies can make the shift to integrated reporting, but also a migration of traditionally non-financial topics into financial reporting.

We are proud to say some of our clients are already leading the way on this.

If you would like to explore how business intelligence software can help you, click here for a free 24 hour trial of Caspian, our entry level cloud based business intelligence tool. Or download our free report on the top emerging issues in Europe and the Americas.

If you want to access the most sophisticated business intelligence tool on the market, request a demo of Datamaran.

*SDG Methodology

eRevalue tracks emerging issues through its proprietary natural language processing and automated machine reading software. The emerging issues are part of a dynamic ontology that is applied to eRevalue’s flagship analytics platform Datamaran, and currently tracks 103 emerging issues across an evolving database of sources

The Datamaran topic mapping against the SDGs is based on the information provided by the SDG Compass initiative. The SDG Compass has been developed jointly by WBCSD, GRI, and UNGC specifically “to support companies in aligning their strategies with the SDGs and in measuring and managing their contribution”. The SDGs involve high-level issues, and its transposition into business activities may be not immediate.

The SDG Compass identifies the business themes, tools, and indicators associated to each SDG – providing a common and authoritative platform to define the scope of the Goals at business level.

Diversity and the US Election

Even if you’d been living under a rock, it would be difficult to filter out the US election. In distant London, it has cast an uneasy air over the city. The residual shock of the recent EU referendum hangs almost in parallel alongside, and combines to give the creeping feeling that although a wave has just crashed over your head (Brexit), a larger one may soon follow.

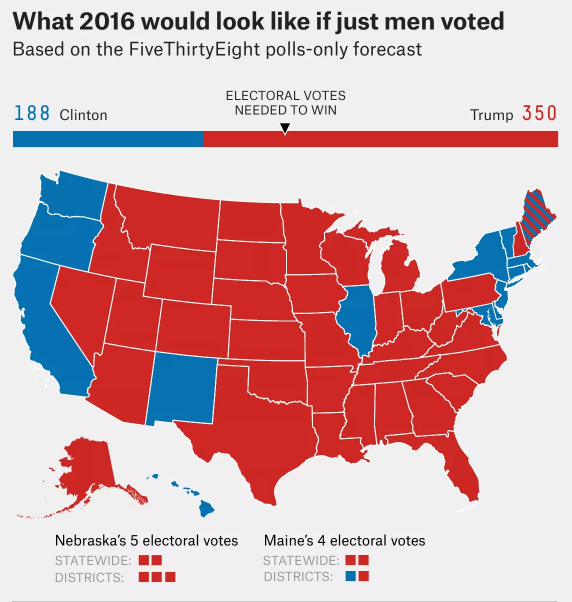

As a controversial campaign draws to a tense conclusion, one graphic sticks in my mind. It is based on a simple premise: this is how the election would look if only men voted.

Source: http://fivethirtyeight.com/features/election-update-women-are-defeating-donald-trump/

Although Republicans usually win a majority of the male vote, Trump’s popularity among men is revealing.

Nate Silver is a fine Statistician and Pollster – see The Signal and the Noise – and if this poll of four weeks out is broadly accurate, it seems to signal that an honest discussion about the extent of gender prejudice is required. This complex issue needs leadership not only in politics, but also in the corporate world.

Despite 96 years elapsing since women were given the vote in the US, it appears the gender of the candidates remains a consideration for many voters.

Are Businesses Doing Enough?

This caused questions to arise on whether businesses in America are doing enough to weave gender issues – and diversity more widely – into the corporate narrative. Does this stack up against the approach businesses take in Europe?

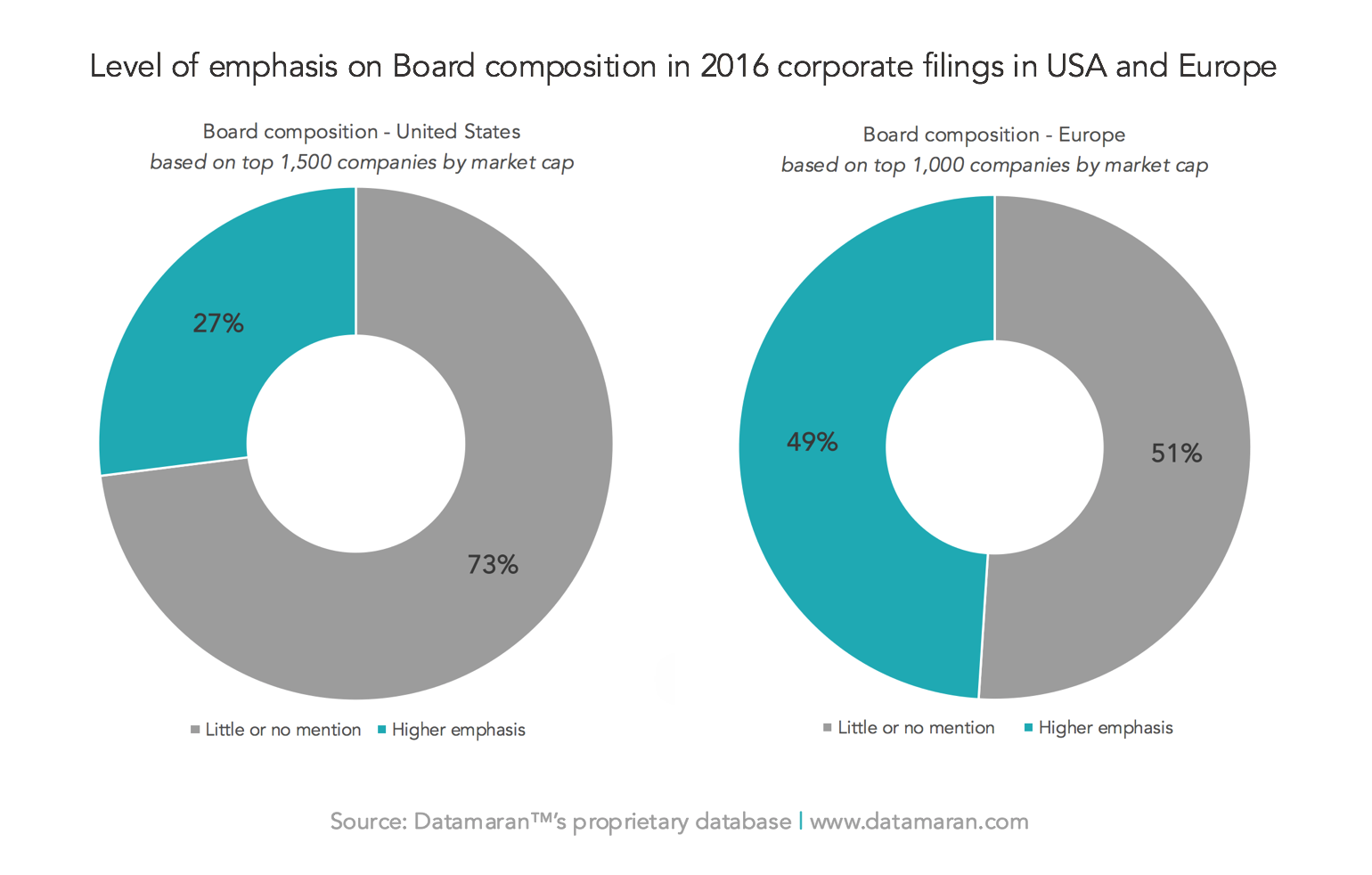

We looked at how American companies are disclosing diversity information at the highest level – the board – and how that compares in Europe.

The data shows that only 27% of US companies put a high or medium emphasis on board composition within 2016 reports (Financial, Sustainability, and SEC filings). This is a small increase from the previous election in 2012, but notably less than 49% of companies in Europe.

Information on this issue in Europe is much more readily available, in part due to the ongoing conversation and collective political and economic agenda driving gender equality in the EU. The European Commission prioritised ‘equality in decision-making’ in 2016 with a Strategic Engagement approach, aimed at meeting the goal of 40% representation of women in decision-making positions by 2020 – coincidently the length of the new US President’s term in office.

Unsupported by such an approach, US companies must supply the issues around diversity with more oxygen. A lack of transparency does make corporations accountable for slow shifts in attitudes.

The Case for Investors

The issue at hand, like many social issues, is an emotive one. Yet this contains more than social and political significance. Diversity at the board level, and throughout organizations, contain important signals for investors too.

An increasing numbers of studies state that boards featuring women provide superior financial returns. Research firm MSCI reported that firms with a strong female influence performed 36% better than those who didn’t. Another study by Credit Suisse’s in 2014 shows a +5% share price performance for boards with women.

The financial trends are even more stark when you also look at ethnic diversity at board level and throughout the company. One report concludes that ethnically diverse companies are 35% more likely to financially outperform non-diverse companies (above the national industry median).

These figures are far from inconsequential.

The above data unites an intuitive feeling about the benefits of diversity with a strong business case. The transition to diversified leadership everywhere can be accelerated by the new President if schemes similar to the EU are placed on the political agenda. Regardless, it is also up to corporate leaders all over America to take a stand on this issue.

Leadership of this kind could lead to a different political picture in future elections. It could also ensure companies that promote equality return better profits, and that seems worth pursuing.

Interested In Hearing More About Diversity?

Check out our webinar on diversity: The Equal Opportunity – Who Runs the World?

Speakers:

• Hedda Pahlson-Moller, CEO OMSINT/TIIME

• Kimberly Davis, Senior Managing Director and Head of Corporate Responsibility and Inclusive Leadership Practice, Teneo Holdings

• Evan Harvey, Director Corporate Responsibility, NASDAQ OMX; Chair of World Federation of Exchanges Sustainability Working Group

• Susanne Katus, VP Business Development, eRevalue

We are delighted to announce several new additions to the eRevalue team! In no particular order..

Kate Rubin will be leading our North American operations. Kate is a results-orientated leader who brings an enormous amount of experience and expertise to eRevalue. She was with IBM for two decades and, while there, led a $100 million technology group. After, Kate was involved in a non-profit trade association focused on growth and global competitiveness for 9 years, before heading up the CSR practice, strategic giving, and innovation for 165,000 UnitedHealth Group employees worldwide. We’re thrilled to have her with us.

Hedda Pahlson-Moller is joining the eRevalue team to drive the development of European client and Investor Relations. Based in Luxembourg, Hedda has a wide array of business interests: entrepreneur, early-stage investor, professor, and public speaker – all united by the common theme of creating ‘social impact’. She will work closely with her fellow co-founder of Tiimeisnow – and another addition to the eRevalue team – Cécile Sevrain. Both Cécile and Hedda have extensive Business Angel networks, and their work mobilizing capital towards projects with a sustainable focus will add specialized subject knowledge. It’s a pleasure to be working with them both.

Hedda Pahlson-Moller is joining the eRevalue team to drive the development of European client and Investor Relations. Based in Luxembourg, Hedda has a wide array of business interests: entrepreneur, early-stage investor, professor, and public speaker – all united by the common theme of creating ‘social impact’. She will work closely with her fellow co-founder of Tiimeisnow – and another addition to the eRevalue team – Cécile Sevrain. Both Cécile and Hedda have extensive Business Angel networks, and their work mobilizing capital towards projects with a sustainable focus will add specialized subject knowledge. It’s a pleasure to be working with them both.

Meet the full team here.

The SEC recently requested comment on the areas of development for Regulation S-K, on the business and financial disclosure required in periodic reports filed by companies. Below are some highlights of our response.

We automate the reading of documents, in particular annual corporate filings, and as such document structure and content are key aspects we pay attention to.

The automated analysis of reports is fast becoming common practice to analyse disclosure on key issues; structure and reliable content are also key to effective machine learning.

A mandate for objective, materially important and standardized disclosure serves to enhance what many companies are disclosing, we are observing changes to corporate reporting content that demonstrates that corporate reports are a key component for identifying emerging risks and opportunities (ESG topics).

Fig. 1 Illustrates that the number of ESG topics mentioned in SEC filings has risen since 2010, despite an imbalance in the level of disclosure (source: Datamaran)

Furthermore, ESG disclosure over three reporting types (Annual Financial, Annual Sustainability, SEC 10-K) has also risen significantly for US companies, and would therefore not represent a costly new set of changes.

Fig 2. Reveals that ESG disclosure in SEC filings for the S&P 500 is common practice (source: Datamaran)

Analysis of SEC filings reveal that a baseline of material topics is already visible, and more precise data will ensure that companies are better equipped to track emerging topics across corporate peers, industries and regions.

The majority of topics (17/20) remain the same from 2010-2015, with over 300 companies emphasising the largest topic – Employee Benefits – in both years, and 65% of companies mentioning the topic in 2015 specifically. The 20th most emphasised topic in 2015 – Materials management – is mentioned by over 25% of companies.

In order to fully utilise the contents of a corporate filing, consistency in the type of documents submitted to the SEC is essential. Features that assist automated document processing and narrative analysis is format and content:

- Html or another markup language is ideal – this would be accompanied by good formatting and a common naming standard within the table of contents and section titles, consistent with other reports

- The structured reporting approach should not compromise the narrative. The greater the degree of disclosure and transparency around company activities provides more robust analysis of emerging risks and opportunities.

For the complete response, see here.

*The data submitted to the SEC highlights how emerging risks and trends can be captured through the reporting lens. However, this can also be done through the analysis of upcoming initiatives and social media trends. Our database covers 6,500 companies, 50,000 reports, and 2,500 regulatory initiatives.

Our dynamic ontology of 106 topics is based upon a flexible framework that can adapt as new issues emerge e.g. most recently: net neutrality, modern slavery, and digital inequality.

Article by: Donato Calace, eRevalue’s ESG specialist with contributions from Marjella Alma and Erin Levey.

Published by: Ethical Boardroom / www.ethicalboardroom.com

Date: Summer 2016