eRevalue BLOG

Rana Plaza – has the retail sector been paying attention?

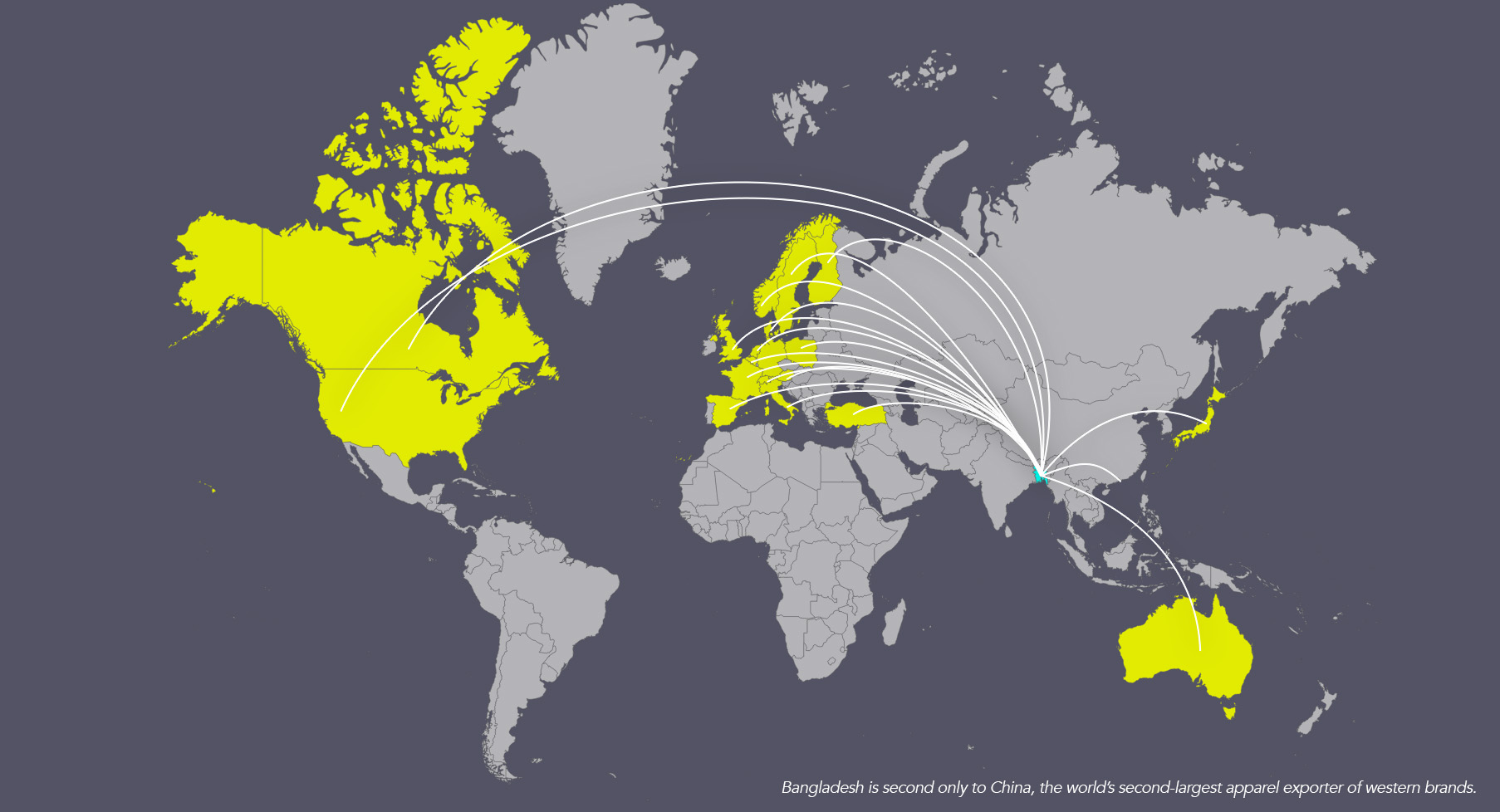

The “world’s worst factory disaster”, as explained by the Guardian, occurred in 2013, killing 1,138 workers in Bangladesh. The Rana Plaza building housed 6 factories manufacturing for US, Canadian and European clothing retailers. The incident highlighted not only to the companies involved, but to the industry as a whole, the importance of monitoring suppliers’ workplaces and sustainable management of the supply chain.

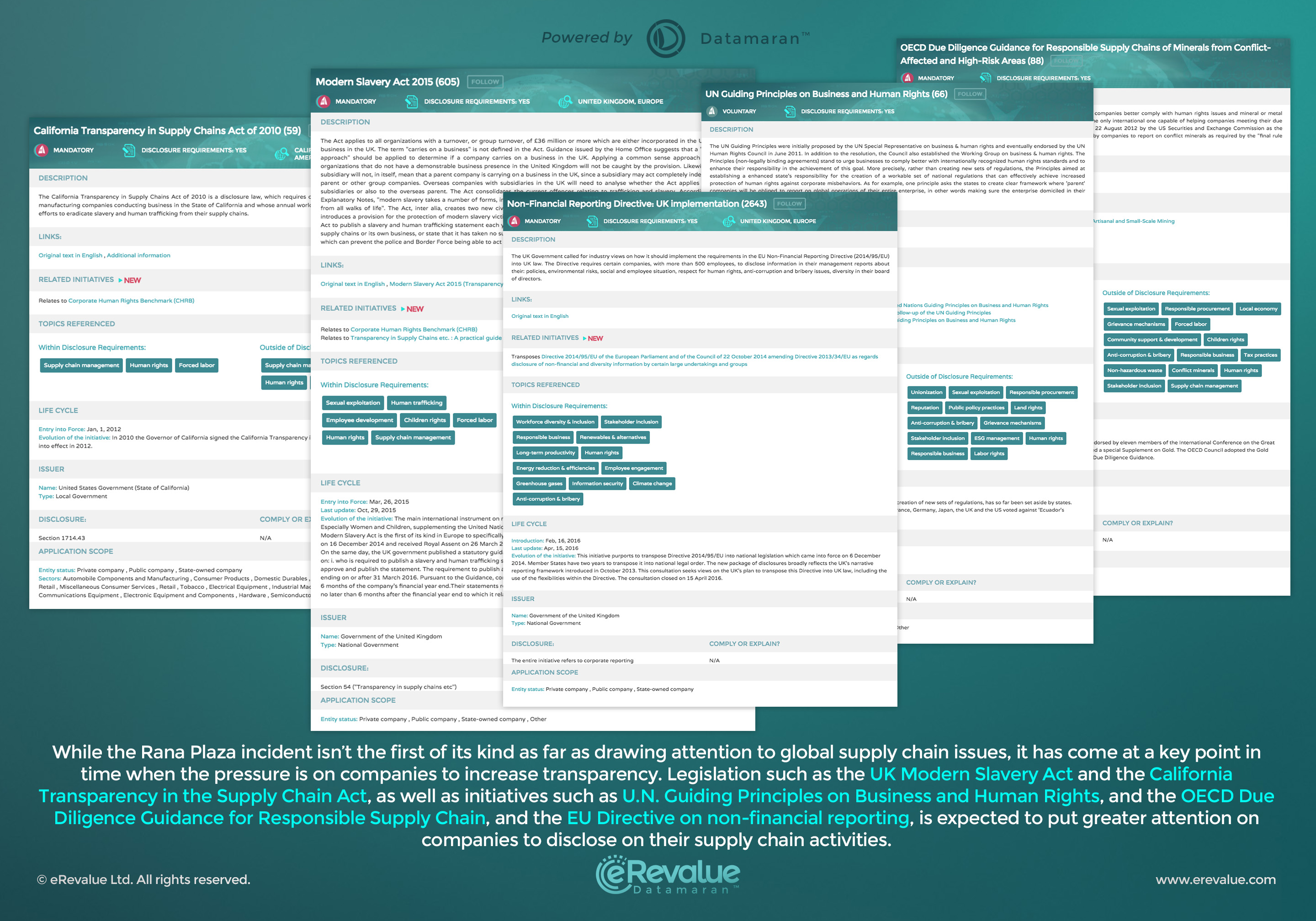

While the Rana Plaza incident isn’t the first of its kind as far as drawing attention to global supply chain issues, it has come at a key point in time when the pressure is on companies to increase transparency. Legislation such as the UK Modern Slavery Act and the California Transparency in the Supply Chain Act, as well as initiatives such as U.N. Guiding Principles on Business and Human Rights, and the OECD Due Diligence Guidance for Responsible Supply Chain, and the EU Directive on non-financial reporting, is expected to put greater attention on companies to disclose on their supply chain activities. Consumers awareness is increasing and campaigns run by organisations like Fashion Revolution are drawing attention to how companies make their products.

Transparency is key

Companies, consumers, government and investor groups are seeking buy-in to the supply chain activities of companies, and in each of these instances, transparency is the key. In the wake of the Rana Plaza incident, we wanted to explore what steps, if any, the global retail industry is taking to mitigate future risks across the supply chain, and what lessons have been shared through their company reports.

Lessons from Rana Plaza for the companies involved

Several key companies with manufacturing activities in the Rana Plaza building, have outlined in their sustainability reports the important changes they have made to their supply chain code of conduct and the conditions of their supplier factories.

Loblaw Companies LTD responded to the accident in a number of ways. In their 2014 annual sustainability report, as well as providing financial compensation, they developed two community based projects (Loblaw REVIVE and Loblaw THRIVE) with the aim of helping the physical and mental rehabilitation of both victims and families. Their immediate action of signing the Bangladesh Accord on Fire and Building Safety, initiated by IndustriALL and UNI global union’s, was also enclosed. In order to ensure the prevention of any future similar accidents occurring, measures such as including the disclosure of information on structural integrity as a standard for monitoring and a full audit of all factories in Bangladesh was also taken.

Associated British Foods PLC’s (Primark) annual 2014 sustainability report also outlines the immediate support for victims provided by the company and the signing of the Accord on Fire and Building Safety in Bangladesh. One of the most important changes Primark made, as outlined in their report are those made to supply chain practices and management. An immediate programme of structural building inspections was initiated immediately after the incident to cover all factories in the company that manufactured for them. Primark’s supplier contract with Liberty Fashion was responsibly terminated after the company refused to evacuate a building deemed unsafe under new supplier code of conduct.

Although the term “Rana Plaza” is not specifically mentioned in PUNTO FA SL-MANGO’s 2015 sustainability report, the company does disclose the measures they have taken in the supervision and management of their supply chain, including their suppliers’ requirement of adopting the supplier code of conduct. PUNTO FA SL-MANGO explains in their report that in the year of 2014, they increased their emphasis on improving their management of factories through more rigorous training of suppliers and more reliable ways of tracing their supplier chain.

Impacts across the global retail industry?

Not only does the tragedy of Rana Plaza highlight flaws in the supply chain practices of the companies involved, but also the deep impact on the retail industry as a whole. Many apparel brands were forced to admit or realise the immediate need to cooperate with regards to creating a platform to improve labour working conditions and safety in Bangladesh. Over 200 clothing retailers and importers all over the world have signed the Accord on Fire and Building Safety in Bangladesh which was established in 2013, a legal agreement aiming to provide a safer environment in factories. Key leaders in the industry (although not involved) such as Fast Retailing Co Ltd (UNIQLO), C&A GROUP, NEXT, INDITEX and Hennez & Mauritz AB have signed the Accord, reflecting the whole of the industry’s concern over the issue of sustainability.

Furthermore, 28 retail corporations are participant members of the Alliance for Bangladesh Worker Safety, adhering to strict guidelines placing factory workers’ safety as top priority. As a member of the alliance, GAP Inc have highlighted one of their key project of conducting interviews/surveys with Bangladeshi factory workers with the sole purpose of obtaining first hand insights on issues regarding labour conditions. Similarly Target CORP as a participant have also highlighted their role in their reports, disclosing that all factories manufacturing for the brand have been audited by the Alliance’s committee and that they have taken immediate remediate responses to any deficiencies.

A rippling effect in the retail industry, leading brands have made improvements to their individual supply chain practices. Esprit have stated in their 2015 Annual Sustainability that all their suppliers in Bangladesh have been audited to determine changes needed to ensure that the factories meet international standards for building and fire safety. Esprit have also gone one step further and found that there are specific failures in the Accord inspections, relating to a lack of sprinkler systems (which, although not required by Bangladeshi law are the best practice, internationally) and the lack of international standard fire doors.

PUMA SE have also explained their increased focus on building safety and comprehensive building structural assessments of all its main suppliers in Asia. INDITEX have begun to submit details of their supply chain in Bangladesh to the Accord on a regular basis and take more responsibility in ensuring these factories are implementing Corrective Action Plans in order to resolve breaches detected during inspections performed at each factory. The strengthened control mechanisms within INDITEX’s supply chain is also of key importance. It is placing an emphasis on communication with external and internal stakeholders and have increased supplier training of code of conduct compliance.

Through the use of Datamaran™, it can be gathered that a large number of retail companies mention “Rana Plaza” in both financial and non-financial reports in 2014, immediately after the accident, 2015 and in 2016. These documents show that brands are highlighting their awareness of supply chain labour issues in the industry and the measures they have taken to improve their own supply chain practices. Although no direct affiliation with the Rana Plaza disaster, the explicit mentioning of these issues shows their dedication to social responsibility as key players in the retail market.

Progress is slow

When we looked at the emphasis companies place in their corporate reports on key supply chain issues since 2013, Datamaran™ displays only a slight increase in the number of companies covering highly relevant topics including occupational health and safety, human rights, labour rights, supply chain management, forced labour and supply chain engagement. Surprisingly then, the Rana Plaza disaster (a huge exposure of the retail industry) did not cause a huge shift in the dynamic of the retail industry as a whole.

The unchanged level of coverage of these issues by the retail industry could be the primary reason as to why many still have the opinion that nothing remains changed even after Rana Plaza. Major players in the Rana Plaza recovery activities, including the Alliance for Bangladesh Workers Safety, and the Accord on Fire and Building Safety in Bangladesh, have admitted that progress in improvements across these key sector issues has been slow.

Maintaining and increasing transparency

Failing to respond to these incidents either through participation in industry level actions or by improving independent practices is a risk to the retail sector. It is encouraging to see some key players in the industry taking steps to increase transparency and highlight remediation actions, and we would hope that others use these examples to follow suite.

About the authors:

Freya Renton is an undergraduate student at Newcastle University studying Politics and Sociology. She is interested in Sustainability, Human Rights and International Politics.

Rina Ansell is an undergraduate student at Kings College London, studying Business Management. She is interested in Corporate Governance, Risk Management, and Financial Accounting.

Freya Renton and Rina Ansell – eRevalue’s Summer Internship Programme

Robin Hood or Greedy Tax Dodger?

Transparency can make the difference for Tax Responsibility

“We never rob. We just borrow a bit from those who can afford it!”

Tax strategies are delicate matters, mostly confidential and not available to public scrutiny. They exist in a grey zone where the boundary between legit and unlawful action is blurred – especially when the European Commission decides that the tax rulings your company agreed with Luxembourg or the Netherlands constitute in fact illegal state aids, inflicting tens of millions euros in additional tax bills.

Moreover, major document leaks such as the Panama Papers or the Luxembourg Leaks have put “sweetheart deals”, “tax havens”, “offshore companies” in the spotlight, raising the sensitivity of public opinion over these issues.

As a result, regulations around tax practices are increasing in number and disclosure requirements. The most important and recent ones include:

- International Tax Compliance Regulations 2015 (UK);

- OECD Declaration on Automatic Exchange of Information in Tax Matters (2014);

- Market Abuse Directive (MAD II) (EU, 2014);

- Proposal for a Council Directive laying down rules against tax avoidance practices that directly affect the functioning of the internal market (EU, 2016);

- Commission Recommendation on the implementation of measures against tax treaty abuse (2016, EU);

- Base Erosion and Profit Shifting (BEPS) Project (OECD 2016)

In addition, UN Sustainable Development Goal SDG 17.1, explicitly aims at improving country tax collection systems as a way to gather resources for the implementation of the Goals.

The key takeaway from these signals is that tax is not merely a cost to minimize, but also an area of risk that calls for thoughtful management.

What kind of risk?

The first step to building a “responsible” tax policy is being aware of and taking into account all the potential risks raised by aggressive tax strategies. As indicated by the PRI in the Engagement Guidance on Corporate Tax Responsibility, “Tax is not a cost to be minimised; it is a key systemic risk that could have a serious effect on the profitability and the sustainability of a company, as well as broader impacts on portfolio and macroeconomic returns.”

A categorization of risk associated to shortsighted tax minimisation can be the following:

- Raising costs: criminal penalties, increased legal and compliance costs, settlements in tax disputes, suspension of key projects (M&A, asset freezes);

- Financial risk: low-quality earnings (profits originating from exploiting tax schemes disappear when regulations change), signal of poor corporate governance;

- Strategy risk: non-strategic acquisitions (sweetheart deals), organisational restructuring (location of HQ, subsidiaries)

- Reputational: license to operate (boycotts and public protests), negative advertisement in the news, brand impact.

- Macro: damage to the whole economy and other actors, as governments miss out on revenues, triggering unfavourable legislative action.

A first step: transparency

Given the wide range of risk associated to tax policies, investors are becoming more active and demanding in this area – anticipating a deeper level of analysis that eventually can spread along supply chains. Indeed, tax analysis is widely considered as an important part of corporate governance assessment, with key questions companies should be prepared to answer:

- Publishing tax policy principles;

- Discussion of tax policies at board level;

- Top tax related risks;

- Explanation on gaps between effective tax rate – statutory average tax rate

- Country-by-country reporting (CbCR)

- Disclosure on intra-company debt

- Transparency related to special tax incentives

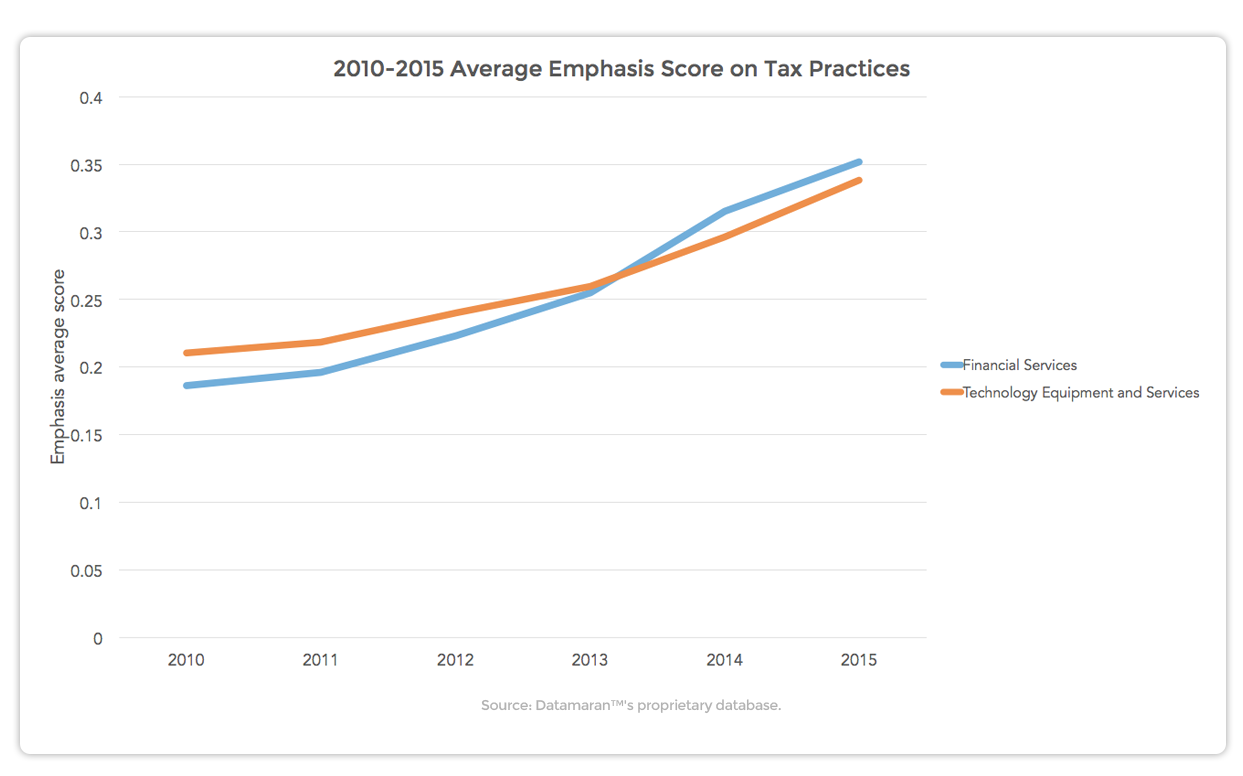

Transparency is then a first step towards tax responsibility, but what is the current status of disclosure on this domain? Let’s take as an example the corporate filings published by companies in the Financial Services and Technology Equipment and Services industries (two industries that are frequently associated to tax controversies – due to their intangible products and multinational operations).

Yearly Emphasis average scores are calculated assigning to our Emphasis categorisation a numerical value, so that No Mention=0, Low Emphasis=1, Medium Emphasis=2, High Emphasis=3. Results from the analysis of 9347 corporate reports show that average Emphasis significantly increased in both industries since 2010 values (+89% in Financial Services, +61% in Technology Equipment and Services). Nevertheless, the average score is still below 1, indicating an overall poor level of Emphasis – and large room for improvement in the next years.

The business of business includes Human Rights

From corporate disarray to long-term business resilience

Dr Jekyll and Mr Hyde

In the early 2000s, Joel Bakan, a Canadian sociologist, published his analysis of corporate behaviours, that applied a personality diagnostic test from the World Health Organization’s Manual of Mental Disorders. His examination of the corporation as a legal ‘person’, resulted in the diagnosis of a personality disorder, the corporation is a ‘psychopath’. Corporations displayed the following traits: ‘Callous unconcern for the feelings of others; incapacity to maintain enduring relationships; reckless disregard for the safety of others; deceitfulness: repeated lying and conning others for profit; incapacity to experience guilt; and failure to conform to social norms with respect to lawful behaviours’

Or why the irresponsible conduct of that supplier in a remote corner of the world puts you at risk…

It was 1961 when Edward Norton Lorenz, American mathematician and meteorologist, decided to rerun a numerical computer model for a weather prediction entering the initial condition 0.506 instead of the full precision value of 0.506127. The final result was a completely different weather scenario – and marked the beginning of what is called chaos theory. Two years later, he stated:

“One meteorologist remarked that if the theory were correct, one flap of a seagull’s wings would be enough to alter the course of the weather forever. The controversy has not yet been settled, but the most recent evidence seems to favor the seagulls.”

Eventually, he followed the advice of replacing the seagull with the more poetic butterfly in his metaphor.

Like weather, modern global supply-chains are complex nonlinear systems where seemingly inconsequential details can have major impacts in terms of reputation, compliance and economic bottom line.

Your supply-chain, your accountability

Being part of a global value chain has significant implications for each of the businesses involved:

- Raw material suppliers have to be compliant with local laws and regulations, as well as codes of conduct and certification schemes imposed by larger clients downstream;

- Intermediaries need to ensure traceability of the materials they supply and face requests for reporting from clients who provide financial incentives for enhanced transparency;

- Retailers directly face the expectations of the consumer market, plus regulations are increasingly holding them legally responsible for irresponsible conduct upstream the supply chain.

The Malaysian palm oil supplier IOI was removed from Unilever’s suppliers list this April after the Roundtable of Sustainable Palm Oil (RSPO) suspended it for several violations of the “No Deforestation, No Peat, and No Exploitation” policy. Shortly after, Kellogg’s, Mars, Nestlè, Hershey’s, Colgate-Palmolive, Johnson & Johnson, Procter & Gamble, SC Johnson, Yum! Brands and Reckitt Benckiser disengaged with IOI. Additionally, other companies, such as Dunkin’ Donuts, are verifying if IOI is in their list of suppliers and have plans to drop it if it is.

IOI’s official press release gives a more vivid idea of the impact on their business. “The suspension of our RSPO certifications, which affected our prevailing RSPO oil contract commitments and caused significant disruptions to certain segments of the European and American food manufacturing sector, has inflicted many stakeholders of IOI: IOI’s 25,000 shareholders, the suppliers of IOI who include small holders, the customers of IOI and other users of certified palm oil down the supply chain, and lastly thousands of the employees of IOI who have put in so much effort over the last ten years in enabling all our Malaysian plantation units and downstream processing units to be RSPO–certified.”

Without adequate supplier monitoring and action the supply chain is dark and full of terrors, as purchasers cannot effectively mitigate the reputational and legal risks it exposes them to.

From the supply-chain to the courtroom

Supply-chain responsibility is no longer part of the soft law world of certification schemes and Fair Trade labels. National and international law is progressively regulating specific issues, thus extending the legal liability of companies to their supply-chains.

For example, the UK Modern Slavery Act mandates commercial organizations with a total turnover of over £36 million per year to publish a slavery and human trafficking statement each year explaining the steps they have taken to ensure there is no slavery or trafficking in their supply chains or their own business.

Similarly, in the US the Business Supply Chain Transparency on Trafficking and Slavery Bill – H.R.3226 – is proposed to require companies with annual worldwide global receipts in excess of $100,000,000 to disclose information describing the measures that they have taken to identify and address conditions of forced labor, slavery, human trafficking and the worst forms of child labor within their supply chains.

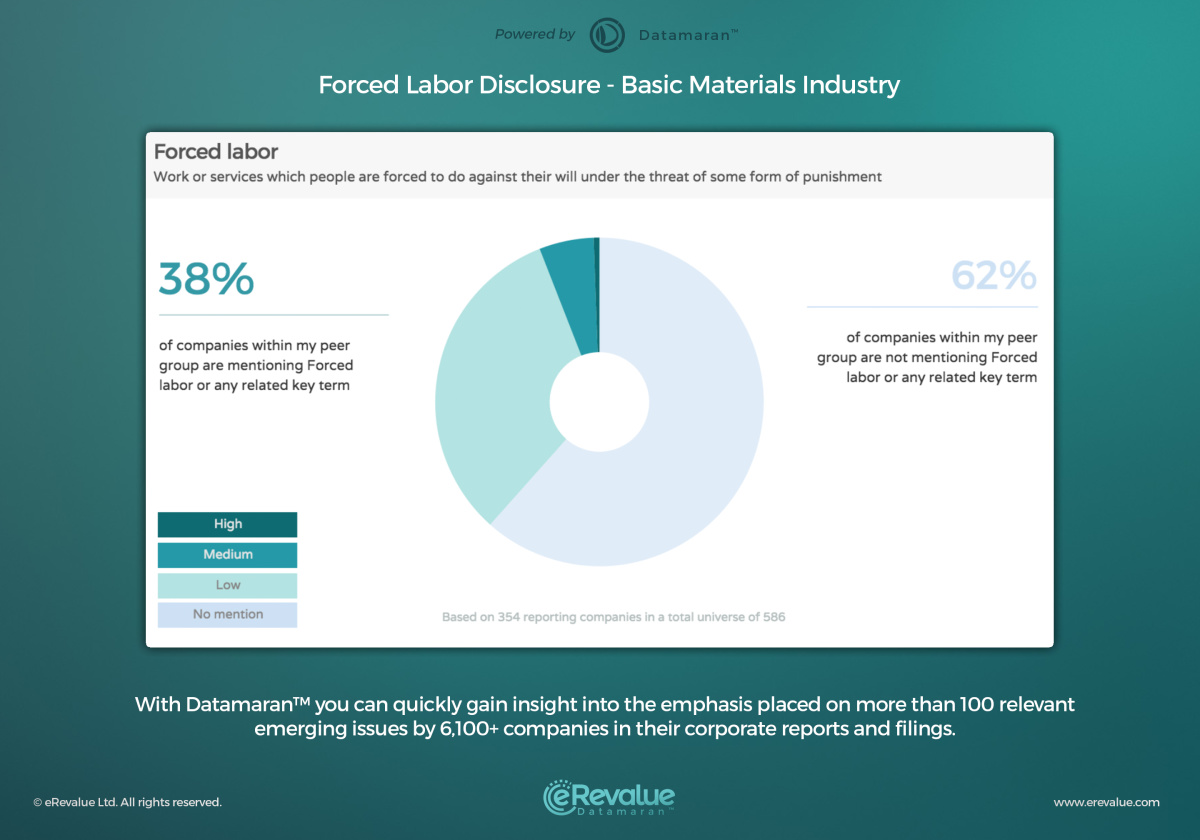

A comparison of the emphasis put on Forced Labor by companies operating in the Basic Materials industry (upstream) and those operating in the Consumer Goods and Service industry (downstream) gives an indication of where along the supply-chain risk mostly resides.

Consumer Goods and Services:

Basic Materials:

Our data shows that the topic is not widely discussed in either industry. However, there is more awareness of issues related to Forced Labor in the Basic Materials industry than in the Consumer Goods and Services Industry.

Analyses of this kind can help inform risk assessments along the supply chain, therefore capturing early warning signals that might prevent dangerous crises.

“For millions of years, mankind lived just like the animals. Then something happened which unleashed the power of our imagination. We learned to talk and we learned to listen. Speech has allowed the communication of ideas, enabling human beings to work together to build the impossible. Mankind’s greatest achievements have come about by talking, and its greatest failures by not talking. It doesn’t have to be like this. Our greatest hopes could become reality in the future. With the technology at our disposal, the possibilities are unbounded. All we need to do is make sure we keep talking.” Stephen Hawking

….and we are talking a lot, Steve. Reports, regulations, guidelines, news, tweets, posts. Every day, we generate an unprecedented flood of narrative that holds precious informational value for strategic decision making.

Nevertheless, making sense out of this unstructured data poses challenges in terms of time, completeness, consistency and accuracy of the analysis. Technology helps us to overtake these challenges.

Teaching computers to read

One such technological development is Natural Language Processing (NLP). As explained by our Lead Data Scientist, Emma Deraze,

“NLP is a large field of research covering multiple approaches to extracting information from various forms of human language. NLP tasks range from low-level text analytics such as ‘named entity recognition’ to more conceptual problems such as ‘sentiment analysis.’”

The rise of Natural Language Processing is especially significant in that it exposes insights that were previously incredibly hard to access. In the past, narrative and qualitative content existed within a “black-box” and insights based on this content were often subjective and hard to replicate.

Consequently, leading companies are starting to take notice of this technology. We are humans after all. We communicate via narrative, not through numbers. Perhaps the most well known example is Google Translate. However, the BBC is also applying NLP in projects such as Juicer and Window on the Newsroom. These projects aim to help journalists and other relevant parties quickly find the content they are looking for, whether it be within the BBC database or other external sources.

NLP is also finding popularity in the healthcare industry, where analysing unstructured clinical data is crucial. A report by MarketsandMarkets estimates that global healthcare NLP market will grow from $1.10 billion in 2015 to $2.67 billion by 2020. One startup taking part in this market is Babylon Health. The company aims to automate GP consultations, and consequently make physicians more effective, by enabling users to describe their health problems and answer specific questions via an automated process.

Sometimes words have two meanings

Imagine you have access to more than 40,000 reports. Access which doesn’t require you to download and read these reports (although, you can if you want), but instead involves someone else (a “robot”) reading them for you. This kind of analysis is not merely counting words -’cause, you know, sometimes words have two meanings– but calculates the level of emphasis on more than 100 ESG topics, utilising a vocabulary consisting in 5000+ key terms.

These strategic insights go beyond the ESG space. For example, picture yourself as a bank. You see that over the last 3 years competitors have begun to emphasize climate bonds more and more. This knowledge is of strategic and competitive importance as it pertains to launching a new product on the market.

The narrative imperative

We believe that this kind of innovation is imperative for companies aiming to ensure resiliency and a spot at the forefront of the next era of competitive advantage. We’re not alone in this thought. For example, the GRI’s Sustainability and Reporting 2025 project predicts that ‘data technology development’ will be a major trend in the coming years. Underpinned by three core elements (new format, new content and new roles for stakeholders), this trend indicates that the use case for technologies such as NLP is growing.

External links: