eRevalue BLOG

Materiality starts where guidelines stop. Let us explain our proposal for the next steps.

“No man ever steps in the same river twice, for it’s not the same river and he’s not the same man”. Heraclitus, a pre-Socratic Greek philosopher born in in 535 BC, coined this statement, meaning that no entity may ever occupy a single state at a single time. However, his “colleague” Parmenides disagreed. Instead, he called reality “what-is”, meaning that change is simply the false appearance of a changeless, eternal reality. In short, Heraclitus believed that things exist as “processes”, while Parmenides believed that things exist as “states”.

But what does pre-Socratic philosophy have to do with Materiality? More than you think, since there is a lot of confusion whether materiality is a process or not.

An ocean of definitions, principles, criteria, concepts and applications

March saw the release of the “Statement of Common Principles of Materiality” by the Corporate Reporting Dialogue Consortium. Released two years after the consortium’s establishment, the statement aims to pursue the much needed yet ambitious goal of “greater coherence, consistency and comparability between corporate reporting frameworks, standards and related requirements.”

The publication is a joint initiative of global reporting bodies and discloses key findings on the application of materiality within a reporting framework:

- Materiality is used in the financial and non-financial domains for reporting and other business purposes (e.g. “material adverse changes” clauses in business contracts);

- Some countries (e.g. United States) have a legal concept of materiality, established by either case law, statute, or regulation;

- Materiality definition is tailored to each organization’s mission, meaning that it is relative to manager’s contextual judgement, stakeholder validation and actual commensurability (if you can’t measure it, it can’t be material)

In addition to the voluntary reporting schemes, there is an increasing number of mandatory requirements regarding non-financial disclosure, which brings an additional layer of complexity to company assessment and disclosure practices. From the highly anticipated EU Directive on disclosure of non-financial information, to more specific regulations such as SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 in India, or the updated release of the South-African King IV Report, new dimensions of materiality are being added to an already busy field.

Failing to manage material issues has a real cost

The key takeaway from these different sources is that materiality is flexible, time-variant, and context-dependent. Consequently, the only defense against subjective and self-serving materiality is to ensure that the Materiality Assessment is accorded with a robust due process.

An inadequate or uninformed assessment approach exposes entities to reputational and legal risks. The court of public opinion is often a good predictor of the real courtroom – especially considering the rise in mandatory disclosure requirements. The path from public outcry caused by greenwashing to legal accusations and sanctions for misrepresentation can be dramatically short.

More importantly, this risk is extended along the whole value chain. For example, Nestlé faces a class action lawsuit filed by California residents upon the allegation that it violated three California laws that prohibit false advertising and unfair competition because its supplier, Thai Union, knowingly uses forced labour to harvest fish used in its cat food.

A new approach

One of the key questions regarding the Materiality Assessment is how often companies should perform it, and the realistic time and resource demands associated with the maintenance of the process. Notwithstanding due process, emerging issues can rapidly change what is material; just think of how the leak of the Panama Papers has put tax responsibility in the spotlight.

Frameworks and regulations are asking for a robust process without describing it and the standards to which companies are required to comply are increasing exponentially. More specifically, there are 10 times the amount of non-financial disclosure requirements today than there were 3 years ago. The below infographic zooms into this trend in the Americas.

Our approach to Materiality starts where guidelines stop.

In our opinion, a robust Materiality Assessment should provide:

- Competitiveness – achieved through benchmarking competitors

- Compliance – achieved through monitoring hard and and soft law affecting the business and its value chain

- Timeliness – achieved through engaging the communities around the business through direct stakeholder engagement and the monitoring of news and social media

Each component has a different time frame and calls for dedicated action. While competitor benchmarking can be done when a new report is published, monitoring regulations and engaging with communities should be constant exercises.

In the face of emerging ESG trends, how can companies ensure that they are on top of materiality? We think we have the answer. It’s called the Continuous Materiality Assessment – and Datamaran has the specific management tool capabilities to enable this process.

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.

We know EESG Kung-Fu

In The Matrix, the hero plugs himself into a computer to upload knowledge on Jiu-Jitsu and other martial arts directly to his brain; becoming a Kung-Fu master in the blink of an eye. Don’t worry, we won’t plug your brain to a computer. But we did teach a computer how to become an economic and ESG (EESG) analyst, reading corporate reports and analysing EESG content.

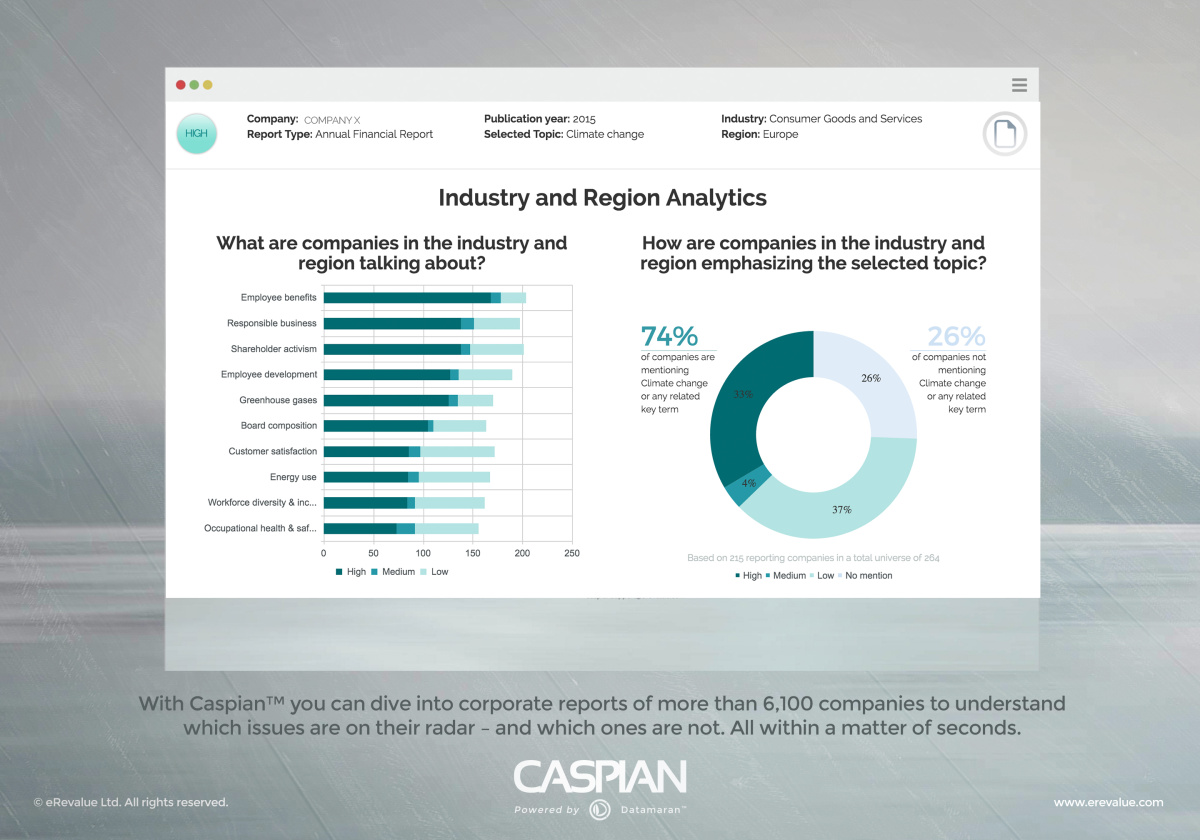

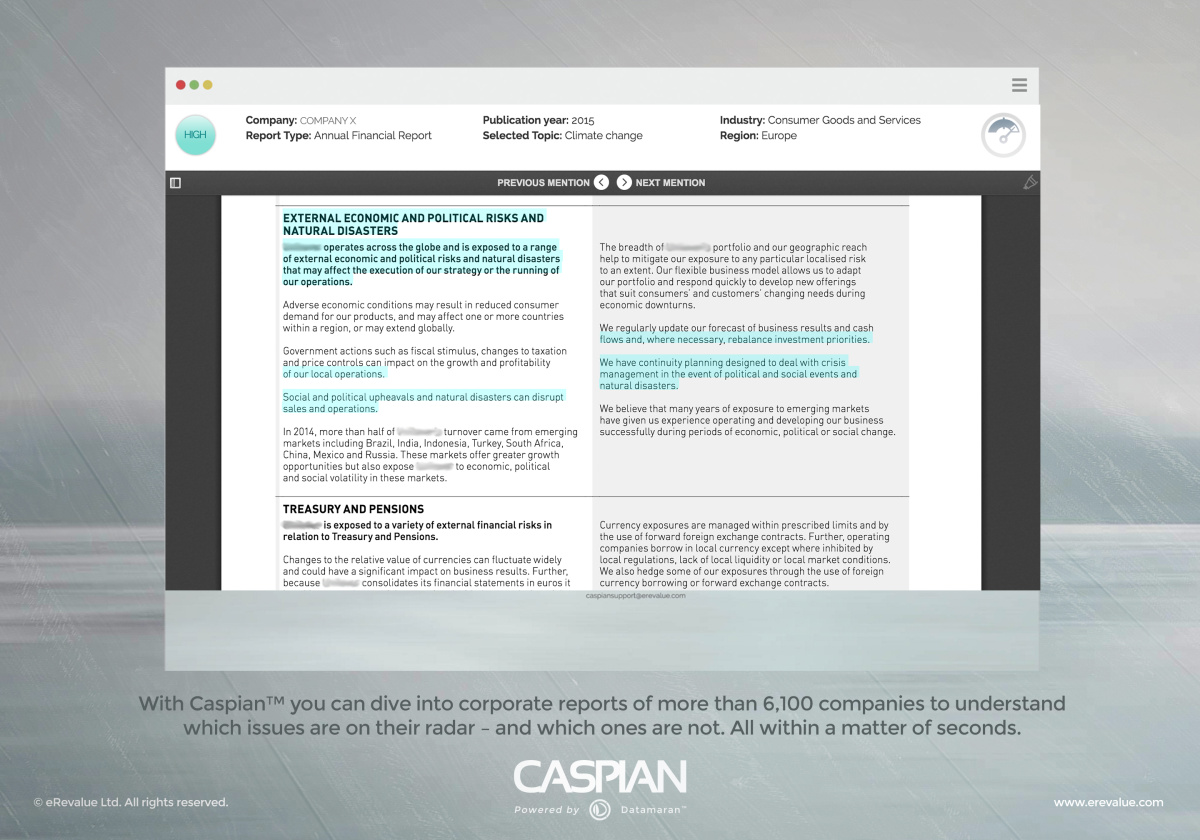

Caspian, our newest research tool, reads corporate reports just as an EESG analyst would. However, it goes a step further, objectively spotting patterns across more than 40,000 reports published by over 6,100 companies from 2010 to present.

In other words, Caspian surpasses the limits of human insight. As Julien, one of our data scientists puts it:

“You can have an army of analysts, but an algorithm is different. An algorithm is always objective, is never tired and does not need coffee, sleep or food. It is able to catch patterns and trends that are not visible to the human eye.”

Robot trainers

Caspian is different from other repositories of corporate filings. Not only does it collect annual sustainability reports, annual financial reports and SEC 10-K filings, but through its Topic Browser, it unlocks the informational value of their narrative content. And it does so in a way which is completely transparent; there is no black box (for more details on Caspian’s functionalities read here).

This is possible because our team of industry experts worked to develop a sound and adaptive analytical framework to delve into EESG disclosures.

“Frankenstein reporting”

Coined by Ioanna, manager of the Industry team, this expression summarizes one of the major challenges of EESG analysis. The proliferation of standards and frameworks has resulted in EESG information being fragmented across a variety of different sources. Consequently, creating a comprehensive database of EESG data is not an easy task.

“We cut through all the wide ‘non-financial’ terminology. With all that redundancy it is very difficult to understand the informational value of each report. This database is unique as it streamlines all the tasks EESG analysts have to do: download reports, code the content, check the consistency of the coding rules, ensure comparability for analytics, run the analysis and visualize the results. We do all that, plus we provide an analytical framework that is expertise-based.” – Michael, Industry Associate

Materiality in the era of “contextual reporting”

Contextual reporting refers to the process of connecting the information included within corporate reports to additional external information, such as that found in websites and in the the news. Jyoti Banerjee, contributor to the seminal book “The Integrated Reporting Movement” by Bob Eccles and Mike Krzus, summarizes the contextual reporting challenge in one question, “is it possible for companies to be more transparent about their operations and meet growing disclosure requirements while providing smaller reports than before?”

Caspian integrates different sources of information so that is possible to track which EESG issues are more recurrent, more emphasised, more material. Furthermore, the observation of topic disclosure trends allows users to understand crucial new dynamics, such as the “migration” of topics from sustainability reports to financial reports (read more here).

“Our approach does not involve a specific source of information. Instead, it looks at the whole corporate reporting suite and its dynamics. By analysing the qualitative and narrative content of reports we are able to observe unique trends, such as topic migration from one document to another. This opens up new possibilities for understanding the future trends in EESG reporting and what is and will be material. ” – Melissa, Industry Associate

Expert companions in your journey through the Data Lakes

With more than 80 percent S&P 500 companies disclosing EESG issues in 2015 (up from 19 percent just five years ago) the amount of EESG information available is enormous. These – “content farms,” or data lakes as we like to call them, represent a huge amount of strategic value. Caspian allows its users to unlock this value through its innovative use of technology; it’s the tool of the future.

From left to right: Michael Agenga (Industry Analytics Associate), Alessandro Laterza (Industry Analytics Associate), Ioanna Chatzidimopoulou (Manager – Industry Analytics), Andreanna Mazereeuw (Marketing Manager), Melissa Fricheteau (Industry Analytics Associate) and Feym Akdas (Communications Associate)

The Caspian sea is the world’s largest inland body of water. With a surface area of 371,000 km² (143,000 sq. mi.), it combines characteristics common to both seas and lakes. Over 130 rivers flow into the Caspian and the area is rich in natural resources including oil fields and natural gas supplies.

We have big news. We want you to visit Caspian. No, we are not launching a brand-new eRevalue travel agency. Caspian is our innovative new research tool. Using Big Data Analytics and Natural Language Processing (NLP) helps people navigate emerging economic, environmental, social and corporate governance (EESG) issues.

The Winds of Innovation

According to the Austrian American economist and philosopher Joseph Schumpeter, Innovation is a force of “creative destruction.” It is a ‘process of industrial mutation that incessantly revolutionizes the economic structure from within, “incessantly destroying the old one, incessantly creating a new one”. No company survives in the long term if they are sailing upwind.

Today’s world is defined by innovation. Just look at the “digital transformation.” With digital technology increasingly being applied to all aspects of human technology, it is no wonder that the transformation of industries is expected to be worth more than $100 trillion by 2025.

The world’s biggest investor, BlackRock, is embracing the digital transformation with the help of big data analytics and machine learning. Having deemed these technologies as “necessary for great investing” it has recognised the importance of innovation for the transition from a short-term to long-term approach to sustainable value creation, the focus of CEO Larry Fink’s letter to S&P 500 CEOs.

Another example can be seen in the mainstreaming of EESG issues. The past months have seen some big developments in the EESG area, including the establishment of a Financial Stability Board (FSB) industry-led Task Force that aims to develop voluntary financial disclosures related to climate risk. Michael Bloomberg, chair of the Task Force, said

“Managing climate-related risk is increasingly critical to financial stability, but it can’t be done without effective disclosure. The recommendations from the Task Force will increase transparency and help to make markets more efficient, and economies more stable and resilient.”

Caspian sits at the intersection of these two processes, allowing users to position themselves downwind of the winds of innovation.

Evolution Made Simple

Caspian is simple to use. It runs on sophisticated Natural Language Processing (NLP) technology, enabling users to save the time and money they would otherwise spend on hours of manual research. This technology works to extract information from various forms of human language. This makes it especially applicable in the EESG space. Here, quantitative data is not enough. And while qualitative data exists, it exists in such overwhelmingly large quantities that there is a huge amount of data that has yet to be fully taken advantage of. Consequently, NLP innovation is not just only a nice-to-have; it’s a crucial element for survival.

The Caspian Way

Caspian has an expanding catalogue consisting of more than 41,000 reports from 6,100+ companies published over the last 5 years. These include Annual Sustainability Reports, Annual Financial Reports and SEC filings.

Caspian puts an end to the slow, unreliable and ineffective methods of content analysis through its “Topics Browser.” It identifies and highlights sections within reports where terms associated with the 100+ EESG topics constituting our Ontology are referenced.

Caspian also provides analytics functionalities. Users will be provided not only with the 10 most emphasized topics within selected industries and regions, but also a breakdown of the levels of emphasis associated with these topics. These functionalities help users to uncover insights not visible to the human eye.

Get on board

Unstructured, qualitative and narrative data analysis is demanding in terms of time and resources and the output is often subjective and unreliable. However, its informational value is strategically crucial, especially when it comes to a domain hard to translate in figures – such as EESG. Caspian provides simple but reliable access to this sea of information.

As our CEO and Co-Founder, Marjella Alma, points out, “We’re making the data lakes more accessible and affordable with Caspian, helping more people find the information they need without spending hours trawling through reports. This accessibility will enable users to identify tomorrow’s trends, today”.

Visit our website to start your Caspian journey now or subscribe to our newsletter.

A spotlight on the UK’s new gender pay gap regulation

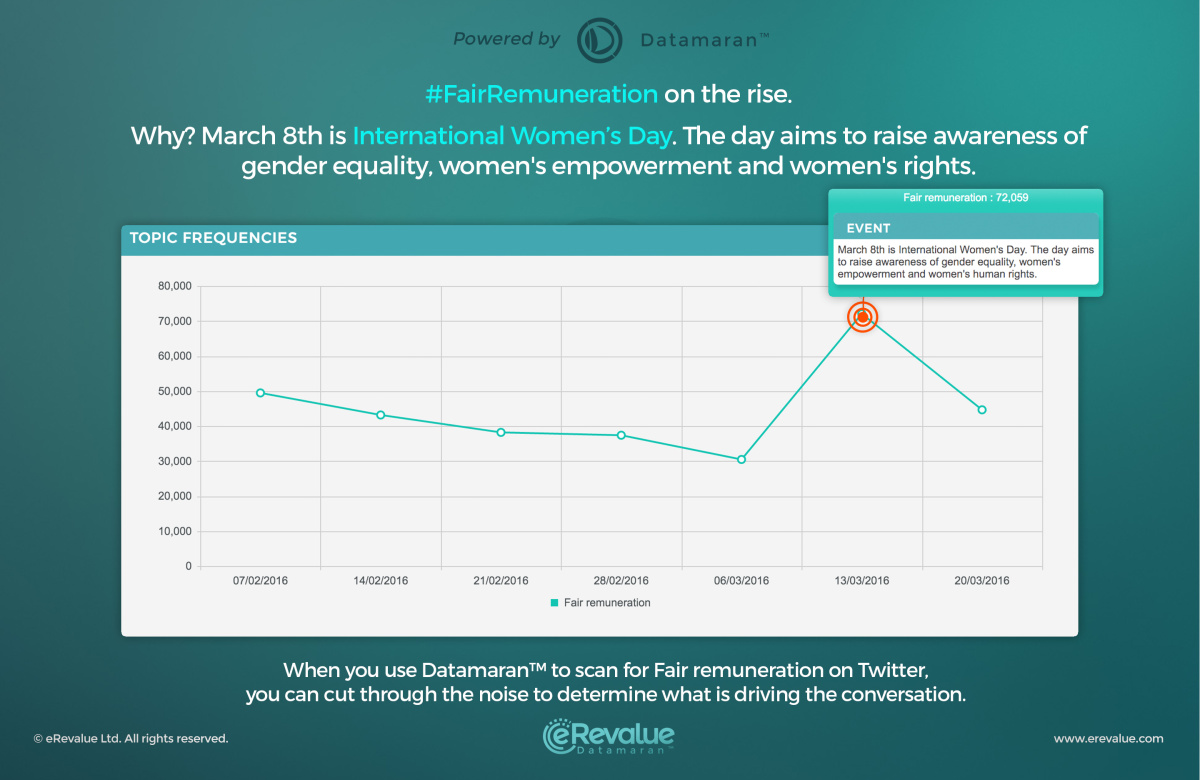

We are a week from the end of the month celebrating International Women’s Day, which means that after an apex of discussions regarding the disparity of rights and opportunities between men and women, things are about to get back to business-as-usual. Or not?

A quick scan of Twitter shows that after the expected peaks on the 8th of March, discussions about fair remuneration faded on social media.

The World Economic Forum (WEF) predicts that it will take until 2133 to achieve gender pay parity at the global level. The fact that such a gender pay gap exists is not only ethically problematic, but also financially material. As argued by WEF, inequality constitutes a substantial obstacle to the career paths of highly skilled women, consequently affecting a country’s ability to generate sustainable and inclusive growth and create jobs.

Given these implications, the topic has moved quickly to the top of the agenda of governments and regulators. Consequently, many mandatory requirements have been enacted to tackle the issue.

The UK leads the way…

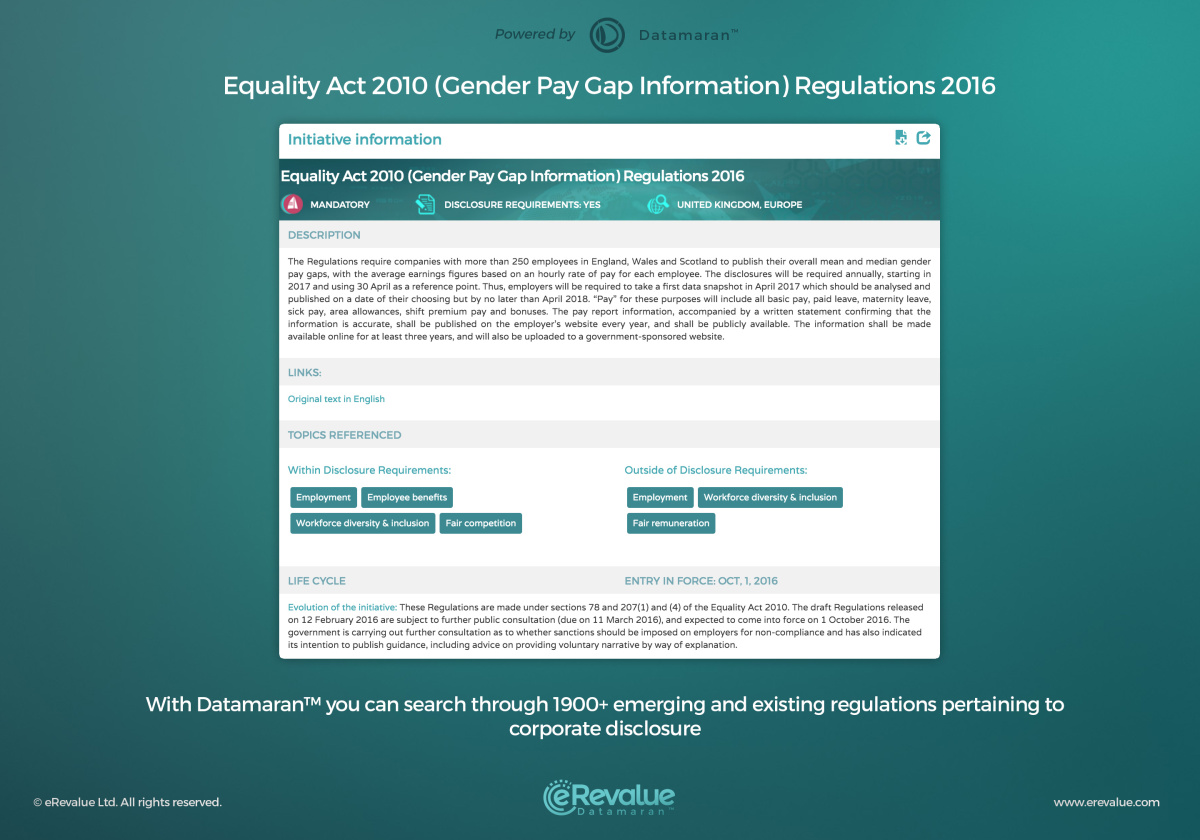

Calls for greater transparency date back to 2010, when the Equality Act came into force. These calls are being amplified with the introduction of the upcoming Equality Act 2010 (Gender Pay Gap Information) Regulations 2016.

According to the BBC, the regulation will affect approximately 8,000 employers across the UK. More specifically, the regulations will require employers with more than 250 employees in England, Wales and/or Scotland to publish an annual report including:

- The mean and median gender pay gap,

- The difference between mean bonus payments paid to men and women,

- The proportion of men and women that receive a bonus,

- The number of men and women in each quartile of their pay distribution.

Companies will be required to publish these reports from 2017 onwards.

…but other countries are following

Moves to regulate these issues are not occurring only in the UK. For example, Israel published the “Male and Female Workers Equal Pay Law” while California issued the “Fair Pay Act, SB-358” .

The European Commission is also taking action. Its recent public consultation on “Equality between men and women in the EU” recognised the need to address the fact that women are being paid over 16% less per hour than men for the same work or work of equal value. Furthermore, the “EU Strategic Engagement for Gender Equality 2016-2019” identifies key actions to be implemented and emphasizes the need to integrate gender equality perspectives into EU policies.

The impact on companies

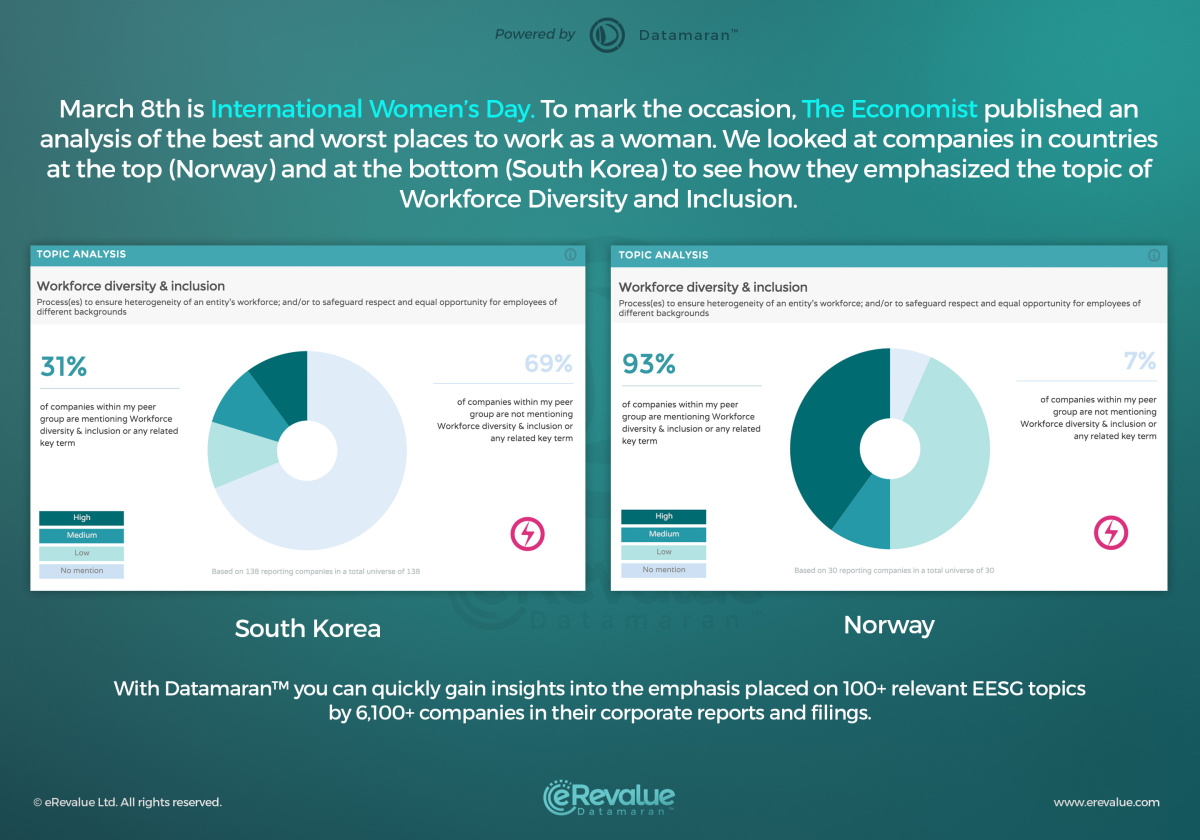

This regulatory trend has deep implications for companies in terms of their policies related to Workforce Diversity and Inclusion, Board Composition, and Fair Remuneration. For example, look at the corporate disclosure of companies from Norway and South Korea – countries at the top and bottom of the The Economist’s list of the best and worst countries for working women.

The two countries put different levels of regulatory emphasis on Board Composition and Workforce Diversity & Inclusion; a fact which is reflected in companies’ references to these issues in their 2015 Financial and Sustainability reports.

More specifically, as the below image demonstrates, 93% of Norwegian companies in our database mentioned the topic of Workforce Diversity & Inclusion in their 2015 Corporate Filings, while only 31% of South Korean did.

Gender pay equality is an issue of utmost importance and the new mandatory requirements make it clear that it will no longer be the elephant in the room. Instead, it will pose profound strategic and organizational implications, thus necessitating a change in corporate behaviour. This change can either be proactive or reactive. In order to ensure the former, and therefore mitigate the regulatory and competitive risks associated with non-compliance, companies must have the necessary tools and processes in place. Datamaran™ can help.

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.

A changing regulatory landscape will cause companies to rethink the ways in which they store and process customer data

Information Security and Customer Privacy are increasingly in the public spotlight

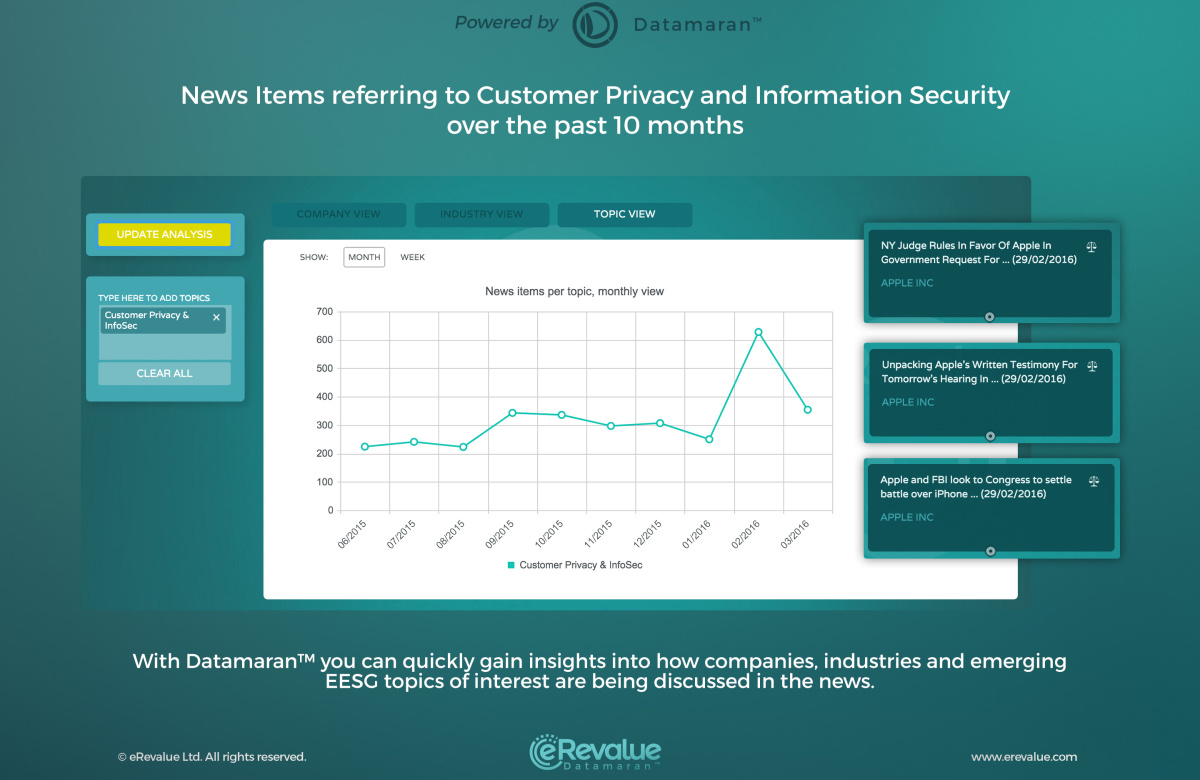

Information Security and Customer Privacy are pervasive themes in today’s conversations. As evidenced by the below image, discussion of these topics in digital news sources has seen a significant increase, especially over the last two months. Due mainly to the arm-wrestle between the Apple and the FBI over “back-door” access to the iPhone, this increase demonstrates that these topics are becoming increasingly important to the general public.

Regulators too are becoming more engaged with these issues.

Regulations are emerging in both the U.S and Europe that could result in up to US $10 million in fines in cases of non-compliance. Despite these consequences, companies do not appear to be ready for these regulations. For example, both the Healthcare & Pharmaceuticals and Consumer Goods & Services industries are highly exposed to the regulatory risks stemming from the new EU-US Data Privacy Shield.

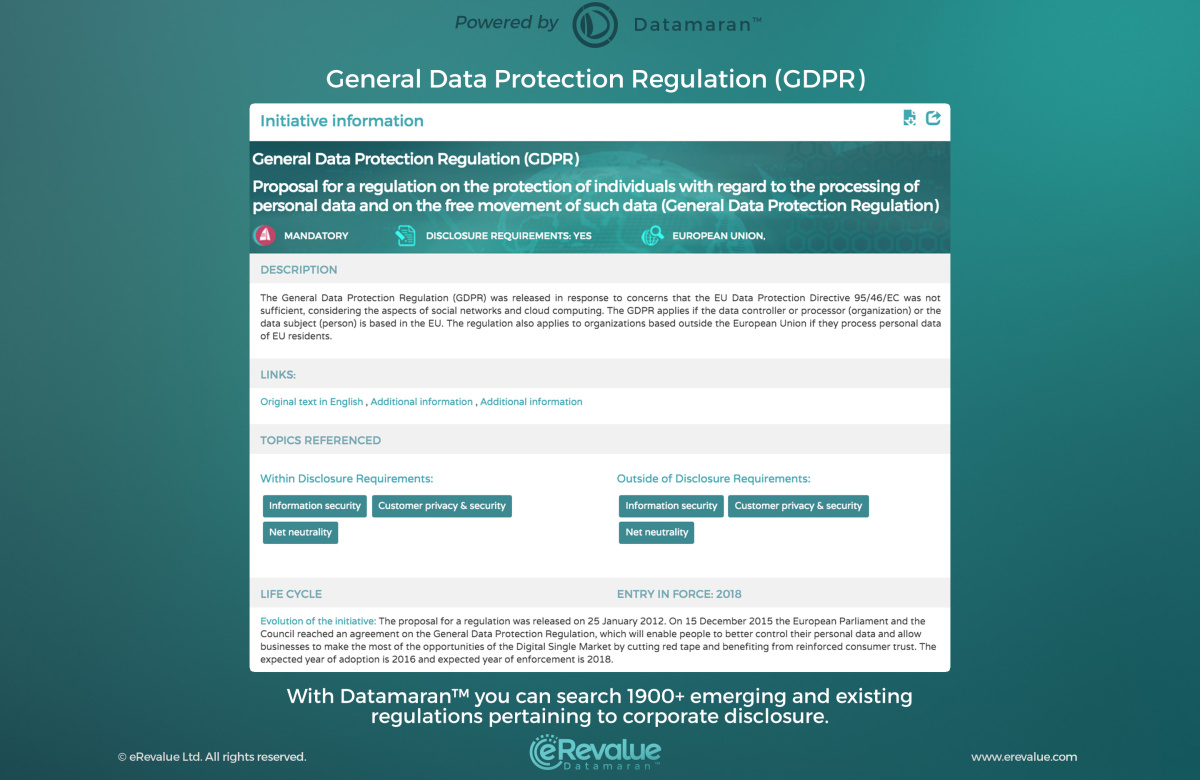

Iceberg Ahoy: The General Data Protection Regulation

When navigating the sea of customer data, it is imperative that companies are aware of their surroundings. A laissez-faire attitude could result in them hitting a swell, or worse, an iceberg, potentially leaving a Titanic sized hole in their reputation.

One such Iceberg is the E.U General Data Protection Regulation. With the potential to be one of the most lobbied pieces of regulation in the history of the European Union, the regulation will be one of the biggest legal game-changers in the field of personal data protection.

This revolutionary regulation is expected to require compliance by 2018 and will repeal the EU Data Protection Directive in order to better facilitate the needs of the digital age. We’ve highlighted the key features of the regulation below.

- The General Data Protection Regulation is a regulation, not a directive, which means that it will be directly applicable to all companies without the need for national implementing legislation;

- All companies exposed to personal data of Europeans, even those not established in the EU, will be affected. The regulation has global ramifications across a wide range of sectors. This includes more obvious ones – such as technology, finance and healthcare as well as those less obvious – such as Electricity, Water and Gas Utilities. Disclosure requirements will affect cloud services as well;

- Companies need to set up data breach notification requirements (breaches need to be notified within 72 hours) and entities above 250 employees (or that hold more than 5,000 records) must appoint a Data Protection Officer;

- Citizens have the right to demand disclosure on what data is held on them and how it is being processed. They will also have new erasure rights (the right to be forgotten). Concerned individuals will be able make compensation claims (after the landmark case Google v Vidal-Hall);

- Tougher sanctions and streamlined incident reporting will enable data protection regulators to impose fines of up to 4% of annual worldwide turnover or EUR 100 million per breach per company (also within the group).

Companies are not prepared

We looked for exact references to the General Data Protection Regulation in the corporate filings of the Global Top 500 Companies by market cap. Our data shows that only 2% of these companies are talking about this regulation in reports released from 2010 – 2015. This result corresponds with research done by Spiceworks. They reported that only 2% of surveyed businesses in North America and 11% in Europe have started aligning their processes to the new requirements.

We also conducted analysis to see how prepared companies are on a broader level. The below visualization shows references to Customer Privacy & Security in Annual Financial Reports, Sustainability Reports and SEC filings for the same group of companies as above. We found that in 2015 62% of companies mentioned this issue. However, only 14.8% put a high level of emphasis on it.

The regulation has yet to come into effect, meaning that now is the time for companies to review the above requirements and implement the processes necessary to enable compliance. Whether or not they do so will have major implications for their future. As any sailor worth their salt knows, a lack of planning and preparation can have disastrous consequences.

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.