eRevalue BLOG

Part 2 of our Analysis of EESG Reporting Frameworks (GRI, SASB and IR)

Last week we presented the first part of our comparative analysis of the three dominant EESG reporting frameworks: the Global Reporting Initiative (GRI),the Sustainability Accounting Standards Board guidelines (SASB), and the International Integrated Reporting Council <IR> Framework.

We analyzed our database of 40,000+ reports from over 6,100 organizations to pinpoint references to the different frameworks in both Annual Financial reports and Sustainability reports.

Don’t worry, we didn’t do this by hand! We had the help of “robots,” or what we like to call “automated human expertise”.

Our results demonstrated that while GRI remains the most widely adopted framework, SASB and <IR> are stepping it up. Given that South Africa’s King Report on Corporate Governance (King III) supports the use of <IR> in the region and that SASB has strong roots in the United States and utilises a definition of materiality that resonates with investors, this is not surprising.

In case you missed it, read it here.

This week we’ll get to the juicy part.

Part two provides insights into not only where reporting frameworks are being referenced but also which EESG topics are being referenced in different report types (i.e. Sustainability or Annual Reports).

We will examine individual EESG topics, perform an innovative EESG topic migration analysis and examine the gaps between Annual Financial Reports and Sustainability Reports.

<IR> and GRI’s paths are diverging, while SASB has yet to find its own

The increasing complexity of voluntary and mandatory disclosure requirements is providing companies with a number of reporting channels (i.e. Annual Financial reports, Sustainability Reports, Strategy reports, etc.). An in-depth look at the EESG frameworks and topics emphasized by companies in different reporting documents is key to understanding future trends and preempting changes in this ever-changing and competitive arena.

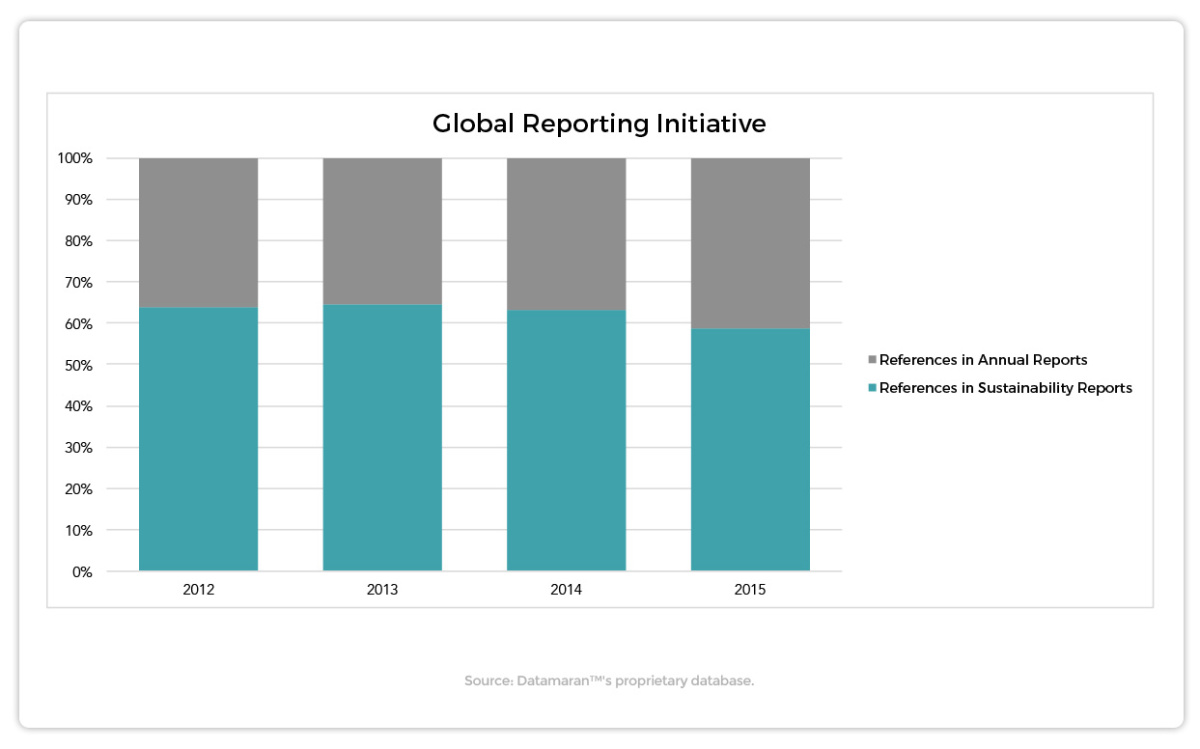

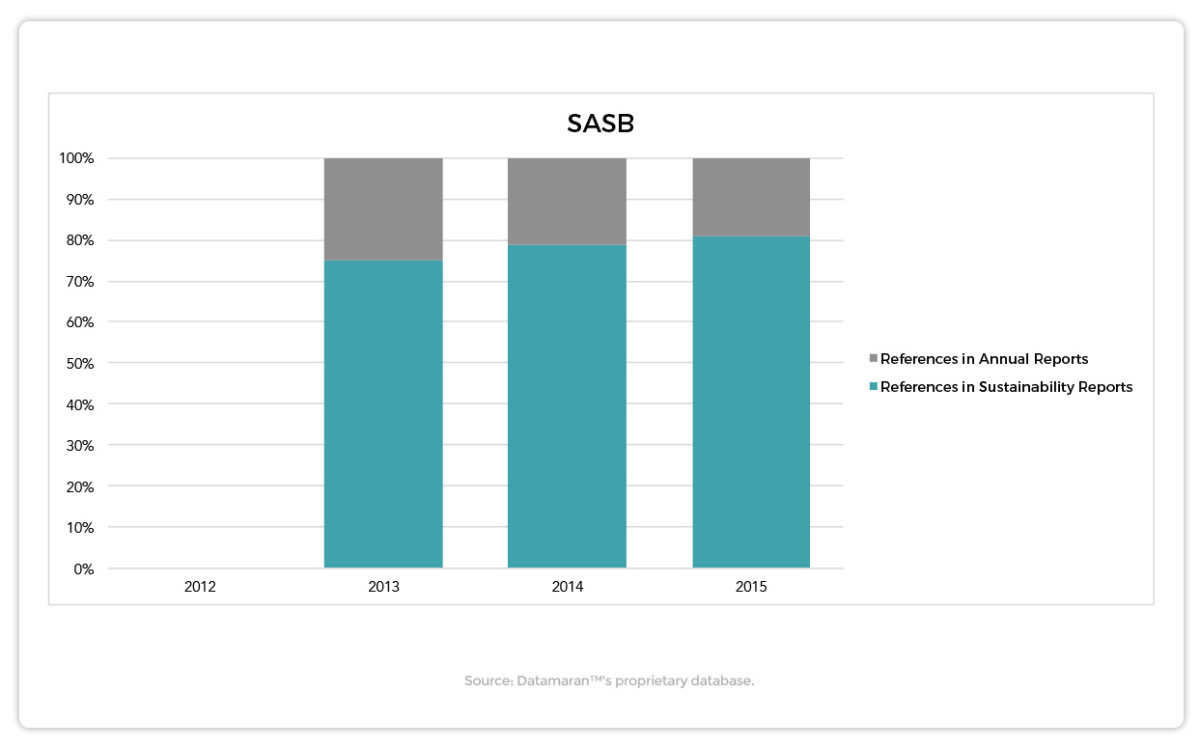

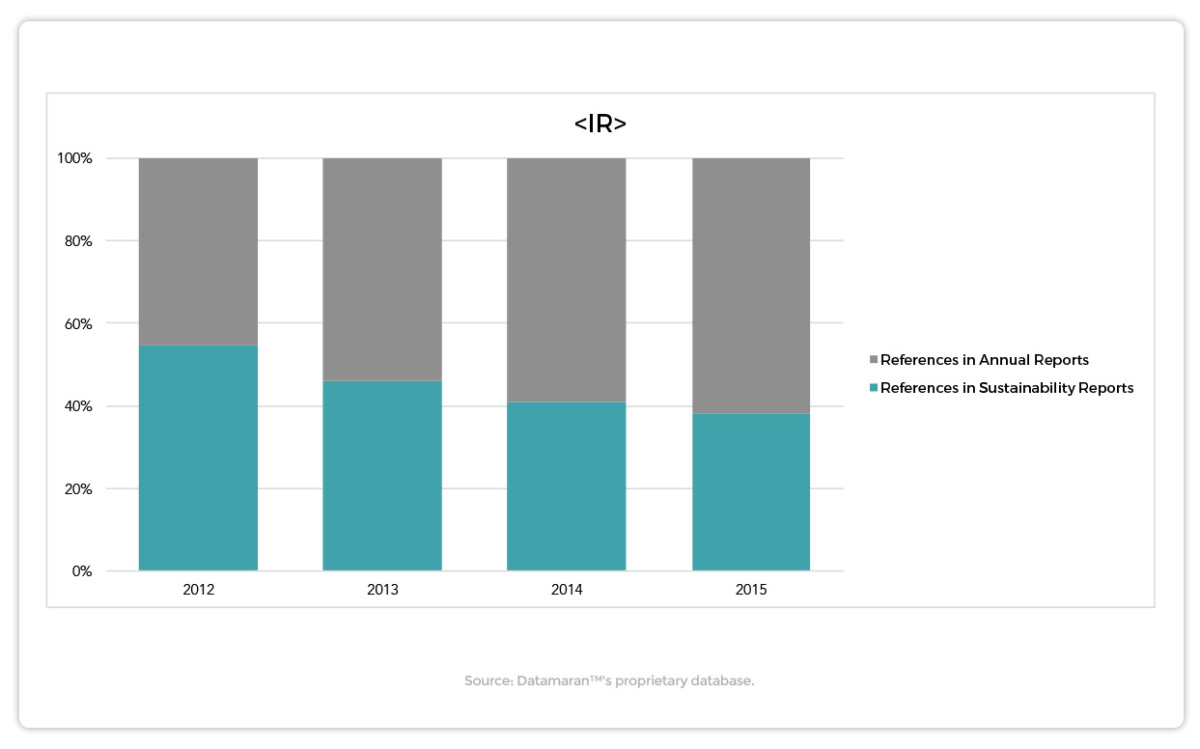

The graphs below show references made to GRI, SASB and <IR> frameworks in the Annual Financial reports and Sustainability reports in our database from 2012 to 2015:

Starting in 2013 (the first reporting year in which the SASB framework was operational) references to the framework had the largest share in Sustainability Reports, suggesting that reporters are eager to use this format to talk about SASB.

More interesting is the comparison between the references to GRI and <IR>. The analysis suggests that while GRI is widely referenced in Sustainability Reports, references to <IR> are increasingly migrating to Annual Financial Reports. This suggests that the ‘integrated philosophy’ behind <IR> is gaining traction and that the two frameworks might further distance and differentiate themselves from one another.

EESG Topic Migration analysis

Datamaran™ also facilitates analysis at a more granular level; processing and annotating specific EESG topics addressed in Annual Financial reports and Sustainability reports. These “highlighted sections” allow us to monitor which reporting format companies use to disclose these topics and to check, for example, how topics migrate from Annual Financial reports to Sustainability reports, and vice versa.

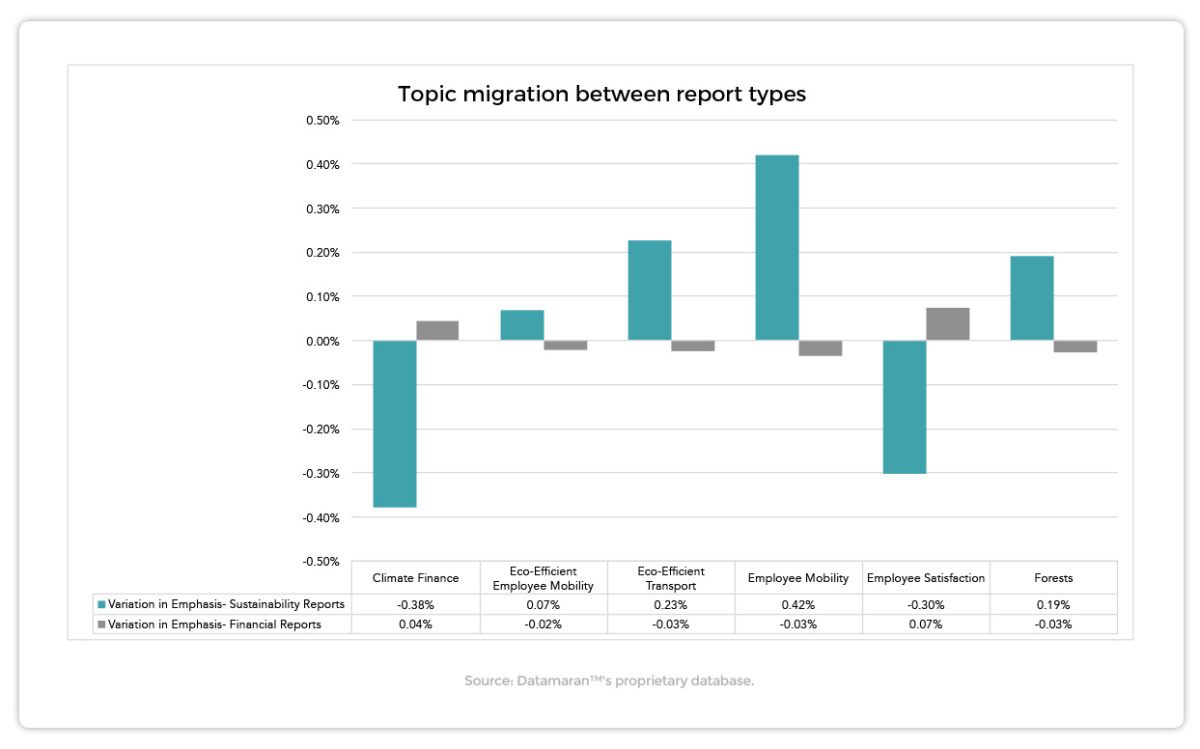

We analyzed EESG topic disclosure trends from 2010 to 2015 for the largest 500 companies in our database publishing both Annual Financial Reports and Sustainability Reports.

This graph tracks the Top 6 “migrating” topics. In other words, topics which show a decline in emphasis in one report type (e.g. Financial reports) and an increase in the other (e.g. Sustainability reports). The growth/decline in the emphasis of a topic is calculated on the basis of the discussion around the topic from 2010 to 2015.

Results show that while emphasis of both Employee Satisfaction and Climate Finance has declined in Sustainability Reports, it has increased in Annual Financial Reports. This is not surprising as these topics are recognized as having immediate financial impact. More specifically, Employee satisfaction has consequences for talent attraction and retention, while Climate Finance aims to minimize the financial risk associated with climate change. The latter is especially relevant given the recent establishment of Michael Bloomberg’s Global Taskforce on Climate Change.

References to transport related topics such as Eco-Efficient Employee Mobility, Eco-Efficient Transportation and Employee Mobility are moving from Annual Financial Reports to Sustainability Reports. The same can be said for the topic of Forests. One possible explanation for this migration is that because these topics are perceived as more sustainability-specific, reporters prefer a more dedicated channel for disclosing information related to them.

Topics “closing the gap” between Annual Financial Reports and Sustainability Reports

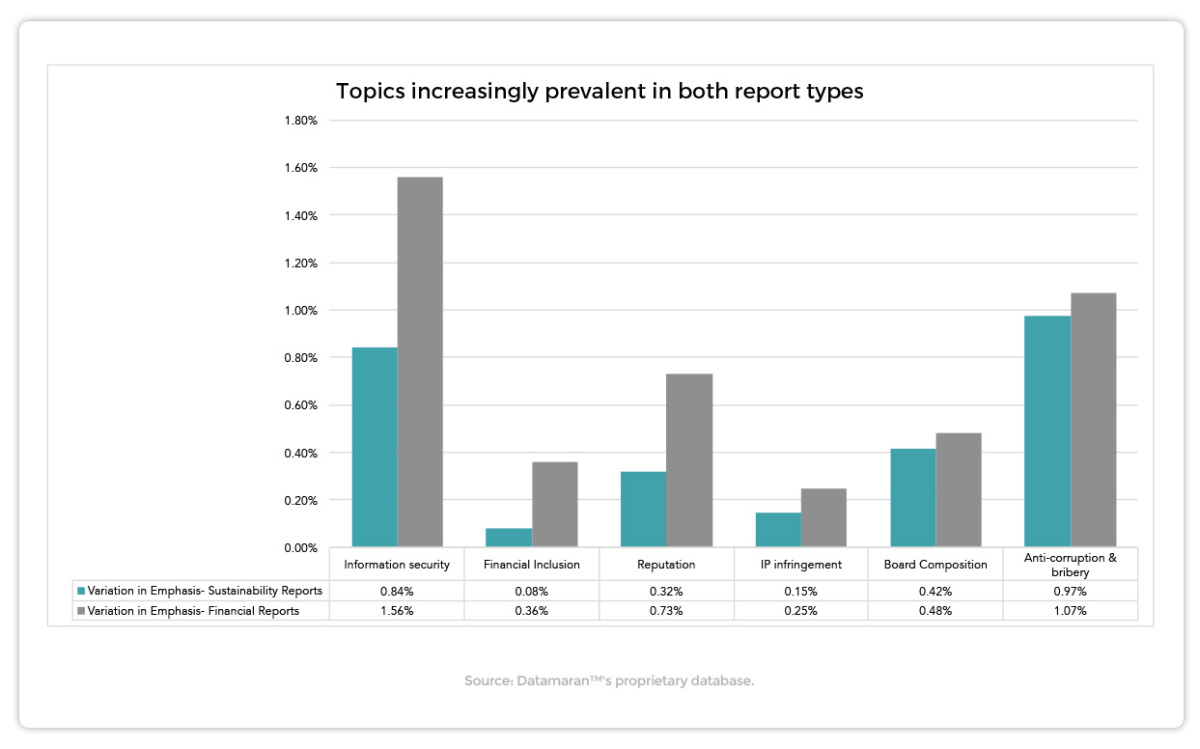

However, it should be noted that Annual Financial reports and Sustainability reports are not necessarily exclusive in their emphasis of EESG topics. Some topics commonly referenced in Sustainability Reports are becoming more represented in Annual Financial Reports – a crucial indication of their strategic importance. Take a look at the below graph:

The results show that Information Security and Anti-corruption & Bribery have experienced a sharp increase in emphasis in Annual Financial Reports. Financial Inclusion, Reputation, IP Infringement, and Board Composition follow, growing in emphasis at a faster pace in Annual Financial Reports than in Sustainability Reports.

Mastering the Materiality Assessment Process

Datamaran™ offers an additional layer of analysis when selecting reporting guidelines. Its unique approach enables users to identify consensus growing around specific reporting trends, reinforcing the validity of materiality assessments in the long run.

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.

Part 1 of our Analysis of EESG Reporting Frameworks (GRI, SASB and IR)

Navigating the unexplored waters of EESG frameworks and indicators is not an easy task, especially if you are not confident in your map.

With all the “maps” (that is, frameworks, guidelines and KPI sets) available, choosing which to use is a crucial decision for the “captain” (such as the manager). Given the fast-changing regulatory environment and the increasing diversification of audiences (investors, the public, employees and NGOs) the risk of falling short on transparency and compliance can be extremely high. This type of risk is complex and comes from a variety of sources such as industry peers, supply-chains and influential stakeholder groups.

Minimizing this risk is key to ensuring that the investment of resources into EESG reporting leads to a positive return. Therefore, before gathering huge amounts of data on CO2 emissions, workforce diversity and board composition, it is essential to determine what framework best addresses your reporting needs and goals.

Collecting information on each of the different reporting frameworks is time consuming. There are global, national and local regulations to take into account, peers and competitors to benchmark, stakeholders to engage and materiality assessments to carry out. With Datamaran, it’s possible to streamline and jumpstart this process to go beyond the most obvious comparative analysis of the different reporting frameworks.

Let’s look at an example.

We compared the three dominant EESG initiatives: the Global Reporting Initiative (GRI), the International Integrated Reporting Council IR Framework, and the Sustainability Accounting Standards Board guidelines (SASB).

Each of these organizations adopts a different definition of materiality, or the principle determining which issues are considered relevant in influencing decision-makers. The GRI G4 indicates that “the report should cover Aspects that 1. reflect the organization’s significant economic, environmental, and social impacts; or 2. substantively influence the assessments and decisions of stakeholders”. The SASB Implementation Guide does not define materiality, but instead refers to the definition set out by the US Supreme Court: “A substantial likelihood that the disclosure of the omitted fact would have been viewed by the reasonable investor as having significantly altered the ‘total mix’ of information made available.” Finally, the IIRC states that “an integrated report should disclose information about matters that substantively affect the organization’s ability to create value over the short, medium and long term.”

Each emphasizes different elements of the broad ESG universe. While GRI G4 builds its materiality around a multi-stakeholder approach, SASB focuses on investor-centric material ESG information. <IR> materiality relies on value creation across six different ‘capitals’: financial, manufactured, social and relationship, intellectual, human and natural.

Approaching the process of framework selection with a “one-best-solution” mindset is a short sighted tactic.

A strategic approach requires an understanding of each framework’s purpose and how it serves a company’s reporting intent. Datamaran™ can help.

The Datamaran database includes more than 40,000 reports from over 6,100 organizations. Where other data providers offer only report metadata, we analyze the content using Natural Language Processing techniques and compare it to disclosure requirements coming from both direct and indirect sources (e.g. supply chain), as well as regional and global regulations, sector/industry peers, stakeholders and digital and social media sources.

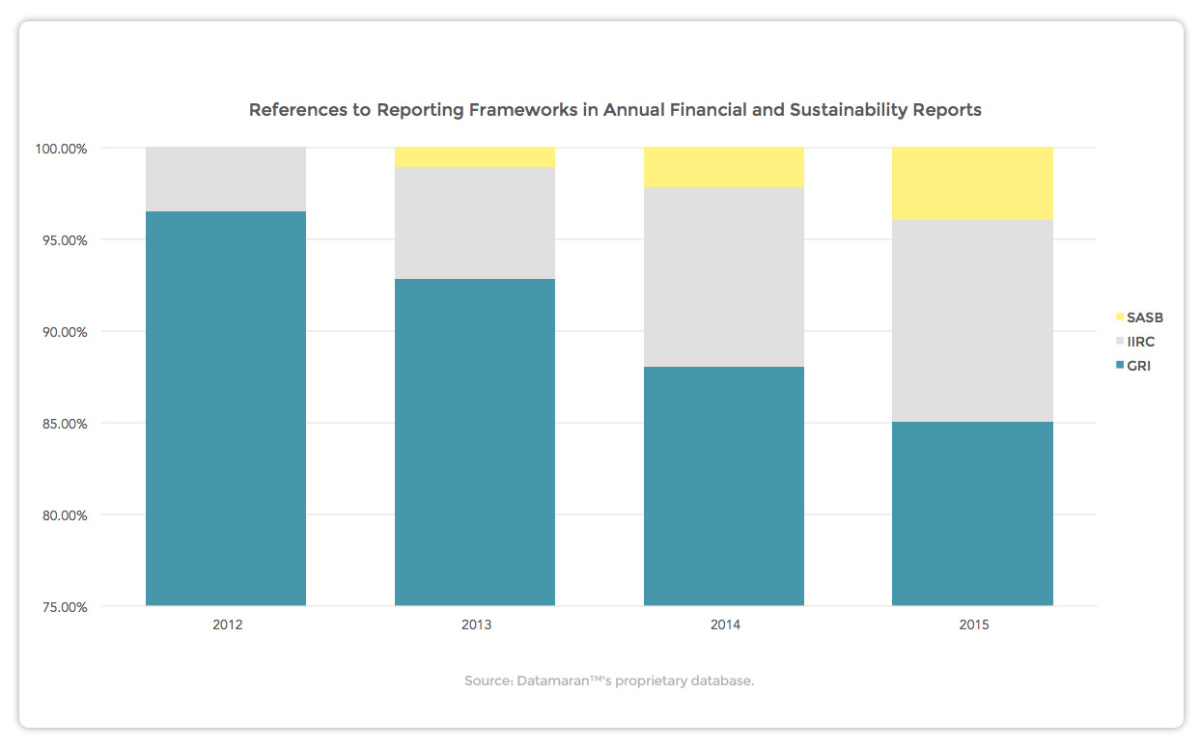

We looked for references to each of the three reporting frameworks in Annual Financial and Sustainability reports for the period from 2012 to 2015. Please note that the Y-Axis begins at 75%.

As already reported by KPMG, GRI is the dominant EESG reporting framework. However, our analysis demonstrates that other initiatives are popping up more frequently, as evidenced by the growing trend in references to the <IR> framework and the SASB-KPIs.

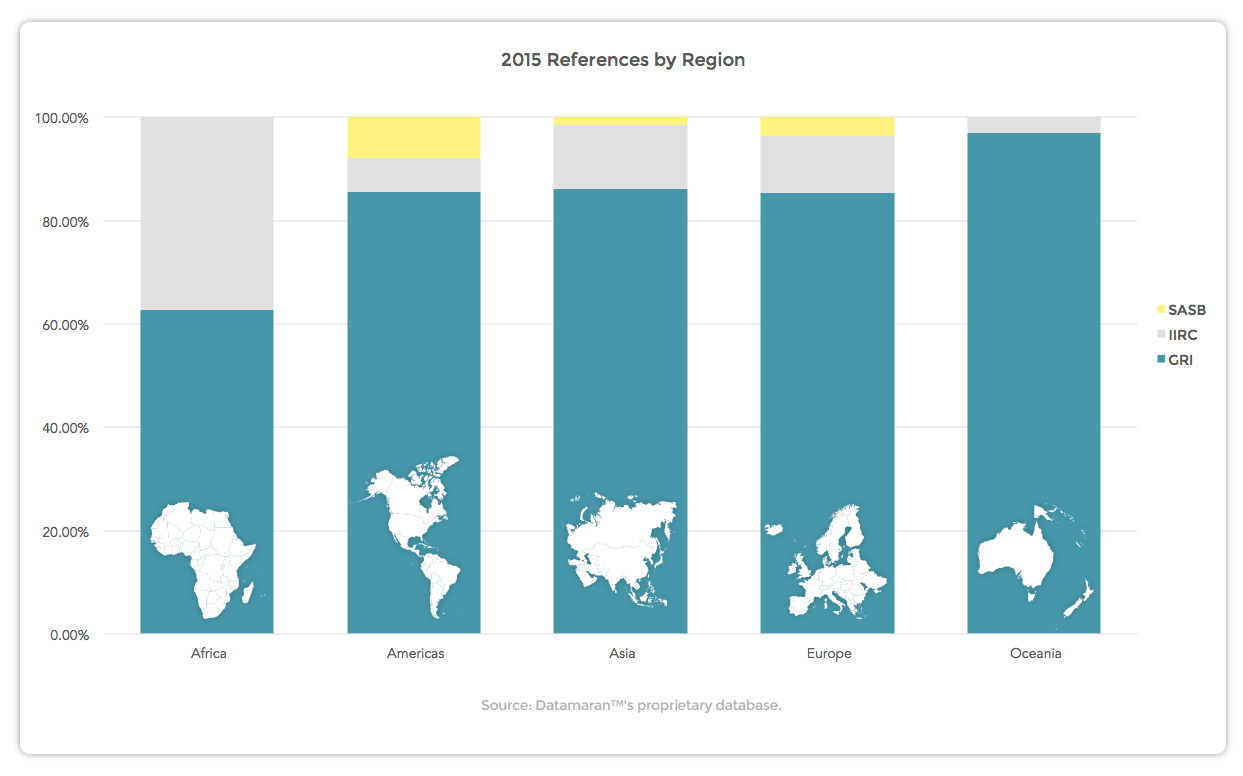

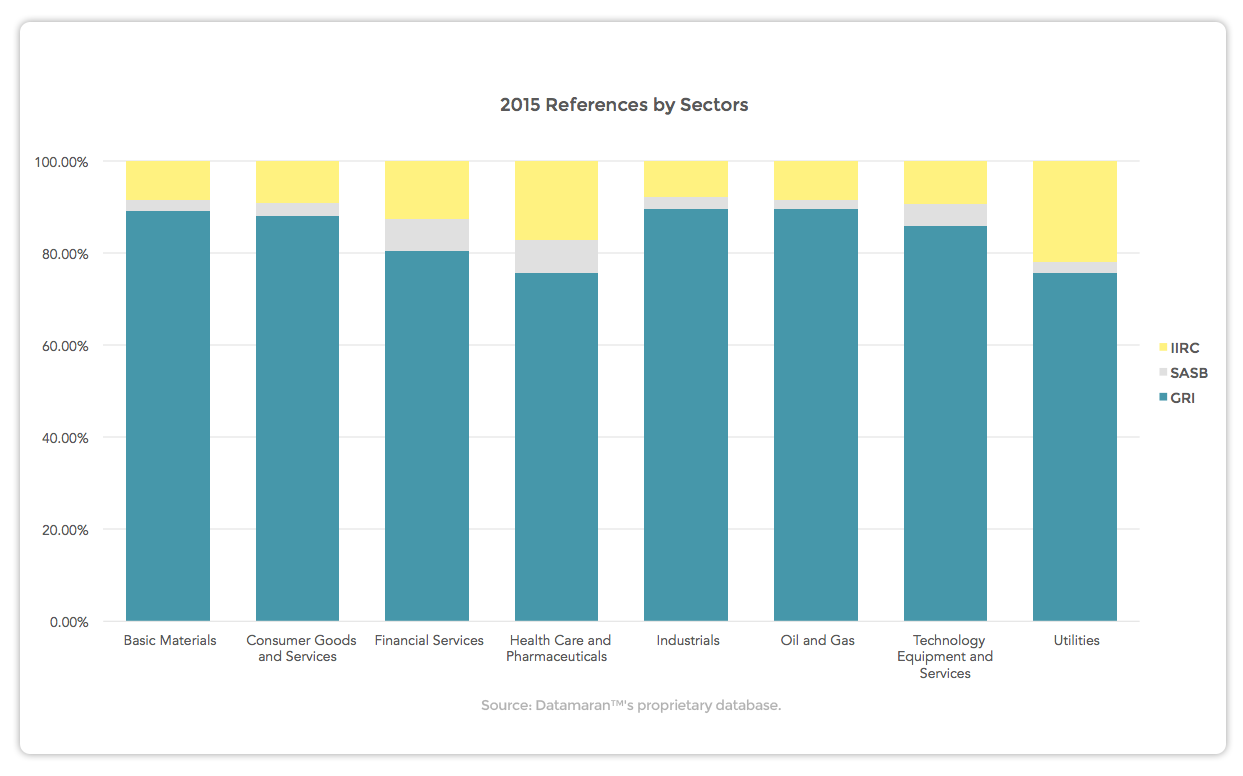

Zooming in 2015, we can identify those regions and sectors that are leading the rise of SASB and <IR>.

As expected, SASB is more dominant in the Americas, while <IR> represents a significant portion of the references in Africa. Indeed, the King Report on Corporate Governance (King III) in South Africa requires companies listed on the Johannesburg Stock Exchange to prepare ‘integrated’ reports including financial and non-financial issues..

When looking at the sector distribution, both the Financial Services and Health Care and Pharmaceuticals sectors put more emphasis on SASB, while <IR> has a significant share in Utilities.

These tools guide first-time reporters in understanding which environmental, social, and governance issues they should address. In addition, both GRI and <IR> frameworks help reporters structure their reporting activity through their contribution to the the development of systematic processes and controls.

Datamaran takes this process a step further.

Even though our analysis did not compare the actual number of companies adopting each or more than one of these frameworks – for this kind analysis we invite you to read the latest KPMG CR Reporting Survey – Datamaran’s unique capability to scan through the narrative and capture the discussion around each framework allows for a different point of view. Its data-driven approach and user-friendly visualizations provide insights into each reporting framework and serve to inform the decision of which ones to adopt. As a result, it helps companies and their decision makers effectively minimize regulatory and reputational risk and supports them in implementing guidelines in the field.

Stay tuned for Part 2! Next week we will complete our analysis by zooming in on the specific content addressed in financial and sustainability reports.

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.

The topic of Customer Privacy & Security poses an increasing risk for a surprising number of sectors. And those with the highest exposure are the ones you wouldn’t expect.

“Information is the new oil.” As the world transitions towards a digital economy the enormous amount of personal information circulating online and consequently, the risk of data breaches, continues to rise.

But are companies prepared and aware of the risks involved? In 2011 the hacker group Anonymous took down Sony’s Playstation Network, stealing personally identifiable information – including credit card data – from each of the 77 million registered accounts. While the Japanese group was ordered to pay only £250k in fines by the Information Commissioner’s Office (ICO), the reputational consequences of this breach were significant.

Given the evident vulnerability associated with personal data regulators are moving fast to protect the rights of data subjects.

Recently, a new transatlantic data transfer deal, the EU-US Privacy Shield, was reached. The new deal will replace the previous Safe Harbour agreement, which was invalidated by the European Court of Justice on the grounds that it violated personal data protection laws. The EU-US Privacy Shield agreement incorporates stringent personal data protection and compliance requirements as set out by the European Union. More specifically, it mandates the US Department of Commerce to monitor that companies publish their due-diligence commitments on the ways in which they process this data. The EU-US Privacy Shield agreement affects around 4,500 U.S. companies across a broad range of industries.

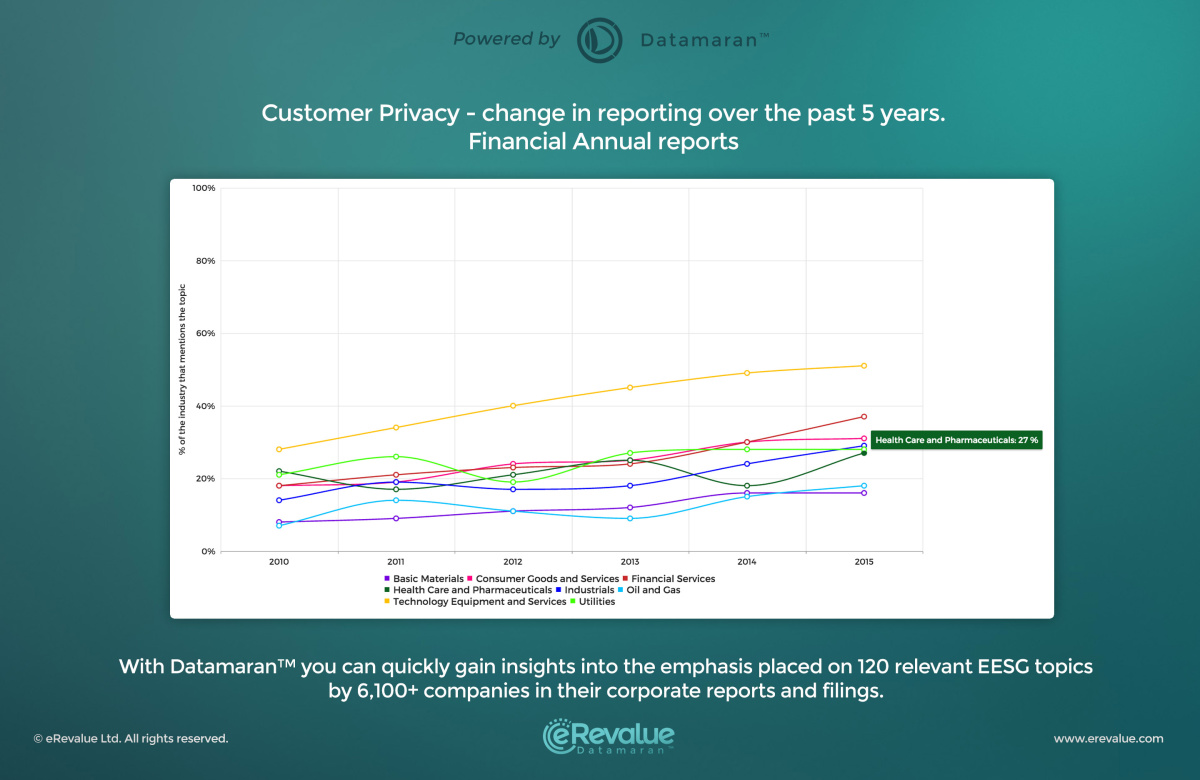

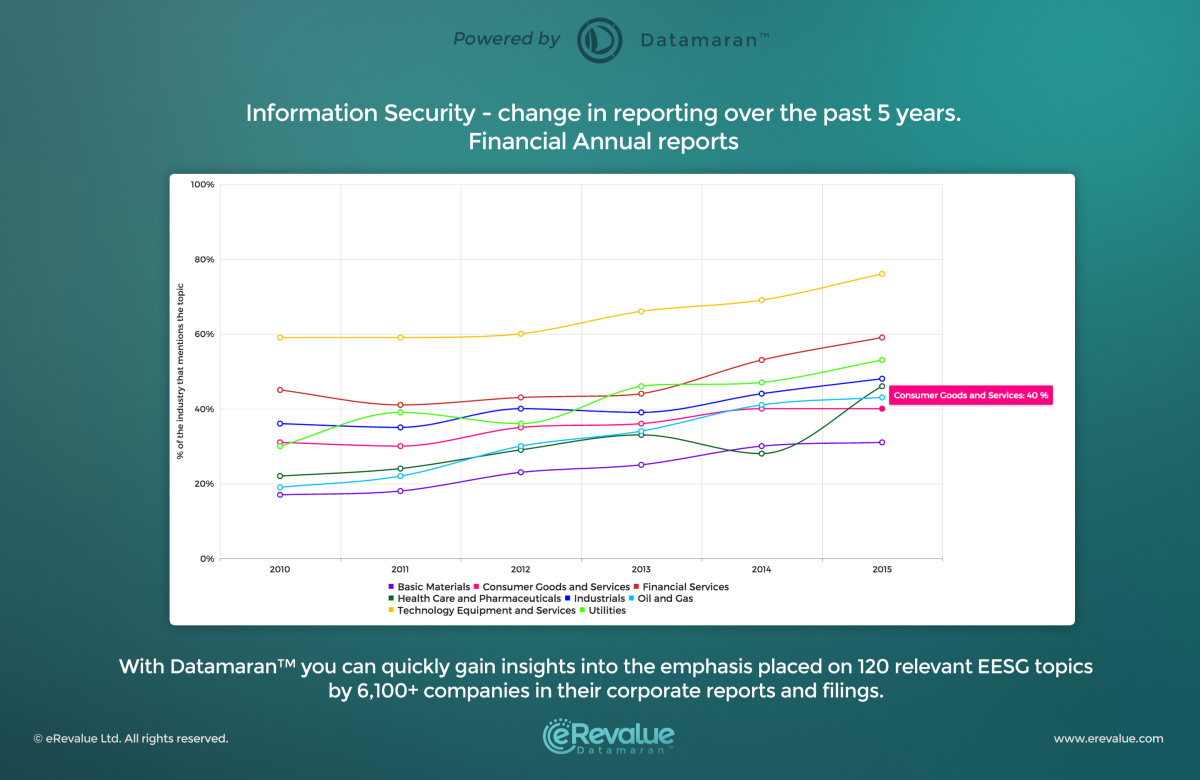

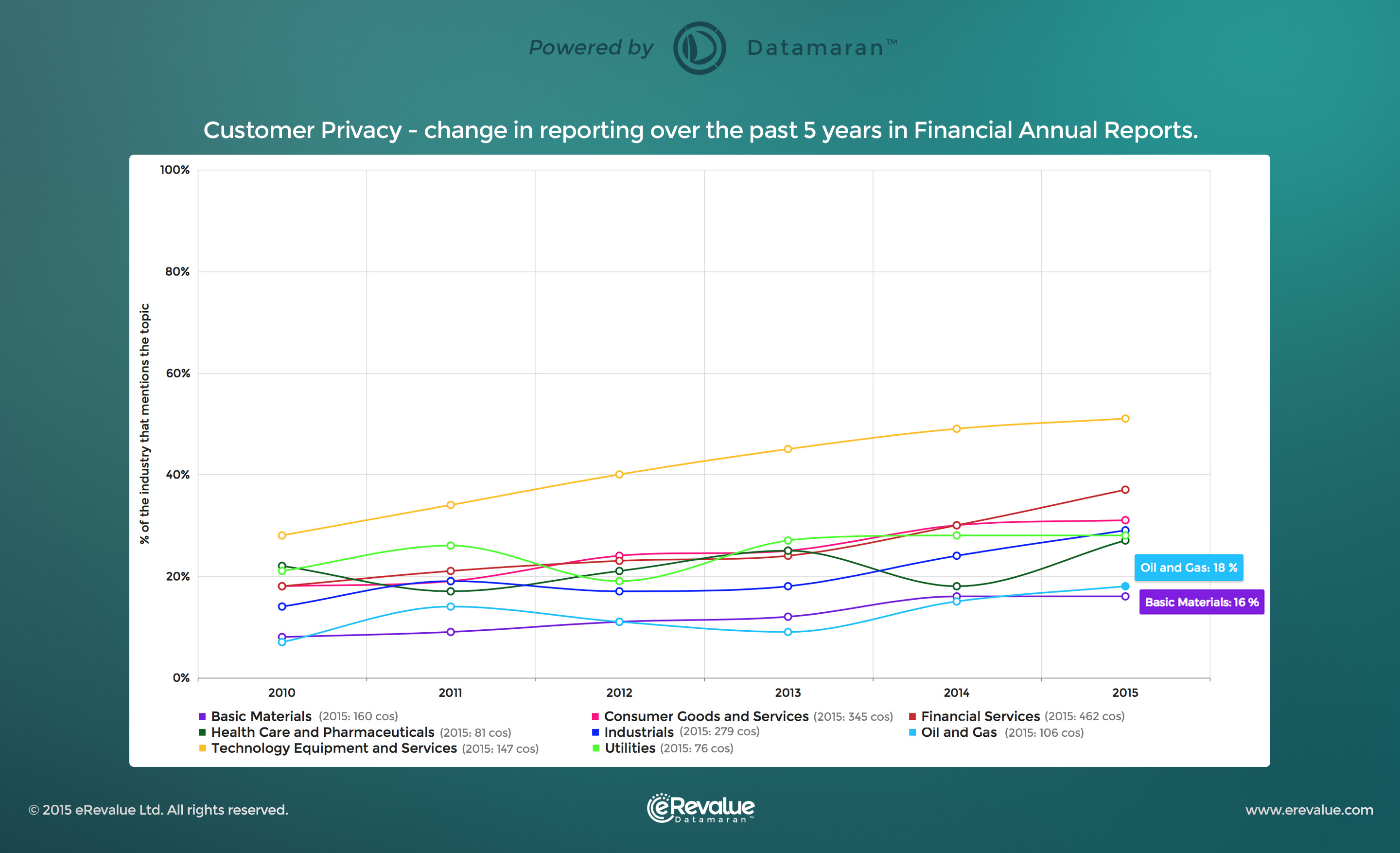

How can Datamaran help companies to identify emerging risks? Data points extracted from Datamaran™ show that companies are slowly but steadily recognizing the importance of customer privacy and information security and are incorporating these issues into their business strategy. The below graphs track the emphasis placed on Customer Privacy & Security and Information Security in Annual Financial reports from 2010 – 2015.

When comparing the sectors, B2C companies in the Healthcare and Pharmaceuticals and in the Consumer Goods and Services sectors show modest to poor reporting efforts on these issues despite the numerous hacking and data leakage scandals that have occurred over recent years.

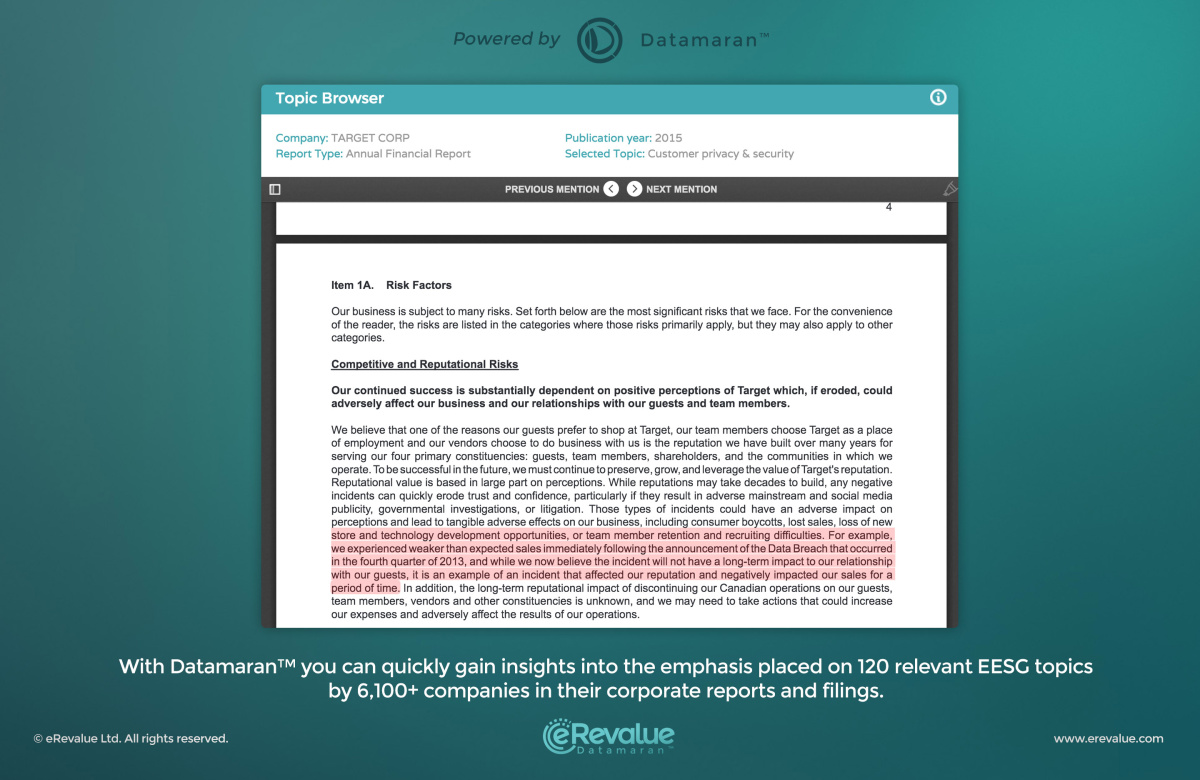

For example, from Nov 27 – Dec 15, 2013, digital thieves breached Target’s database and stole customer names and account data, including credit and debit card information. It was only after this breach that the company mentioned Customer Privacy & Security in their Annual Financial Report. See the below extract:

Key Takeaways: The graphs generated by Datamaran™ effectively demonstrate that the regulatory and reputational risks associated with the digital age are greater for some sectors than others. More specifically, the Healthcare and Pharmaceuticals and the Consumer Goods and Services sectors face the immediate challenge of responding effectively to the ever-changing regulatory environment. But the question remains – are they ready for this?

Discover how Datamaran™ can help you. Subscribe to our newsletter or get in touch to schedule a demo.

Legal requirements around environmental, social, and corporate governance (ESG) issues are on the rise.

For companies, performing supplier due diligence is a well known challenge given the complexity of today’s global economy and the lack of accessible information on business partners. But as regulatory requirements accelerate worldwide, corporations will increasingly be held accountable for activities in their supply chains and subsidiaries, especially in relation to issues like human trafficking and human rights.

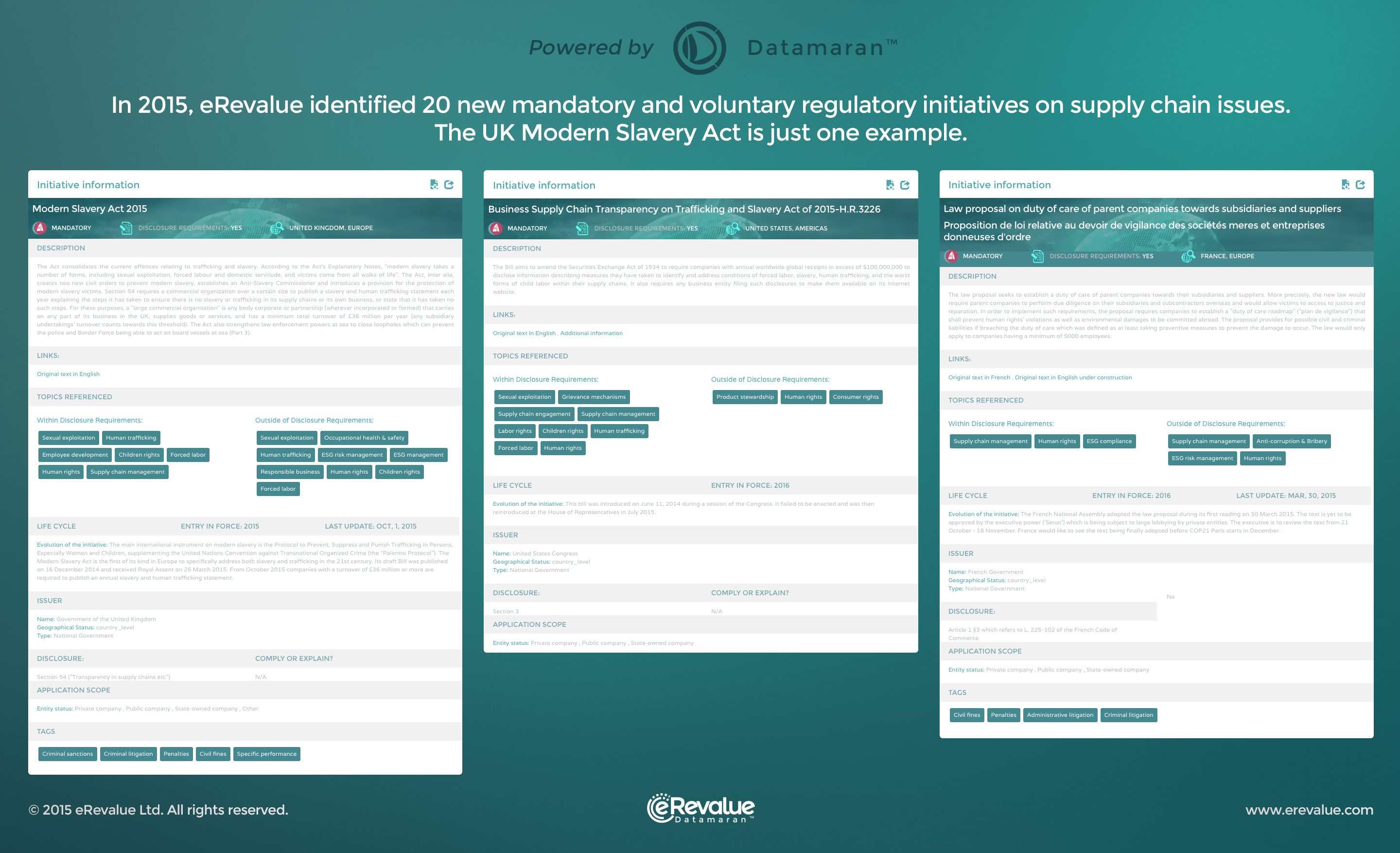

In 2015, we identified 20 new mandatory and voluntary regulatory initiatives focusing on these issues in the supply chain. The UK Modern Slavery Act enacted in October 2015 is just one example.

Are companies prepared for increasing regulation?

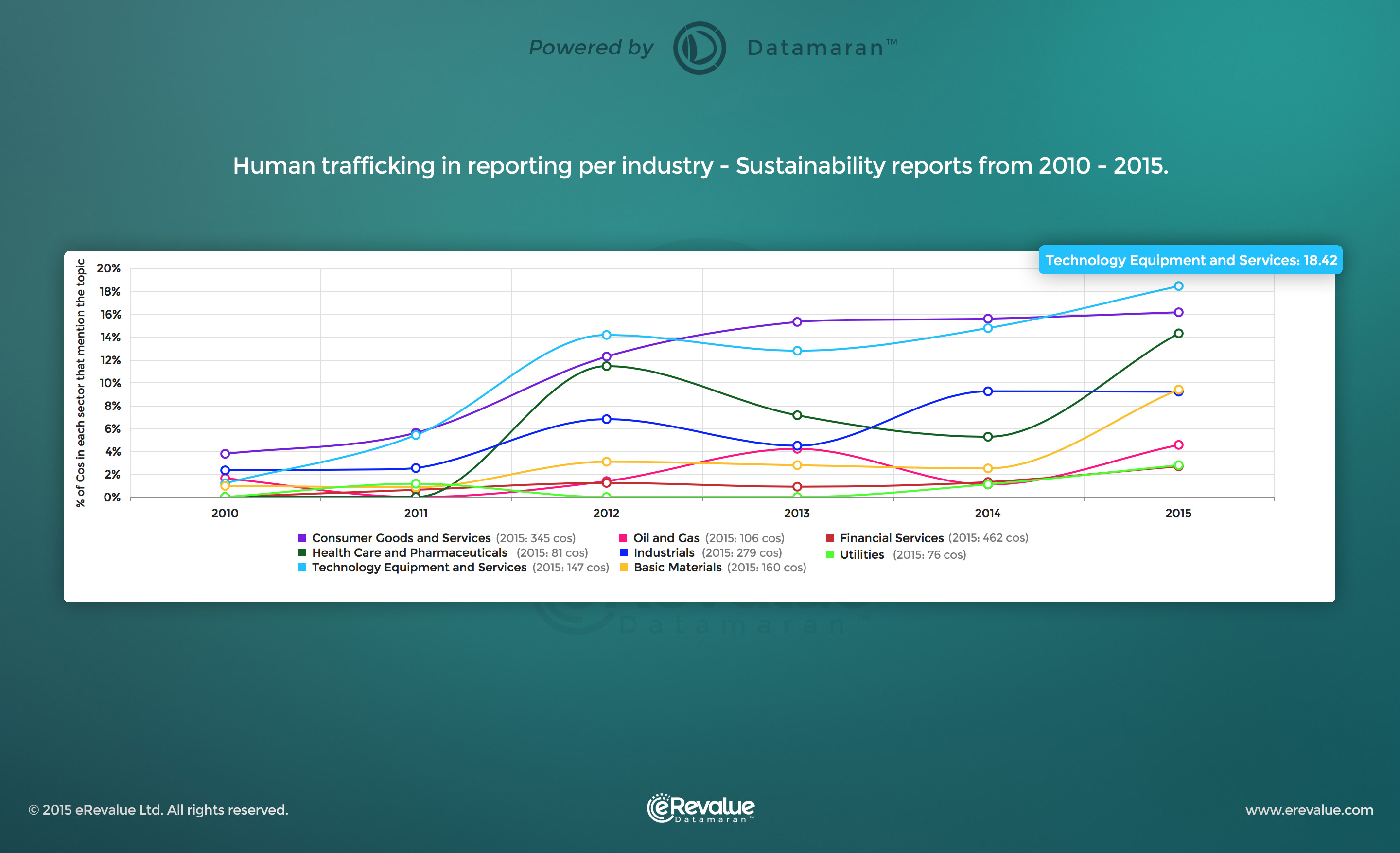

While we’ve seen an increase in corporate disclosure on the topic of human trafficking since 2010, less than 20% of companies in the below industries are currently reporting on the issue.

What’s the risk?

Recent corporate lawsuits highlight the consequences companies face with regard to incidents related to human trafficking in their global supply chains. These regulations may serve as a wake up call to companies who need to adapt to hardening transparency requirements, but legal enforcement is just one of the pressures companies now face.

A recent survey by Triodos Bank shows that 67% of investors would withdraw their investments if forced labour was present within a company’s operations, and 70% would do the same in relation to human trafficking.

»At eRevalue, we will help you understand this transition from voluntary to mandatory disclosure requirements aboard Datamaran™, your emerging risks radar.

Discover how Datamaran™ can help you avoid these risks. Get in touch to schedule a demo and learn more about our 2015 Launch Pricing Package, available through December.

Multiple incidents of data breaches involving big corporations have attracted the attention of regulators.

Customer privacy and information security are two of the top regulated ESG issues in expected regulatory initiatives captured by eRevalue’s Datamaran™. In Europe and in the US, in particular, companies will soon have to disclose information on the material risks of cyber incidents. Is your business prepared?

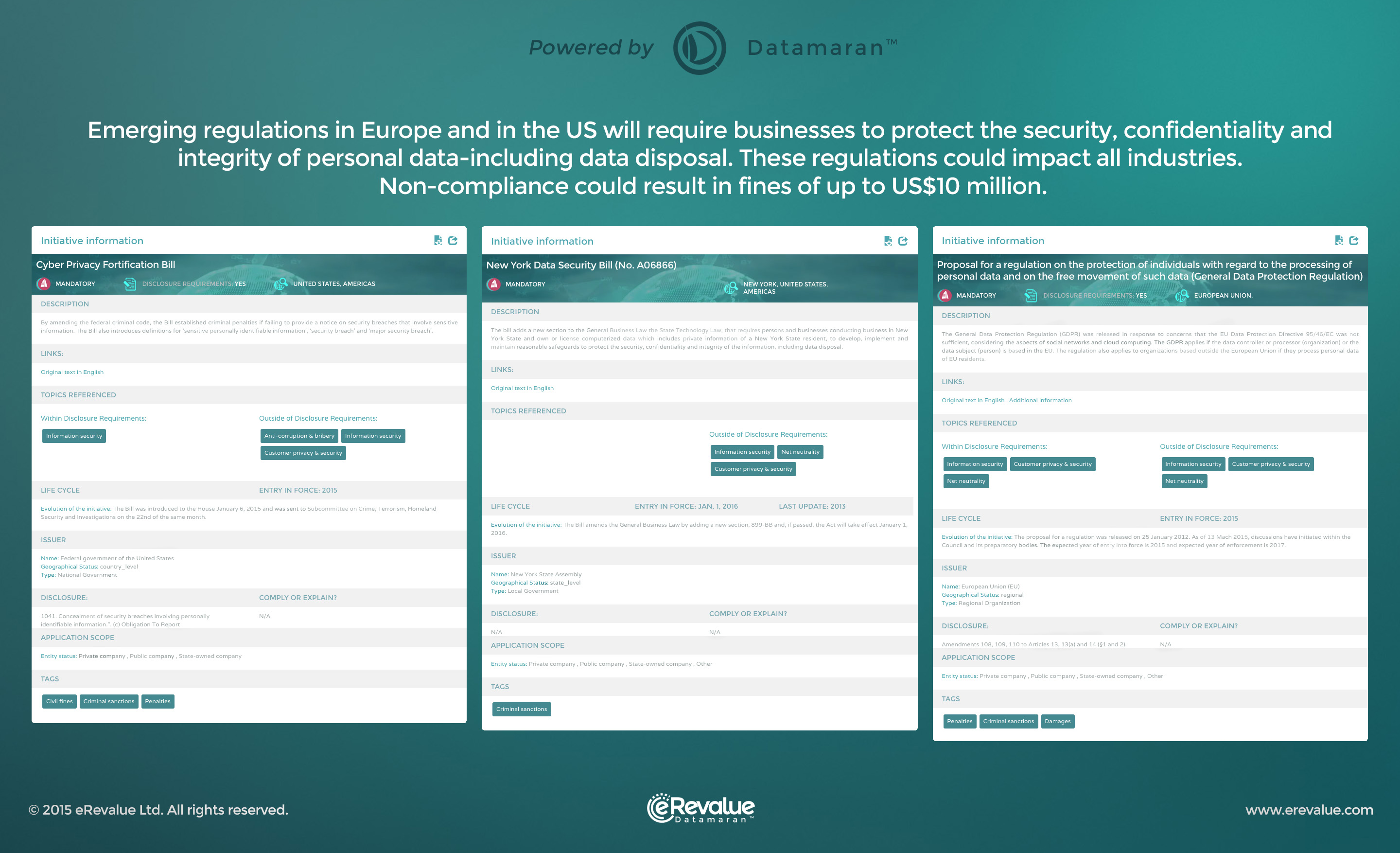

Cyber security: which regulations are on the horizon?

Emerging regulations in Europe and in the US will require businesses to protect the security, confidentiality and integrity of personal data, including data disposal, and disclose related information in their corporate filings. These regulations could impact all industries. Non-compliance could result in fines of up to US$10 million.

Which industries may be at risk?

A study conducted by Symantec Corp., the world’s biggest cybersecurity firm, found that computer-system invaders attacked 43 percent of global Mining and Oil and Gas companies in 2014.

But when we look at corporate reporting on the topic of customer privacy over the past 5 years, we see limited disclosure by companies in both the Basic Materials (including Mining) and Oil and Gas industries, especially in comparison to other industries.

Beyond rising legal consequences, investors are demanding more information about security practices. Research done by the credit reporting company Experian shows that cyber breaches are one of three factors that have the greatest impact on brand reputation, poor customer service and environmental disasters being the other two.

»At eRevalue, we will help you monitor these emerging regulatory, competitive and reputational risks aboard Datamaran™, your emerging risks radar.

Discover how Datamaran™ can help you avoid these risks. Get in touch to schedule a demo and learn more about our 2015 Launch Pricing Package, available through December.